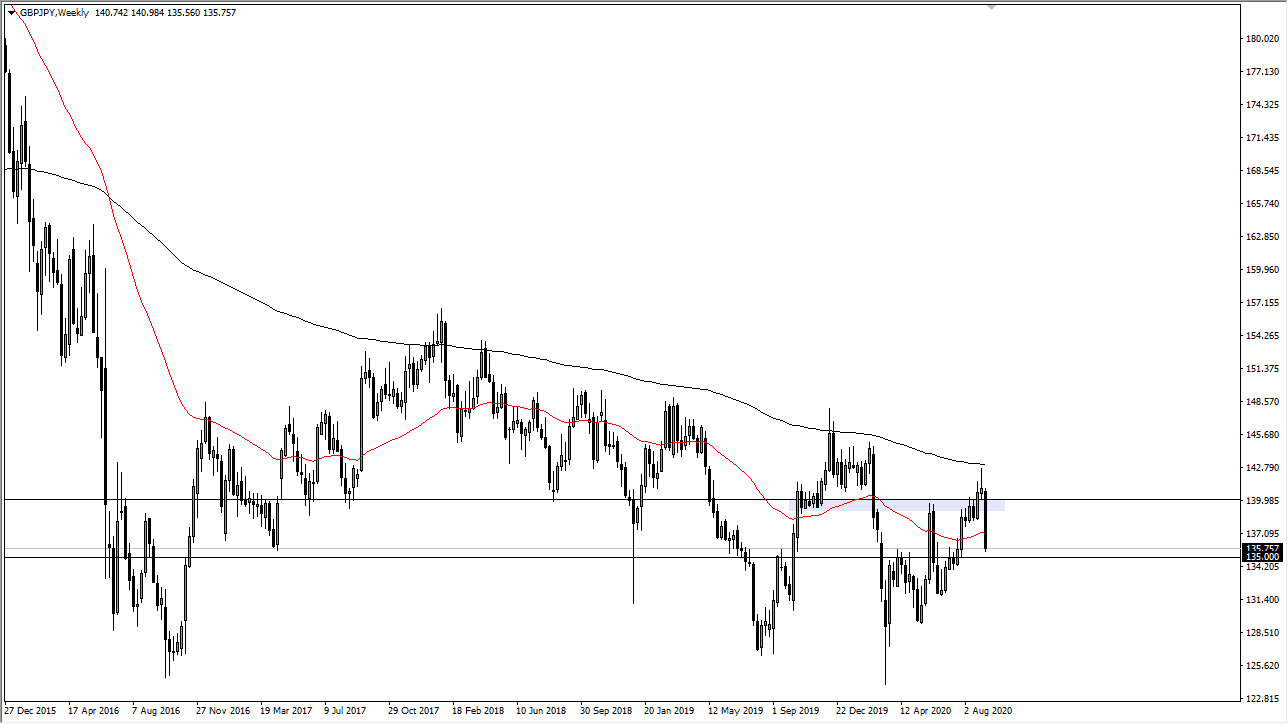

GBP/JPY

The British pound got absently crushed during the trading week as Brexit has reentered the headlines again. That being the case, it is obvious to me that the market is continuing to get more volatile, and with the nasty looking candlestick that we had formed for the week, it is very likely that we will continue to see somewhat bearish pressure. However, the ¥135 level could be the beginning of a turnaround, so be cognizant of the fact that a bounce could be coming. Furthermore, the sad reality is that if you are trading the British pound, you are going to be at the mercy of the latest Tweet, rumor, or headline. I anticipate that this week is going to be extraordinarily volatile, with an eye looking at the ¥135 level.

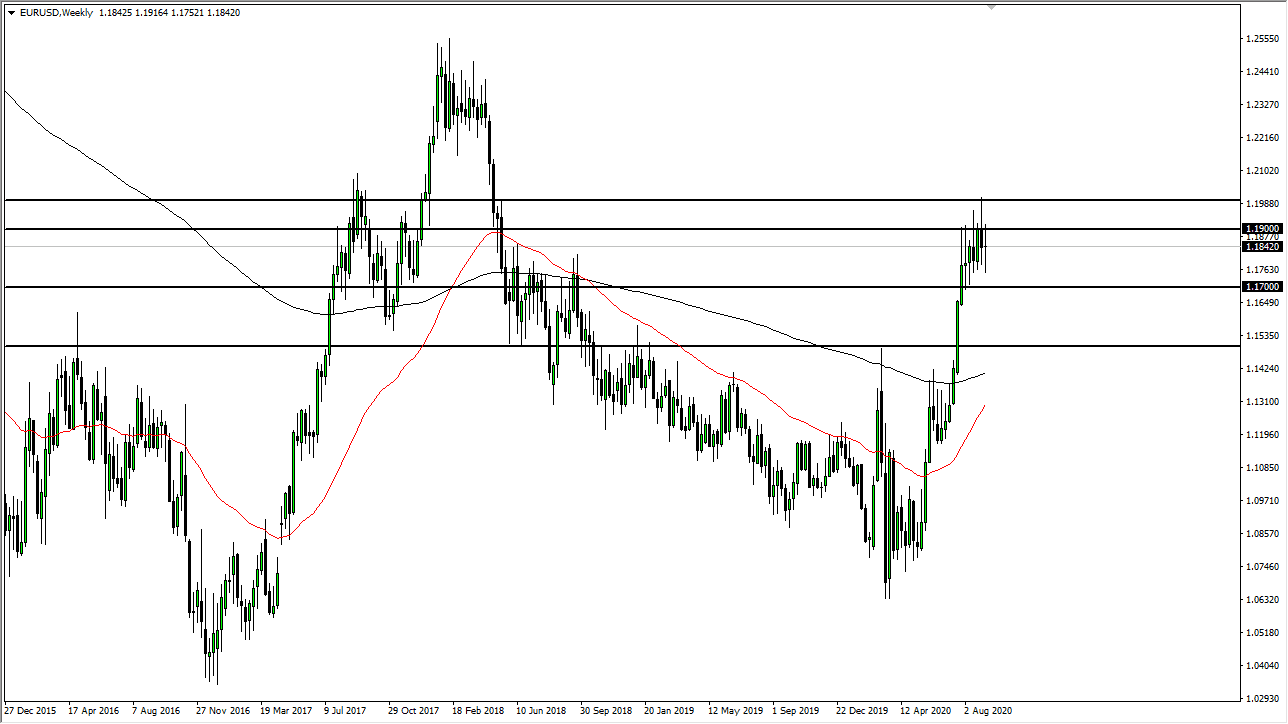

EUR/USD

The Euro has been very choppy during the last week ending up relatively unchanged. However, it is obvious at this point that the 1.19 level continues to offer resistance, and therefore you should be paying attention to it. I think at this point we are going to continue to struggle to get above there, let alone the 1.20 level. I am not necessarily saying that you should be overly bearish of the Euro, but fading in that general vicinity has worked for some time, and I would also point out the fact that the high from this week was 90 pips lower than the high from last week. The 1.17 level below should be significant support.

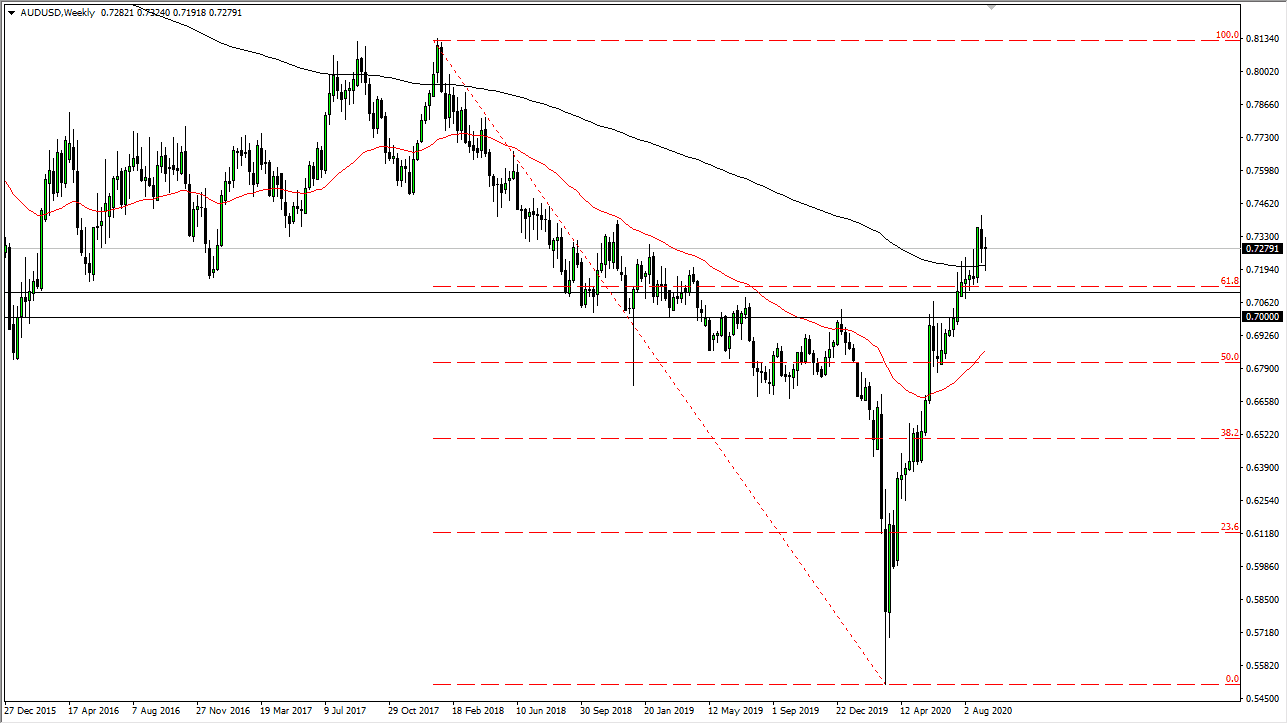

AUD/USD

The Australian dollar has gone back and forth during the course of the week forming a neutral candlestick much as the Euro did. That being said, unlike the Euro it has broken through several major barriers, so at this point, I think we are probably more likely to see the Aussie “kill time” over the next couple of sessions. The 200 week EMA sits just below, just as the 0.71 level does. I think both of those offer potential support. Even if we did pullback, I would be looking for some type of bounce to take advantage of, as the Aussie is benefiting from being so highly correlated to China.

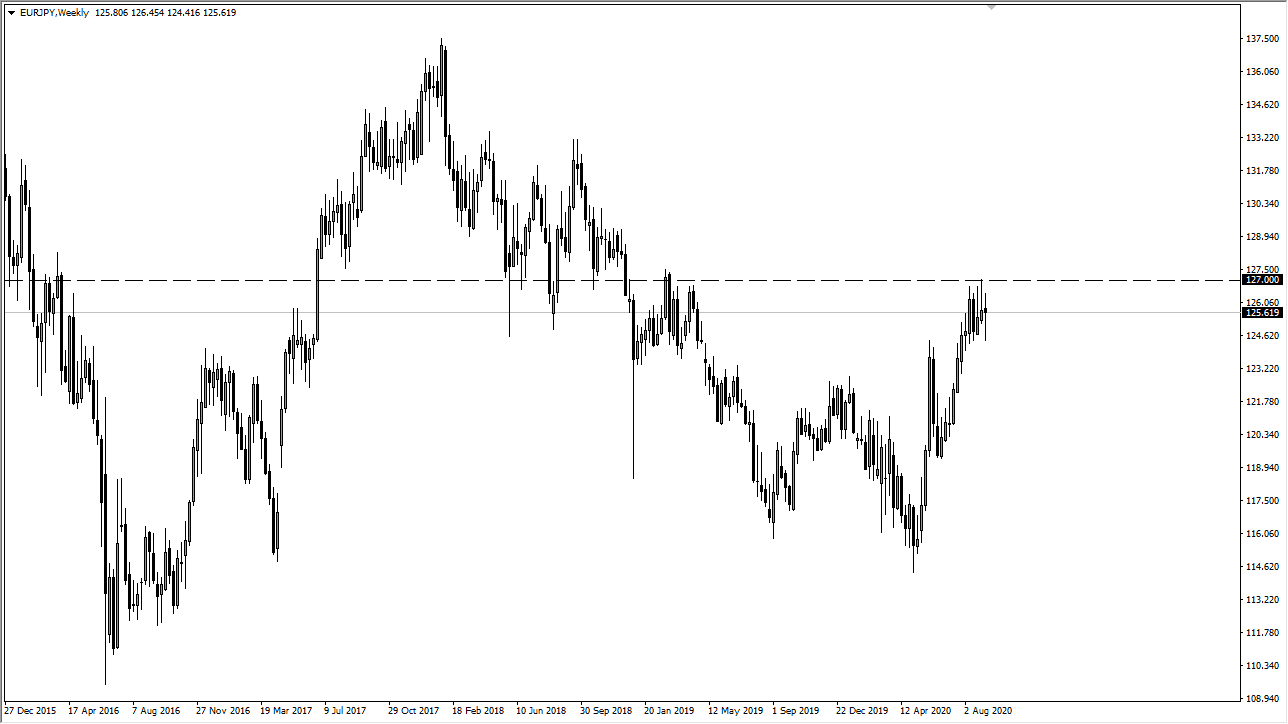

EUR/JPY

The Euro went back and forth during the week against the Japanese yen, forming a slightly negative close. At this point though, it is worth noting that the previous couple of candlesticks were shooting stars, and I think this is another place where we are starting to see a little bit of Euro exhaustion. I am looking to fade short-term rallies unless of course, we managed to break above the ¥127 level, which would be a very bullish sign.