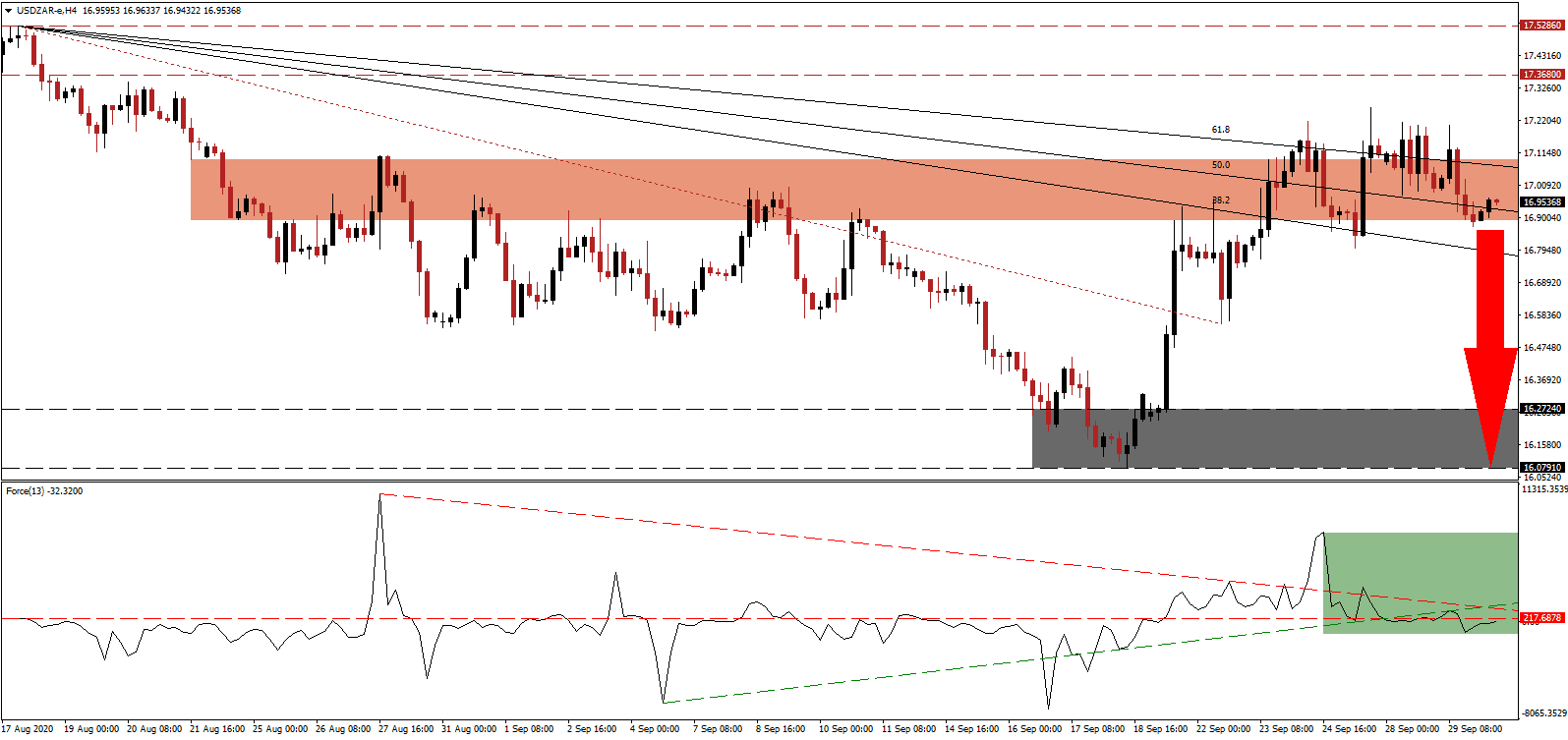

Out of the Top 10 most-infected Covid-19 countries, South Africa reports the lowest new daily cases, which drop below 1,000 during some days. While it does not resemble the pandemic under control, it allows the depressed economy to stabilize more rapidly. President Cyril Ramaphosa confirmed his government is close to finalizing the Presidential Employment Stimulus Plan to return to economic growth and promote job creation. He claims his cabinet reached agreements with social partners and the National Economic Development and Labour Council (Nedlac). The USD/ZAR remains under selling pressure, magnified by its descending Fibonacci Retracement Fan sequence.

The Force Index, a next-generation technical indicator, confirms the dominance of bearish momentum and remains below its horizontal resistance level, as marked by the green rectangle. Downside pressure increased after the contraction below its ascending support level, with the descending resistance level expected to guide this technical indicator farther into negative territory. Bears are in complete control of price action in the USD/ZAR.

Statistics South Africa, the national statistical service of South Africa, reported 2.2 million job losses in the second quarter, the most massive loss since 2008, which led to a decrease in the unemployment rate from 30.1% to 23.3%. It reflects the shrinking of the labor force during the nationwide lockdown, preventing the unemployed from seeking employment. The most recent struggles in the USD/ZAR to extend its counter-trend advance established a new short-term resistance zone located between 16.8926 and 17.0924, as identified by the red rectangle.

Peter Montalto, the Head of Capital Markets Research at South African consultancy Intellidex, noted to focus on the extended definition of unemployment, accounting for individuals who want to work, but were unable to seek employment actively. It places the unemployment rate for South Africa between 42.6% and 52.7%. The labor force declined by 5.0 million, poised for a massive rebound in the third quarter. Breakdown pressures in the USD/ZAR remain elevated, despite short-term pressures, and price action is vulnerable to an extended sell-off into its support zone located between 16.0791 and 16.2724, as marked by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 16.9550

Take Profit @ 16.0800

Stop Loss @ 17.1550

Downside Potential: 8,750 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 4.38

Should the Force Index reclaim its ascending support level, acting as resistance, the USD/ZAR could push higher in the short-term. With the US facing an increase in Covid-19 infections, stimulus running out, and political uncertainty ahead, consumer spending is vulnerable to decrease and force a secondary economic contraction. Forex traders should sell any rallies with the upside potential limited to its resistance zone between 17.3680 and 17.5286.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 17.2650

Take Profit @ 17.4350

Stop Loss @ 17.1550

Upside Potential: 1,700 pips

Downside Risk: 1,100 pips

Risk/Reward Ratio: 1.55