The Australian dollar rallied a bit during the trading session on Wednesday, as we continue to trade in the same range that is just above a major support level. That being said, the market is looking for some type of catalyst to move in one direction or the other. Without a doubt, the most widely followed variable right now is the idea of whether or not there is going to be stimulus out of the United States, which traders seem to believe is in fact eventually going to happen. Having said that, I think there might be a bit of a disconnect from reality again, as it is very difficult to imagine that a whole lot can be done between now and the election.

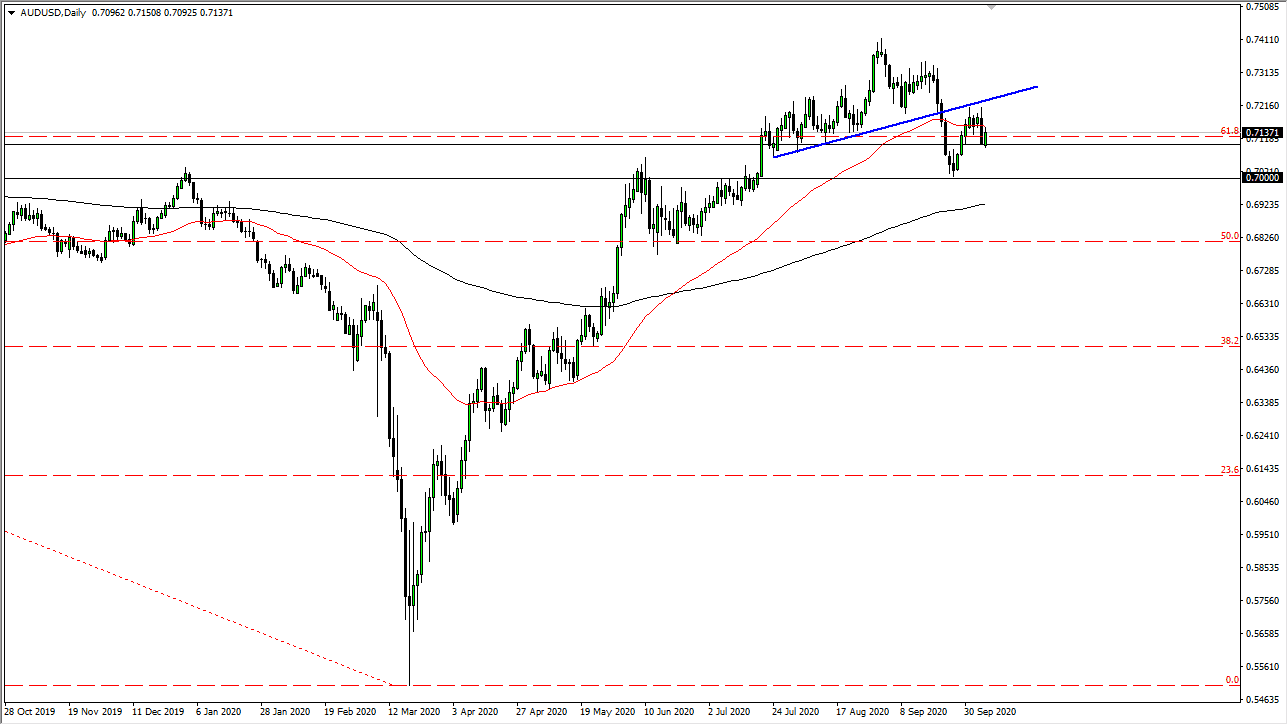

With that being said, there is most certainly more danger of a “risk off” type of situation than a major “risk on” one. I believe that although we could rally and more of our bullish sentiment when it comes to riskier currencies such as the Australian dollar, I think that it is going to be difficult to clear the hurdle above that would send this market much higher. I see the 0.72 level as significant resistance and it is also backed up by the previous uptrend line that we are now significantly below. Having said all of that, there is also a significant amount of support underneath, so I think that tends to lead this market sideways more than anything else.

When you look at this chart, you can see that I have the 0.71 level and the 0.70 level marked. That is essentially a “zone” of interest in the market. It is presently acting as support, but it is worth noting that we drove all the way to the bottom of it before bouncing this time. This does suggest that there could perhaps still be a lot of weight around the neck of the Australian dollar. This would make quite a bit of sense with everything that is going on around the world, but the Aussie does have the added benefit of being highly levered to China, which is one of the few bright spots. That being said, I think we are more likely to see sideways action between 0.71 and 0.72 then we are anything else, but I most certainly favor the downside, at least in the short term. Longer-term, if we get stimulus coming out the United States and more “risk on” behavior around the world, that typically favors the Australian dollar.