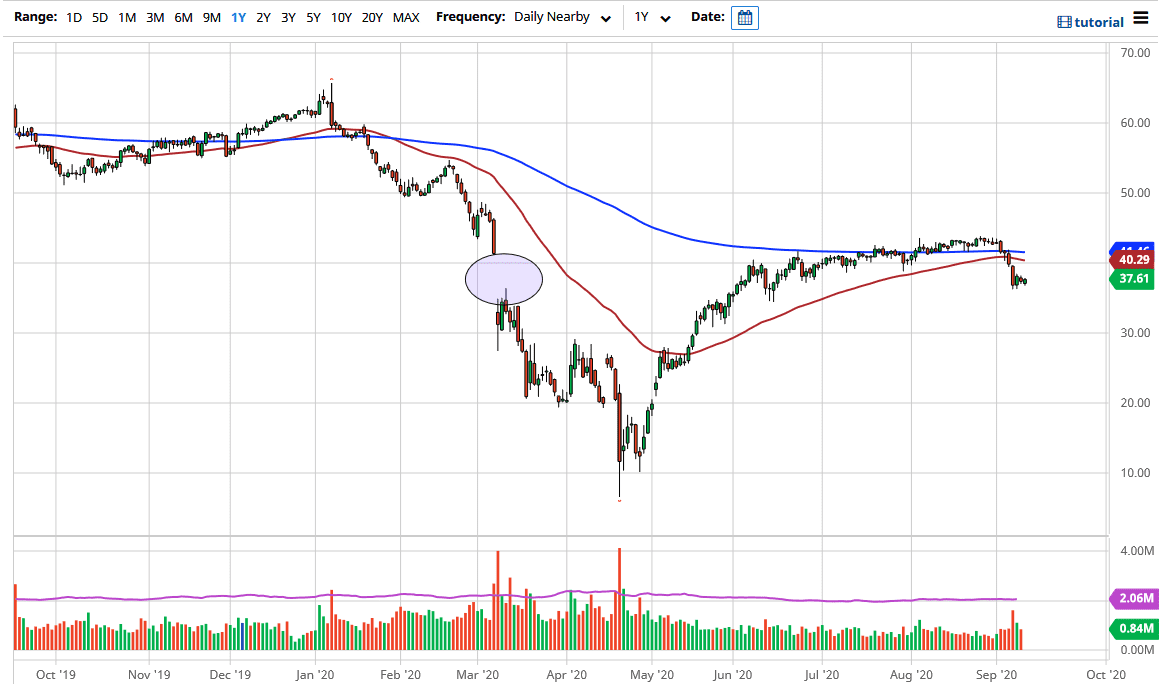

The West Texas Intermediate Crude Oil market did have a positive session on Friday, as we continue to hover around the $37.50 level on the front contract. The market sold off so hard earlier in the week that it should not be a huge surprise that we would struggle here. I think at this point in time it is only a matter of time before we reach towards the 50 day EMA again. However, I think that is a nice selling opportunity as the overall attitude of the market has most certainly shifted recently.

As Saudi Arabia has announced that it was going to be selling oil at cheaper prices that have really put a jolt into this overall market, as all grades of crude oil continue to struggle. That being said, it is very likely that we will continue to see a lot of back and forth, but I look at any rally at this point as an opportunity to start shorting again. Beyond that, if the US dollar starts to pick up steam again, and gains a bit of value, that will probably work against the value of commodities on the whole, including crude oil.

On a break down below the candlestick from the last couple of days I expect that this market goes looking towards the $35 level, possibly the $30 level after that. I think that this last week or so has been a significant signal that we are ready to go lower, so it is a bit difficult to get overly bullish on any move higher, at least not until we break above the 50 day EMA on a daily close, or perhaps even the 200 day EMA which is marked in blue on my chart. Because of this, I do believe that fading rallies will continue to work more than anything else, especially if the US dollar starts to strengthen because it is starting to show signs of doing that against certain currencies. Even if it does not, I think that the lack of demand is the real story here anyway, so I believe at this point it is the only thing that most traders are paying attention to. In a world that is simply awash with oil, it is difficult to imagine that we will suddenly see a reversal in the fortunes of the market.