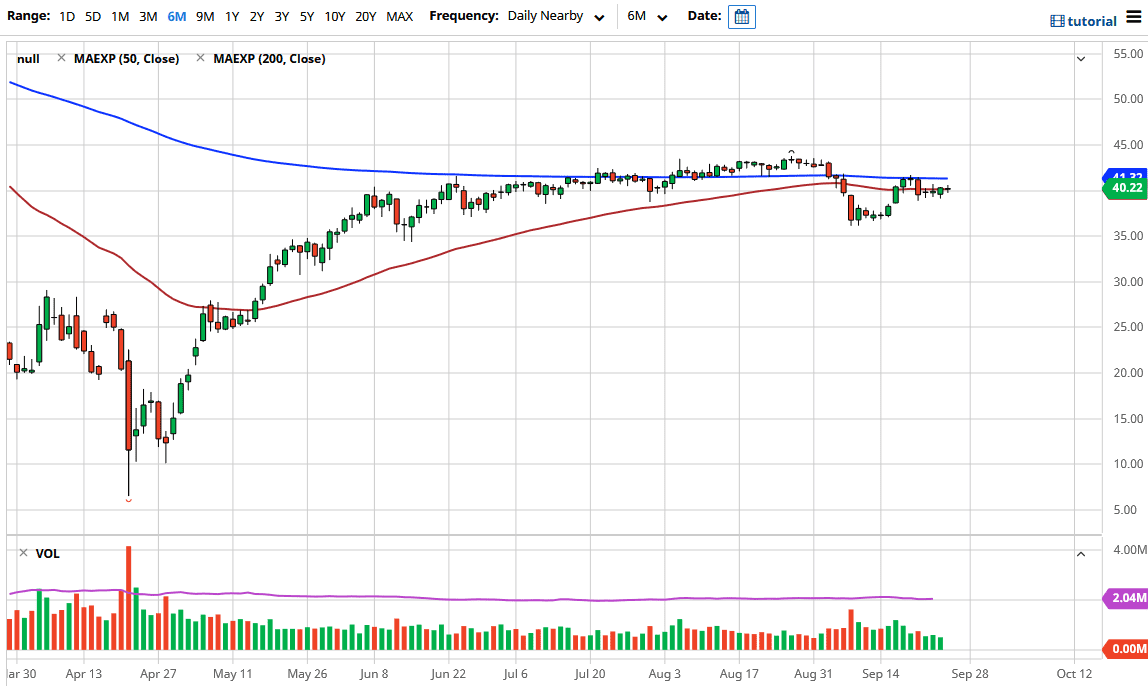

At this point, the market is oscillating around the 50 day EMA, which is sitting flat on the $40 level. The $40 level course is a large, round, psychologically significant figure and therefore it attracts a lot of attention. Beyond that, it also attracts a lot of attention due to the fact that a lot of options will expire in this general vicinity, so it does tend to act bit of a magnet for price.

The US dollar has been all over the place, showing signs of strength previously in the week, and it should be noted that the oil markets have held up rather well, so that is I suppose a bullish scenario. That being said, the 200 day EMA is currently sitting at the $41.32 level, and that could cause a bit of technical resistance. If we break above there, then we could go looking towards the $44 level which has caused selling pressure previously. On the other hand, if we break down below the lows of the money candlestick, it is likely that we are looking towards the $37.50 level. That is an area that has been supportive.

All things being equal, the market does not really know what to do with itself because we have concerns about demand, but there have also been a lot of jawboning by OPEC, and with that being the case it is likely that a lot of “push/pull” will continue to be the case. All things being equal, we are essentially at “fair value, considering that the $35 level underneath seems to be an area of interest, just as the $45 level is. In other words, as we sit in this area there is a bit of equilibrium, and that always tends to make the market a bit quiet, until we get the next catalyst to move in one direction or the other. Right now, the best thing you can do is simply let the market tell you where it wants to go. Right now, it does not want to go anywhere. Once we get an impulsive candlestick, we can follow it. It is worth noting that the most recent high was lower than the one before it though.