Amid the global Covid-19 pandemic, where many countries prepare for a second infection wave, the Singapore business community is alarmed by the growing protectionist moves by the government. The intention is to ensure that the core business community remains staffed by Singaporeans. Patrick Tay, a Member of Parliament, lobbies to increase the minimum qualifying salary for Employment Pass (EP) holders in the information and technology sectors, similar to the move announced last week for finance professionals. The USD/SGD embarked on a brief breakout after recording a fresh multi-week low.

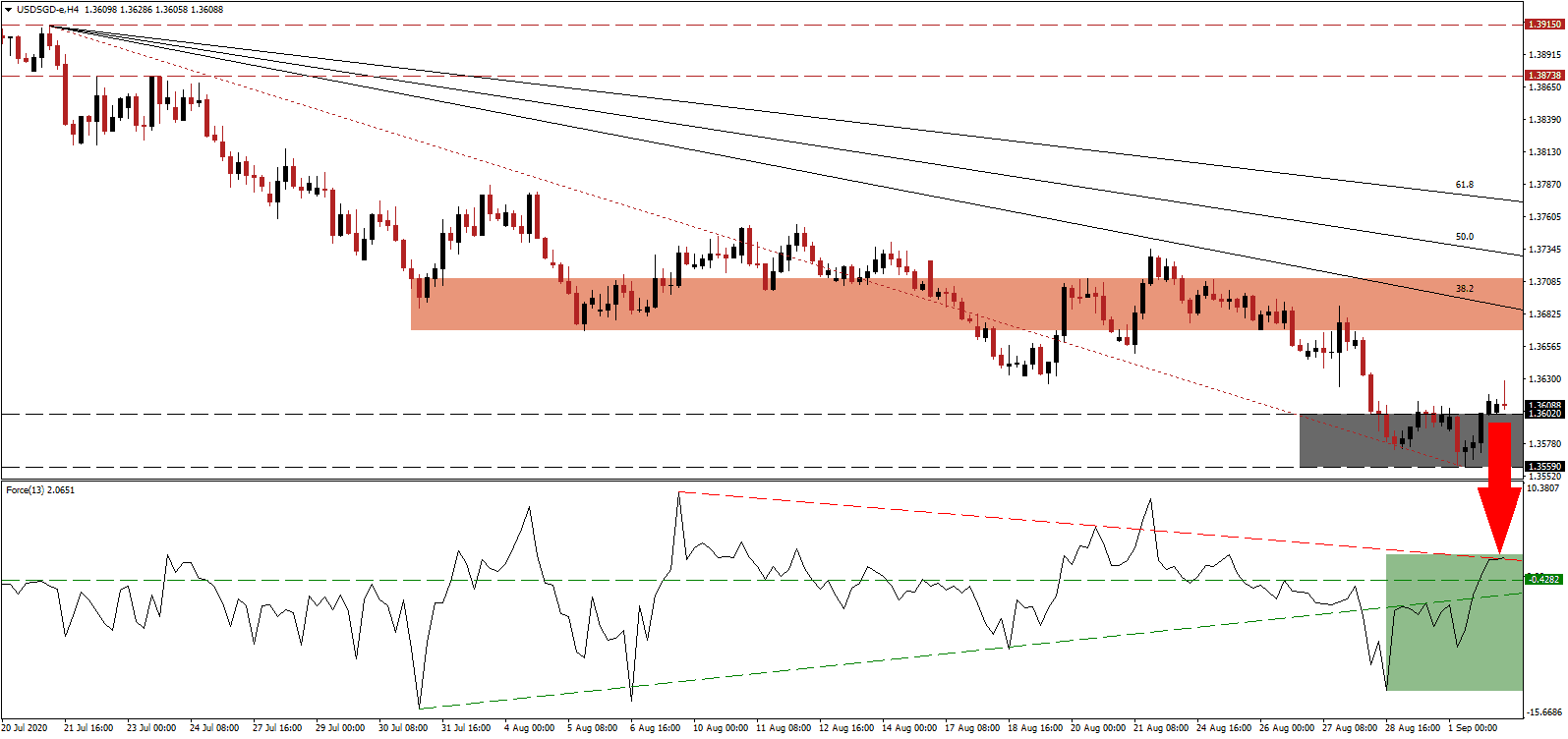

The Force Index, a next-generation technical indicator, confirmed the spike in bullish momentum following the conversion of its horizontal resistance level into support, assisted by its ascending support level. It is now challenging its descending resistance level, as marked by the green rectangle, which is favored to pressure this technical indicator below the 0 center-line, granting bears the upper hand over the USD/SGD.

During the height of the Covid-19 related nationwide lockdowns across the world, many companies discovered the benefits of remote work. The trend is expected to accelerate, threatening many positions in developed economies, easily outsourced to qualified offshore locations. Singapore became home to a comparably expensive workforce, while its neighbors closed the quality gap. The minor bounce in the USD/SGD is anticipated to keep the bearish pattern intact, with the upside potential limited to its short-term resistance zone located between 1.3669 and 1.3711, as identified by the red rectangle.

MP Tay added another proposal, a to-tier quota system for high-skill and medium-skill labor. It is opposed by the Singapore Business Federation, while concerns over the number of qualified employees that can be produced domestically to staff necessary positions exist. The descending 38.2 Fibonacci Retracement Fan Resistance Level is well-positioned to force the USD/SGD into a breakdown below its downward revised support zone located between 1.3559 and 1.3602, as marked by the grey rectangle. An extension of the sell-off into its next support zone between 1.3443 and 1.3482 is probable.

USD/SGD Technical Trading Set-Up - Breakdown Resumption Scenario

Short Entry @ 1.3605

Take Profit @ 1.3445

Stop Loss @ 1.3645

Downside Potential: 160 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 4.00

An extended move higher by the Force Index, guided by its ascending support level, could allow the USD/SGD to add to its advance temporarily. While the third quarter remains on track to deliver positive GDP figures, the threat of a double-dip recession is elevated. Forex traders should sell any advance on the back of intensifying US Dollar weakness. The descending 50.0 Fibonacci Retracement Fan Resistance Level reduces the upside potential in this currency pair.

USD/SGD Technical Trading Set-Up - Reduced Breakout Extension Scenario

Long Entry @ 1.3680

Take Profit @ 1.3730

Stop Loss @ 1.3645

Upside Potential: 50 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 1.43