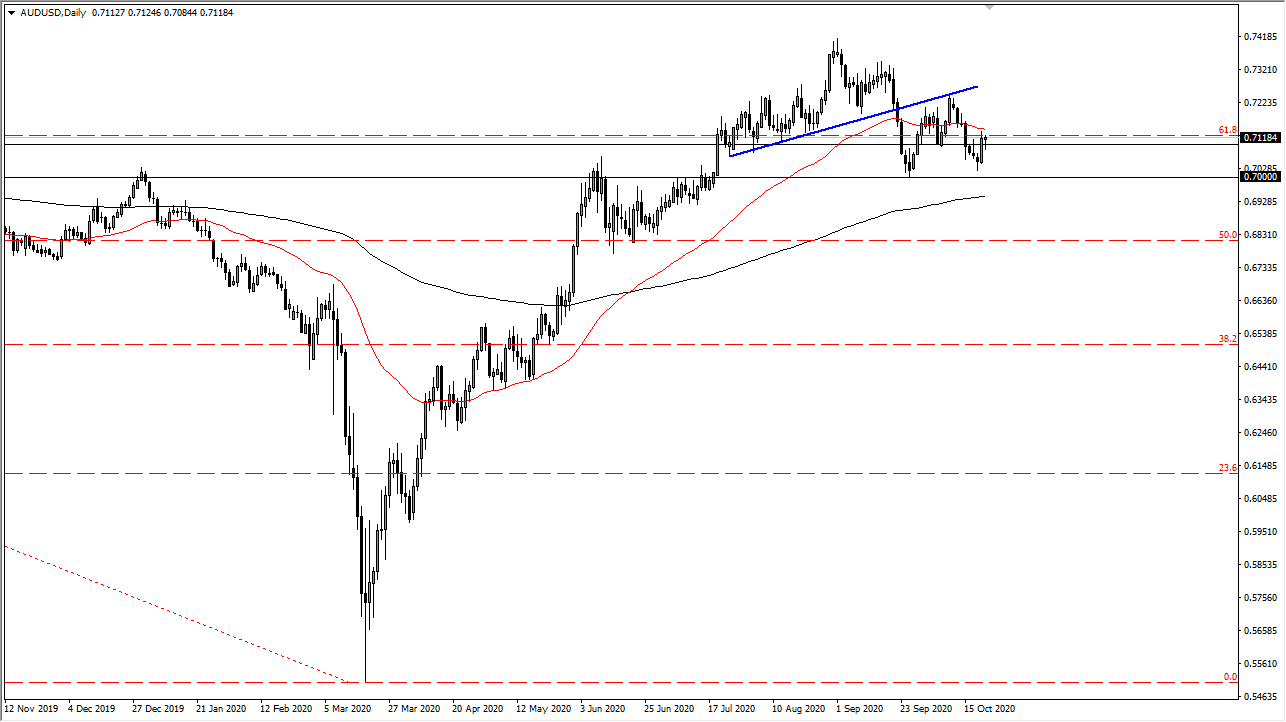

The Australian dollar initially pulled back a bit during the trading session on Thursday, dipping below the 0.71 handle. However, we have turned around later in the day as the world awaits and anticipates the possibility of stimulus. Just above current trading, the 50 day EMA is sitting and driving lower, but ultimately this is a market that is going to continue to be very noisy. Keep in mind that the Australian dollar is getting a little bit of a boost due to the idea of stimulus coming out the United States and driving down the value of the US dollar, but we also have another major issue on the other side of the coin.

The Reserve Bank of Australia is starting to talk rather openly about the idea of interest rate cuts during the November meeting, and therefore it will put a bit of pressure on the Aussie dollar. Having said that, the market has already noticed that so it would not be a huge surprise that we would see negativity but maybe not as much as anticipated. The move has already started, as we broke down through the previous uptrend line, and then retested it only to fall again. The question now is whether or not this is going to be the beginning of some type of bigger move? I think that becomes much more obvious if we break down below the 0.70 level, which would invalidate what could possibly be a potential “double bottom.”

Looking at this chart, if we were to break down below there it is likely that we would go looking towards the 0.68 handle. Obviously, the 200 day EMA is floating around the same area but I think at this point there is so much tension build up in the markets overall that would not be a huge surprise to see the market fall apart. I think ultimately this is a market that continues to see a lot of volatility but until we break down one has to assume that we continue to trade in the same general consolidation area between the 0.70 level and the 0.73 handle. Once that gets broken, we can have a much bigger move come into play. Once we get through stimulus then we have to pay attention to the RBA and maybe not the cut, but perhaps the language going forward.