South Africa suffered a 51.0% GDP collapse in the second quarter and remains the ninth most-infected country globally and the most-infected one in Africa. Confirmed cases pasted the 660,000 level, with almost 16,000 deaths in a country shy of 60,000,000. President Cyril Ramaphosa pledged to rebuild the economy and pass reforms, but doubt over his recovery plan remains. South African politicians are known to present well, but to execute poorly, but the severity of the pandemic may deliver the necessary spark. The USD/ZAR embarked on a healthy short-covering rally and is now vulnerable to a renewed sell-off.

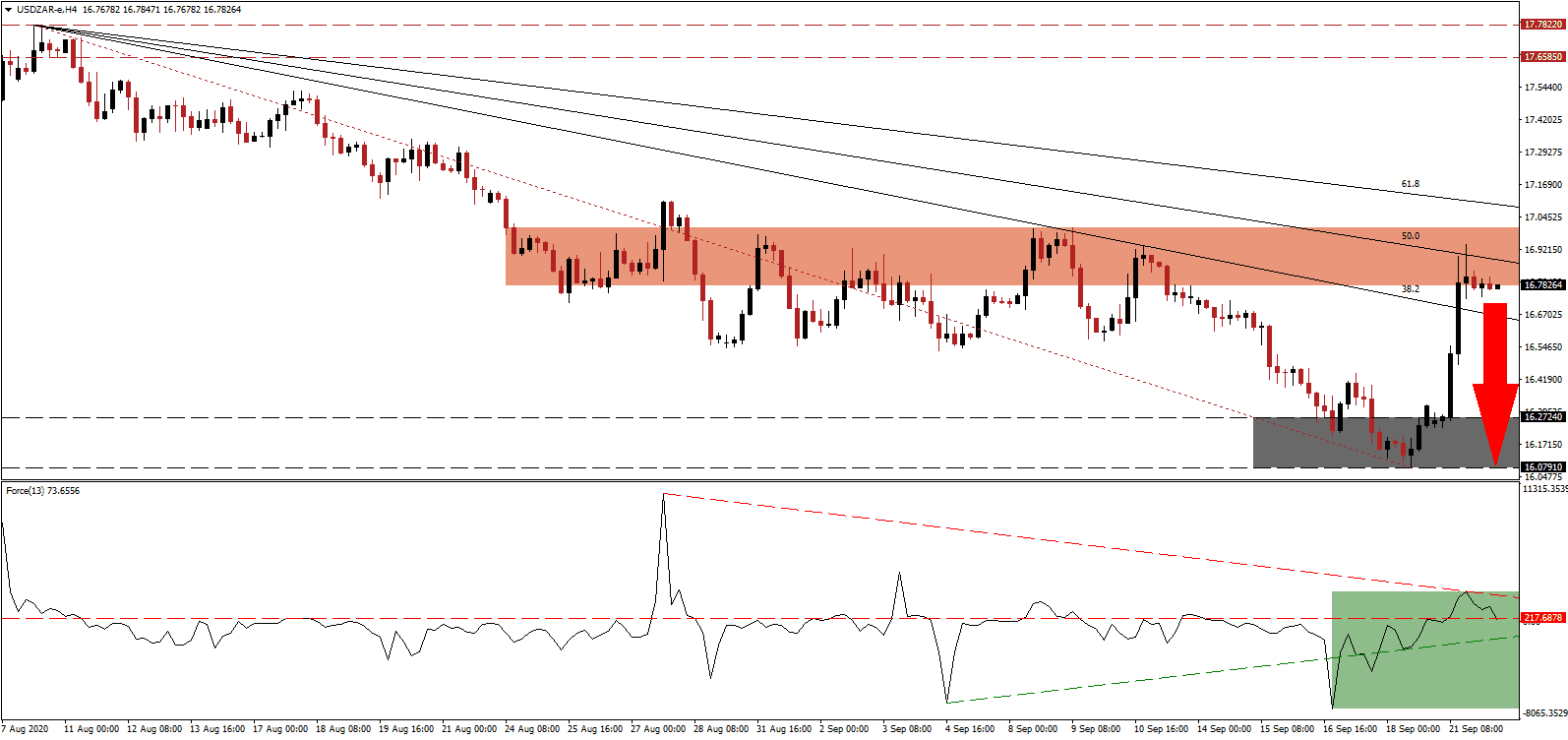

The Force Index, a next-generation technical indicator, reversed from a new multi-month low and briefly pushed above its horizontal resistance level, as marked by the green rectangle. Bullish momentum faded, and the adjusted descending resistance level supplies dominant downside pressure. This technical indicator is on course to correct below its 0 center-line, and through its ascending support level, granting bears complete control over the USD/ZAR.

Sipho Pityana, President of Business Unity South Africa (BUSA), warned that South Africa could not afford stalled policy reforms. He urged the country to avoid a third economic crisis, which he classified as terminal. South Africa lowered its Covid-19 alert level to one. Zweli Mkhize, the Minister of Health, cautioned against a resurgence of the virus and added level one aims to rebuild the economy. After the USD/ZAR spiked into its short-term resistance zone located between 16.7800 and 17.0013, as marked by the red rectangle, bearish pressures expanded.

After the South African Reserve Bank (SARB) left interest rates unchanged, Governor Lesetja Kganyago added that the 300 basis points of interest rate cuts of 2020 have not filtered through the economy. The central bank also suggested that third-quarter GDP could surge by 45.2%, while the full-year outlook remains for a decrease of 8.2%. A breakdown in the USD/ZAR below its descending 38.2 Fibonacci Retracement Fan Support Level will allow for an extended sell-off into its support zone located between 16.0791 and 16.2724, as identified by the grey rectangle.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 16.7850

Take Profit @ 16.0800

Stop Loss @ 16.9850

Downside Potential: 7,050 pips

Upside Risk: 2,000 pips

Risk/Reward Ratio: 3.53

In case the Force Index pushes through its descending resistance level, the USD/ZAR could seek more upside. Forex traders should consider any price spike as a secondary selling opportunity, amid the quickly deteriorating outlook for the US Dollar. Political uncertainty and the rise in Covid-19 infections add to a bearish outlook for the debt-burdened US economy. The upside potential is confined to its intra-day high of 17.3449.

USD/ZAR Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 17.1350

Take Profit @ 17.3350

Stop Loss @ 16.9850

Upside Potential: 2,000 pips

Downside Risk: 1,500 pips

Risk/Reward Ratio: 1.33