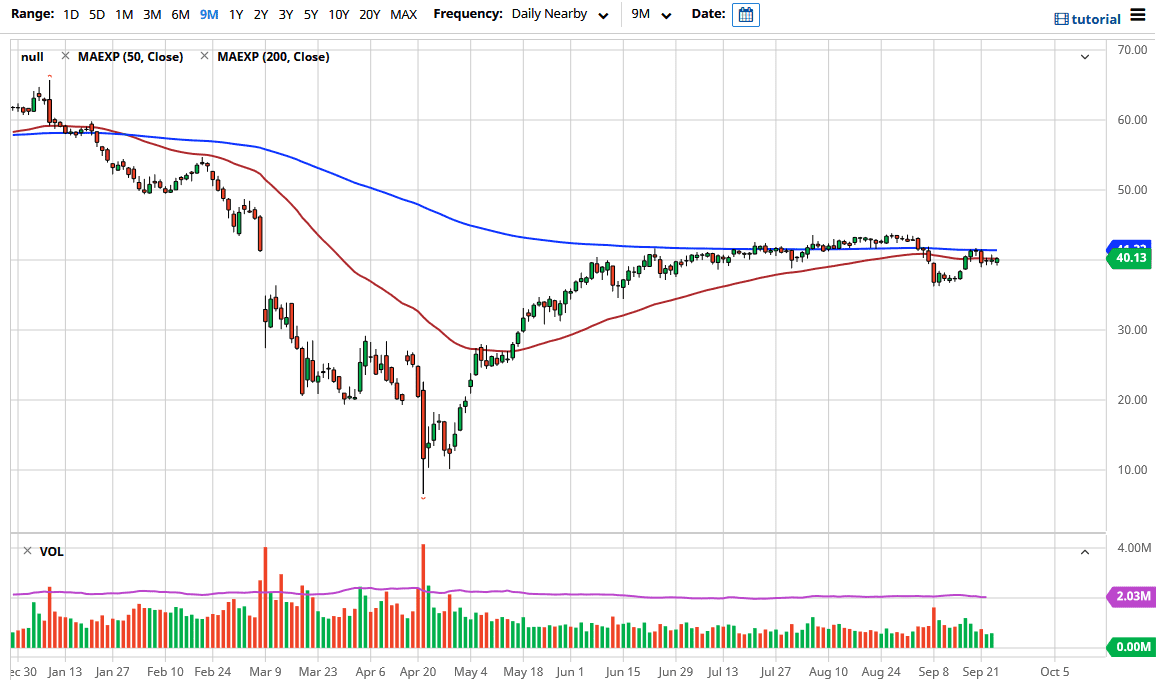

The West Texas Intermediate Crude Oil market went back and forth during the trading session on Thursday again, putting people to sleep. Remember, this market essentially did nothing for several months but grind slightly higher. At this point, now it looks as if we are at an inflection point and people will have to decide what happens next. The $40 level seems to be the epicenter of this inflection point, so pay close attention to what is going on here and keep in mind that the US dollar has a huge part to play in this market.

Ultimately, the US dollar has been rallying and that has been suppressing some of the strength from crude oil, and that could be one of the bigger issues. Having said that, we also have to worry about the fact that Chinese imports of crude oil are starting to show signs of weakness as well, meaning that demand continues to be a real question as well. Think about it this way: if the global economy is in fact starting to slow down a bit, then it makes sense that the demand for crude oil falls right along with it. In other words, the question remains how long can the market support $40 oil? I think in the next couple of weeks we will have a definitive answer, and right now I am still thinking the downside is very likely.

To rally from here would be a bit difficult, and would invite selling near the 200 day EMA, possibly even the recent highs near the $43 level. If we can break above there, then I might be convinced but right now I look at rallies as an opportunity to sell crude oil. We are obviously in a volatile time right now, as the world is trying to figure out whether or not we are dipping back into recession or if we will somehow slog through. After the global lockdown of so many economies, it is difficult to imagine how we suddenly just take off like nothing happened. A little bit of common sense could go long way but then again, the biggest problem that traders have is that common sense very rarely has anything to do with what the market is doing. The easiest way to trade this is to simply pay attention to the US Dollar Index, and trade in the opposite direction.