Last week’s transactions were harsh for the USD/JPY, as the pair collapsed towards the 104.34 support, the lowest level for more than a year after moving for several sessions in a limited range. We indicated then that there is a strong move coming in one of the two directions. The most prominent at the time was the control of the bears on the performance. The pair failed to close the week’s trading around the 105.00 level and closed around the 104.70 support. The US dollar remains under pressure as the US stimulus talks continue, so far the Senate approval is still unknown. In addition to the size of the package, there are many members who object to elements of that package, making it unlikely that there will be enough votes to join the Democratic senators to pass the bill.

In fact, perceptions that the numbers are now non-existent are beginning to discourage some Democrats in the House of Representatives, all facing re-election, from wanting to return to halt the campaigning and return to Washington.

The future of US-China relations: Next week, the US presidential election will be held, and its results will determine the future of relations between the two largest economies in the world. During the Trump administration, the two faced their biggest conflict in history. A global trade war erupted because of them, increasing pressure on the global economy. Fears subsided a little after the signing of the Phase 1 agreement between the two, but shortly after, the global economy faced the deadly Corona epidemic that pushed it towards the strongest recession since World War II.

In general, it appears that Republican and Democratic lawmakers and their voters are unwilling to adopt a softer approach to China, which could herald more conflict in the future, regardless of the election outcome. Relations between the United States and China have plummeted to their lowest level in decades amid a raft of conflicts over the coronavirus pandemic, technology, trade, security and espionage.

Despite disagreement on many other fronts, both parties criticize Beijing's trade record and attitude toward Hong Kong and Taiwan, and religious and ethnic minorities in Tibet and Xinjiang, where the ruling Communist Party has detained Muslims in political re-education camps. On the other hand, American public opinion is equally negative. Two-thirds of people surveyed in March by the Pew Research Center had "unfavourable views" of China, the highest percentage since the Pew Center began asking questions in 2005.

In this regard, Chinese analysts say that Biden's presidency may restore a more predictable relationship after Trump's tariff war shocks and his contacts with India, which is seen as a strategic competitor, along with Southeast Asia countries, with which there is a series of regional conflicts with Beijing. Commenting on this, Yu Wanli, a professor of international relations at Beijing University of Language and Culture, said, at least, Biden's policy "will not be as emotional and funny as Trump's." Shi Yinhong of Renmin University in Beijing, one of the country's leading international relations scholars, said: "Democrats seem to be less hard-lined, so they may care more about preventing even limited military conflicts and pay more attention to continuing crisis management with China,".

Regarding the US elections: Biden, Obama's vice president in 2009-2017, leads in the polls but Trump may win if he attracts enough voters in major states including Florida. Trump hit a similar surprise in 2016 when he lost the popular vote but won enough states to secure the 270 votes required in the Electoral College that decides the election.

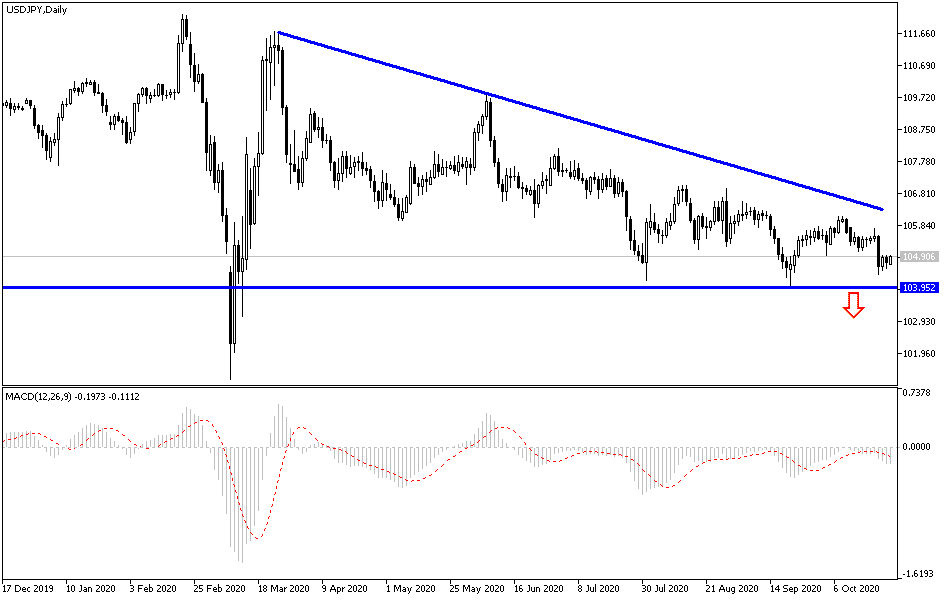

According to the technical analysis of the pair: USD/ JPY general trend, according to the performance on the daily chart, is still bearish, and stability below 105.00 level supports the bears dominance, and thus the move towards stronger support levels, the closest currently being 10455, 103.90 and 103.00, respectively. At the same time, those levels will push the technical indicators to oversold areas, from which currency traders will begin to think about buying, waiting for the moment to rebound to the upside. The 108.00 resistance will remain the most important for a real shift in the general direction. Still, I would prefer to buy the pair on every downward move. The pair is awaiting the announcement of the number of new US home sales along investors risk appetite.