South Africa continues to struggle with the Covid-19 pandemic, reporting over 2,000 new cases daily. With the unemployment rate depressed and the acceptance of a highly controversial $4.3 billion bailout from the US-based International Monetary Fund (IMF) by the government of President Ramaphosa, he survived a leadership challenge over the weekend. The governing African National Congress, deeply divided, convened a three-day meeting of the top leadership. He was accused of bribery to win the presidency, but the motion failed to gain traction. The USD/ZAR ended its temporary counter-trend advance and was rejected by its downward revised short-term resistance zone.

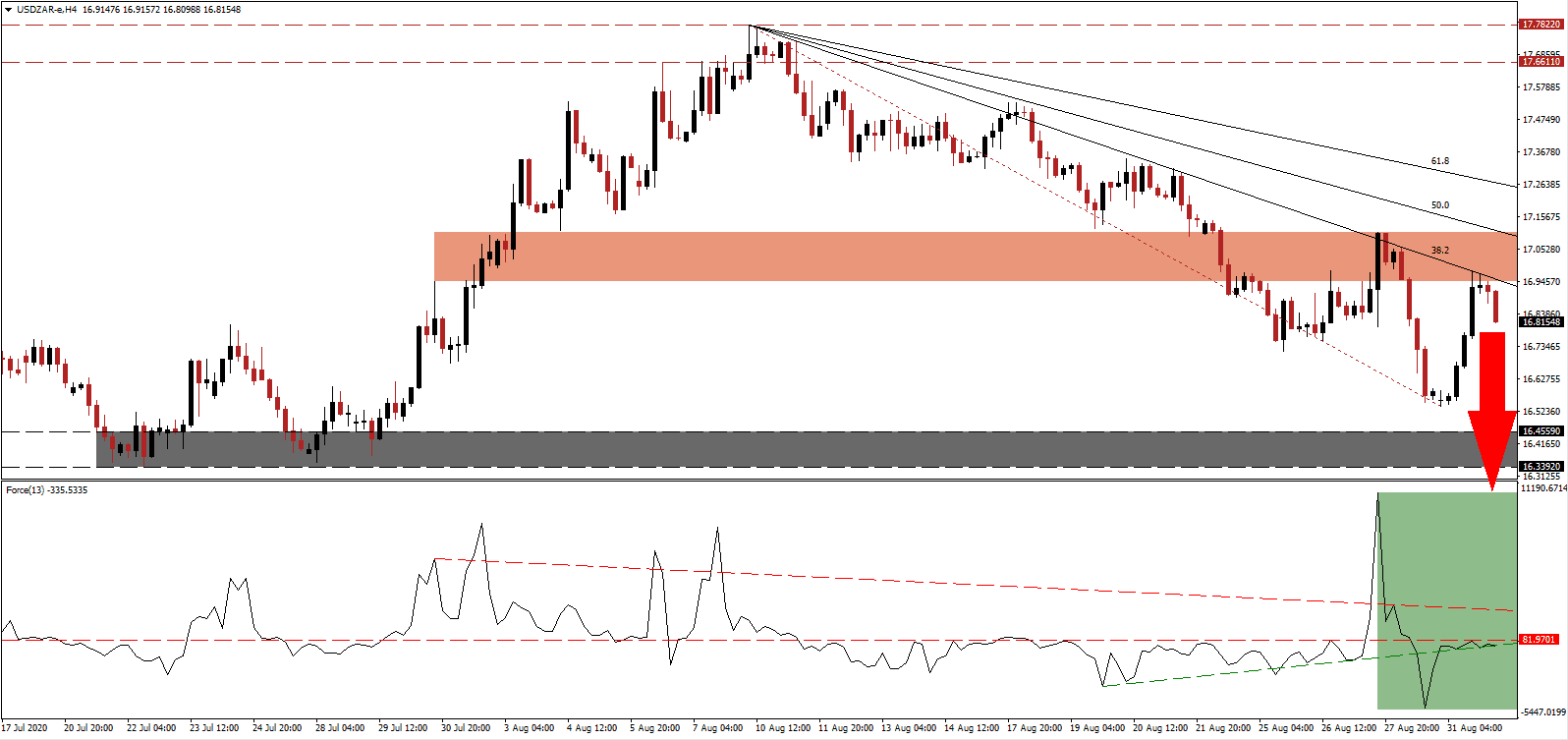

The Force Index, a next-generation technical indicator, maintains its position below the horizontal resistance level. It is now challenging its ascending support level, as marked by the green rectangle, while the shallow descending resistance level applies ongoing downside pressure. Bears wait for a confirmed breakdown in this technical indicator below it, which will grant them complete control over the USD/ZAR.

Following the unsuccessful bid to out President Ramaphosa, he is clear to reshuffle his cabinet in an attempt to speed up necessary reforms and boost investor confidence. Finance Minister Tito Mboweni denied rumors he resigned, as the ANC came under renewed graft and corruption accusations. The USD/ZAR was rejected by its descending 38.2 Fibonacci Retracement Fan sequence inside of its short-term resistance zone located between 16.9456 and 17.1058, as identified by the red rectangle.

Edgar Sishi, the acting Head of the Budget Office to the National Economic Development and Labour Council, cautioned that there are no additional funds for government departments over the next three years. Funding for new projects requires cutting allocated capital from existing programs. The June supplementary budget included plans to raise R40 billion over the next four years. An accelerated sell-off in the USD/ZAR, after the rejection, is favored taking it into its support zone located between 16.3392 and 16.4559, as marked by the grey rectangle. An extended corrective phase with a breakdown into its next support zone between 15.7482 and 15.9963 cannot be excluded.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 16.8100

Take Profit @ 15.8100

Stop Loss @ 17.1100

Downside Potential: 10,000 pips

Upside Risk: 3,000 pips

Risk/Reward Ratio: 3.33

Should the Force Index advance into positive territory, guide higher by its ascending support level, the USD/ZAR may embark on a brief breakout. Forex trades should consider any advance from present levels as a selling opportunity, due to intensifying bearish progress in the US Dollar. The US Federal Reserve committed to an extended weak US Dollar policy, and the upside potential remains limited to its intra-day high of 17.5286.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.2600

Take Profit @ 17.5100

Stop Loss @ 17.1100

Upside Potential: 2,500 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.67