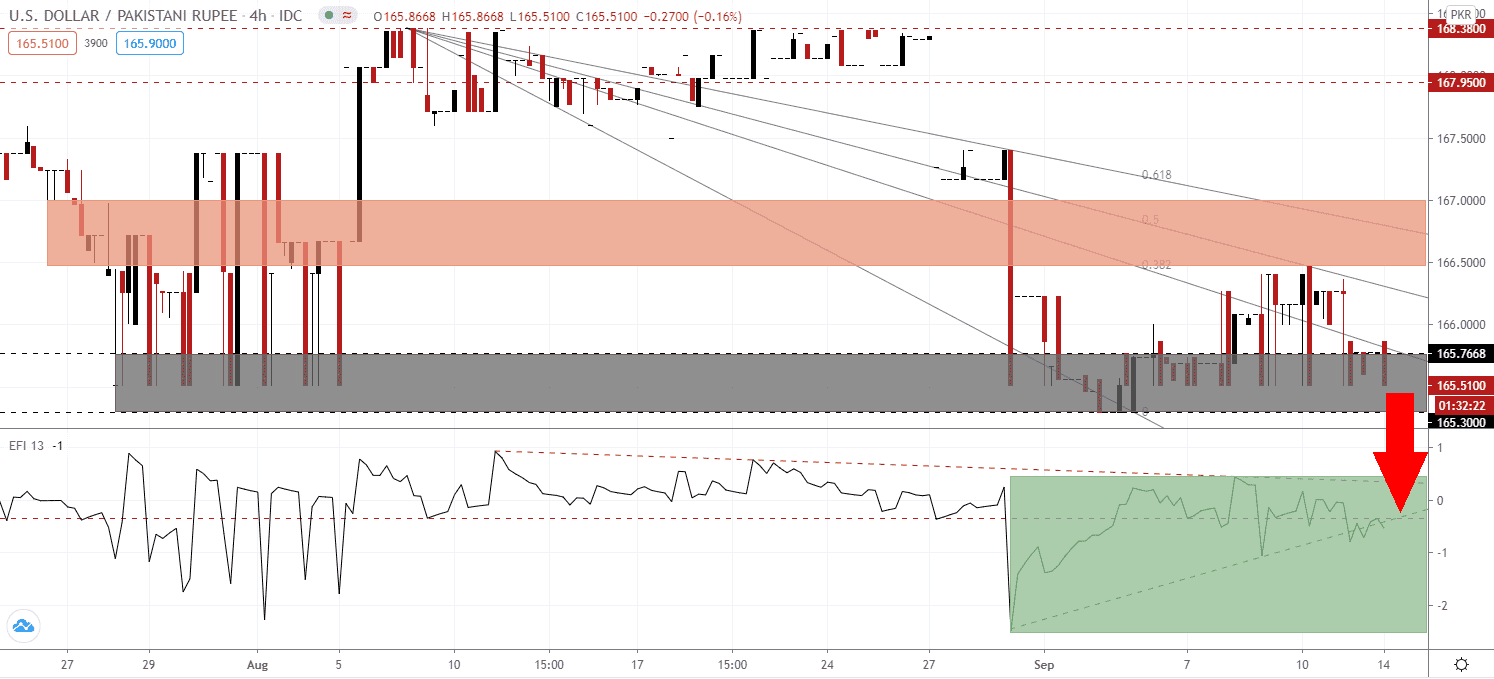

Pakistan crossed the 300,000 level in total Covid-19 infections, remaining the seventeenth most-infected country. With a population of over 220,000,000, daily new cases receded from a daily record above 7,000 to below 700, placing Pakistan on the right trajectory. By comparison, India accelerated to the upside, approaching nearly 100,000 new confirmed cases. Some experts point towards the median age in Pakistan, which stands at just 22.0 years. The USD/PKR, following a breakdown below its resistance zone, accelerated to the downside. It is now challenging its support zone.

The Force Index, a next-generation technical indicator, recovered from a multi-week low but was rejected by its horizontal resistance level. It is now in the process of moving back below its ascending support level, as marked by the green rectangle. Adding to downside pressures is the shallow descending resistance level. Bears wait for this technical indicator to slide deeper into negative territory to resume complete control over the USD/PKR.

Prime Minister Khan refused a nationwide lockdown, arguing his country is too poor to afford one. He did note that if public finances allowed it, one would have been implemented, but with 25% of Pakistanis below the poverty line, the option was not available. Despite the lack of a lockdown, Pakistan handles the crisis better than India, having a similar demographic. A brief reversal in the USD/PKR was rejected by its short-term resistance zone located between 166.4667 and 166.9750, as marked by the red rectangle.

Adding a positive boost to the Pakistani economy is the resumption of deal-making within the troubled China-Pakistan Economic Corridor (CPEC). Retired Lt. Gen. Asim Saleem Bajwa is the new chairman of the China-Pakistan Economic Corridor Authority (CPECA), and two deals worth $11.1 billion were signed in June and July. A $3.9 billion hydropower project and a $7.2 railway modernization project, the largest project to date. The deals followed the creation of a new economic zone (SEZ) in Faisalabad. The descending Fibonacci Retracement Fan sequence is well-positioned to pressure the USD/PKR below its support zone located between 165.3000 and 165.7668, as identified by the grey rectangle. Price action will face its next support zone between 163.1200 and 164.0000.

USD/PKR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 165.5000

Take Profit @ 163.1000

Stop Loss @ 166.2500

Downside Potential: 24,000 pips

Upside Risk: 7,500 pips

Risk/Reward Ratio: 3.20

A breakout in the Force Index above its descending resistance level could lead the USD/PKR into a temporary price spike. Forex traders should consider any advance from present levels as a selling opportunity, amid a distinctively more bullish news flow out of Pakistan than the US. The latest data shows the US labor market weakening again, with nearly 30 million receiving assistance, while the risk of a double-dip recession advances. The upside potential is limited to the intra-day high of 167.3979.

USD/PKR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 166.7500

Take Profit @ 167.3500

Stop Loss @ 166.2500

Upside Potential: 6,000 pips

Downside Risk: 5,000 pips

Risk/Reward Ratio: 1.20