Amidst a move that confirms the extent of the GBP/USD price's thirst for a rebound, there was a strong upward rebound during last week's trading. It reached the 1.3177 resistance, its highest level in nearly two months, amid investors abandoning the dollar. By the end of the week’s trading, the pair returned to decline, reaching the 1.3018 support, before closing trading around the 1.3044 level. Regarding Brexit, the file most influencing the Pound's trends, Reuters reported that France is reducing, although not abandoning, its demands on British fisheries in the Brexit negotiations.

Trade Minister Liz Truss said: "We've made real progress, and a deal could be struck”, echoing the government path, as both celebrated the signing of the revised European Trade Agreement with Japan. Commenting on this, Derek Halbene, Head of Research, Global Markets Europe, Middle East and Africa at MUFG says, “Depending on where the pound is trading, risks are skewed to the downside. Sure, Wednesday's confirmation of talks resumption was good news, but there is still a path to negotiations.” This was all after Brexit talks were said to have been renewed, with Prime Minister Boris Johnson previously claiming to have cancelled these talks, which helped briefly make the British pound the best-performing main currency of the period.

The Pound was also relieved when European negotiator Michel Barnier reportedly said that he was "not concerned about anything other than fish".

Peter Karbata, ING's chief currency and bond strategist, Europe Middle East and Africa said: “As has been the case during the past weeks, the price movement of the GBP/USD should be determined mainly by fluctuations in the EUR/USD since the British pound, in the absence of news about Brexit, should remain stable to some extent".

Ahead of the weekend, Brexit-inspired profit taking will be one explanation of why the British pound continued to fall last Friday, with the pound against the dollar remaining near 1.30 even with the S&P500 index performance.

On the economic side, the UK reported stronger than expected retail sales for September, and the PMI for October reflected slowing economic activity with the impact of new social restrictions. Retail Sales in Britain rose 1.5% and 1.6% without these restrictions. The median in the Bloomberg survey was expected to increase of 0.2% and 0.5%, respectively. Home improvement and horticulture products were particularly strong. Grocery purchases increased, while purchases of clothing decreased. Online sales accounted for 27.5% of the total compared to just over 20% in February. The new social restrictions may affect consumption this month. On the other hand, the British Treasury Secretary has strengthened government support for troubled businesses, including making more generous wage subsidies and new grants for companies.

UK manufacturing PMI for October decreased to 53.3 from 54.1. It was slightly better than feared. The Services PMI was much weaker than expected, and as such, it fell to 52.3 from 56.1. These combined results led the composite index - which includes the manufacturing and services sectors together - to 52.9 from 56.5. It is the lowest level since June. The Bank of England will meet on November 5, a few hours before the conclusion of the FOMC meeting. As such, it is widely expected to ease the policy by boosting their purchases. There was some risk of bringing the 10 basis point interest rate down to zero.

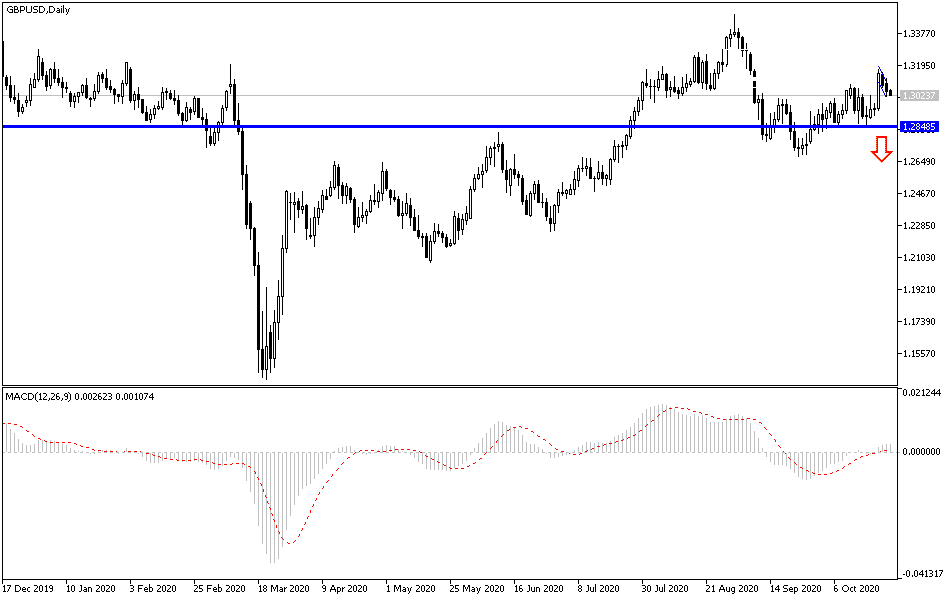

According to the technical analysis of the pair: According to the GBP/USD performance on the daily chart, if it moves below the 1.3000 support, the bearish momentum will increase and thus the rush towards the support levels at 1.2945, 1.2880 and 1.2800, respectively. On the near term, and based on the hourly chart performance, it appears that the GBP/USD is trading within a bullish channel. Which indicates a slight upward slope in the short term in market sentiment. The pair has recently retreated to approach the oversold levels of the 14-hour RSI. Accordingly, the bulls will target short-term rebound gains around 1.3166 or higher at 1.3258.

There are no significant UK economic issues today. From the United States, new home sales will be announced.