With new Covid-19 cases surging across the globe, South Africa reduced its five-stage warning system to level one. The Minister of Tourism, Mmamoloko Kubayi-Ngubane, published a directive, allowing wedding venues, restaurants, and events to resume at 50% capacity and a maximum of 250 attendees inside and 500 outside. Zwelini Mkhize, the Minister of Health, warned against an uptick in daily infections. The USD/ZAR ended its counter-trend advance and embarked on a new breakdown sequence, positioned to accelerate.

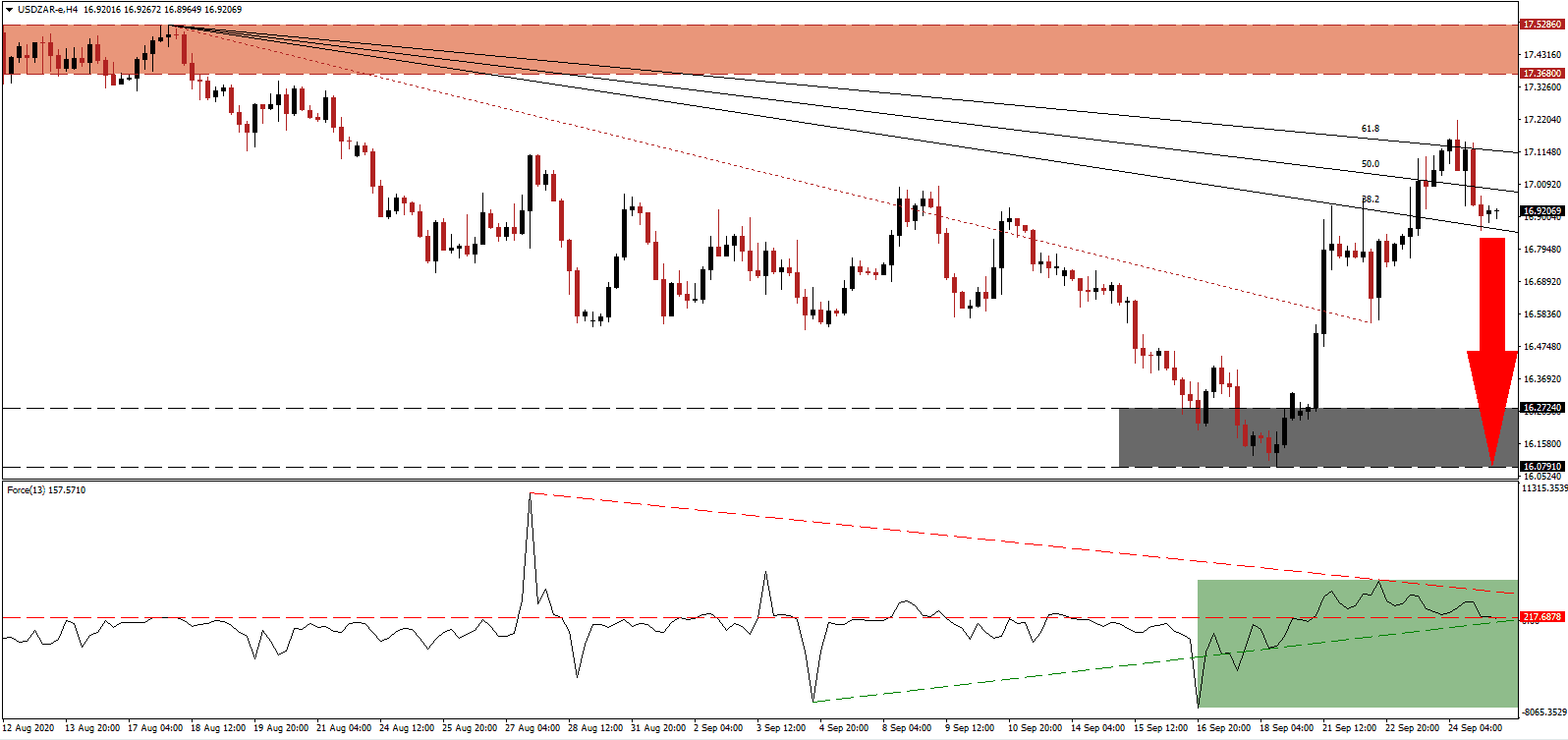

The Force Index, a next-generation technical indicator, retreated from its peak while price action drifted higher, allowing for the formation of a negative divergence. Bearish pressures increased following the slide below its horizontal resistance level, as marked by the green rectangle. The descending resistance level is expected to pressure this technical indicator below its ascending support level and into negative territory, granting bears full control over the USD/ZAR.

With the government of President Cyril Ramaphosa hailing progress on an economic revival plan, in collaboration with the National Economic Development and Labour Council (Nedlac), it needs to address the government wage bill. It has been a sensitive topic, but a necessary first step to show struggling South Africans, impacted more by the economy than the Covid-19 virus, it is ready to move on from mistakes of the past. The breakdown in the USD/ZAR below its descending 50.0 Fibonacci Retracement Fan Support Level magnified bearish pressures. As a result, a downward adjustment in its resistance zone followed. It is now located between 17.3800 and 17.5286, as marked by the red rectangle.

Addressing the ongoing electricity concerns at Eskom, Gwede Mantashe, the Minister of Mineral Resources and Energy, confirmed that nuclear energy would play a more prominent role in the energy mix of South Africa. Eskom is partially blamed for a weak economy, before the Covid-19 pandemic, amid insufficient capacity and outdated equipment. The utility warned the power grid is under severe pressure. A slide in the USD/ZAR below its 38.2 Fibonacci Retracement Fan Support Level will clear the path for a collapse into its support zone located between 16.0791 and 16.2724, as identified by the grey rectangle

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 16.9200

- Take Profit @ 16.0800

- Stop Loss @ 17.1200

- Downside Potential: 8,400 pips

- Upside Risk: 2,000 pips

- Risk/Reward Ratio: 4.20

In case the ascending support level allows the Force Index to reverse, the USD/ZAR could attempt a second breakout. Forex traders should take advantage of any advance with new sell orders. The US labor market continues to worsen, reporting its third weekly negative surprise with upward revisions to the prior week. The upside potential remains confined to the top of its downward revised resistance zone at 17.5286.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 17.2700

- Take Profit @ 17.5200

- Stop Loss @ 17.1200

- Upside Potential: 2,500 pips

- Downside Risk: 1,500 pips

- Risk/Reward Ratio: 1.67