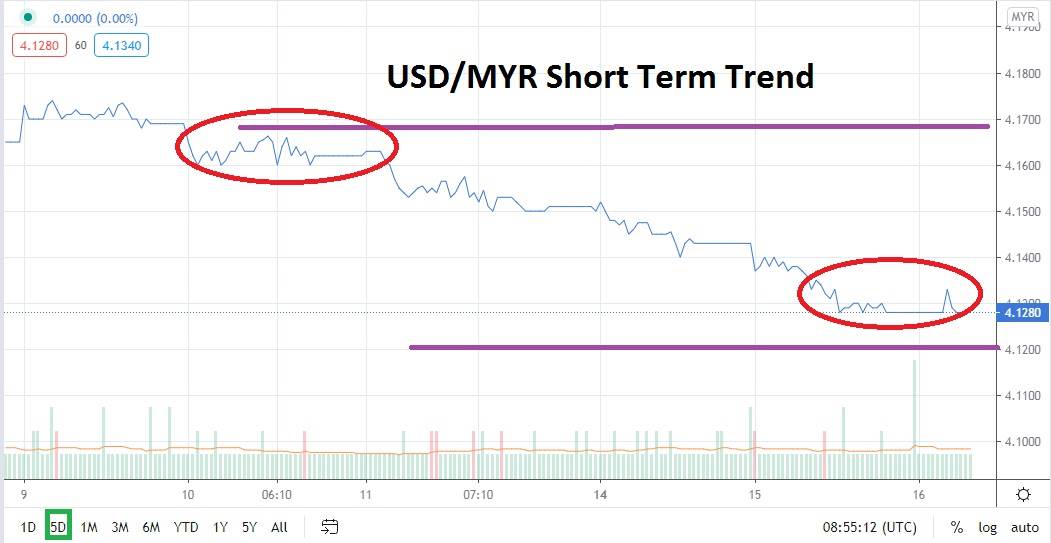

The USD/MYR has continued to deliver a rather dynamic bearish trend. Trading yesterday produced another strong leg downwards for the forex pair as important support levels not traversed since February of this year have been touched. The Malaysian Ringgit remains a tantalizing emerging global currency to trade because of its transparent governance.

The current price range of the USD/MYR should intrigue speculators because it is trading within a value band which it has not experienced since early this year. The price level of 4.1000 has not been reached yet by the USD/MYR, but as the forex pair trades near the 4.1280 juncture early this morning, it must be noted that the Malaysian Ringgit is starting to flirt with values that it was trading pre-coronavirus fears.

The USD/MYR still needs to enjoy a solid run of downward momentum to see the 4.1000 mark but this level was experienced in late December of 2019 and saw a further run down to values near 4.0500 in mid-January. The point being that if the USD/MYR continues to see bearish selling the forex pair will soon be exploring price territory which is clearly embracing risk appetite.

Speculators have seen strong bearish sentiment the past week, but the 4.1280 has served as a solid baseline for the USD/MYR the past day. Trading within the forex pair may be rather cautious because its value is now challenging support levels that have not been experienced since February. If the current price level continues to break through short term support, it will be trading in waters in which no short term technical data is clearly established, except to say a bearish trend exists.

Speculators may want to continue to pursue selling positions of the USD/MYR and look for targets below which can be taken advantage of by using take profits. Reversals higher have been demonstrated by the USD/MYR too, trading only two days ago saw the forex pair near the 4.1500 juncture. However, after reaching a high of 4.1735 on the 9th of September as risk-averse trading dominated, the USD/MYR has seen a steady bearish trend reemerge. If global indices remain optimistic there is reason to suspect lower price levels may continue to be seen.

Malaysian Ringgit Short Term Outlook:

Current Resistance: 4.1300

Current Support: 4.1260

High Target: 4.1330

Low Target: 4.1230