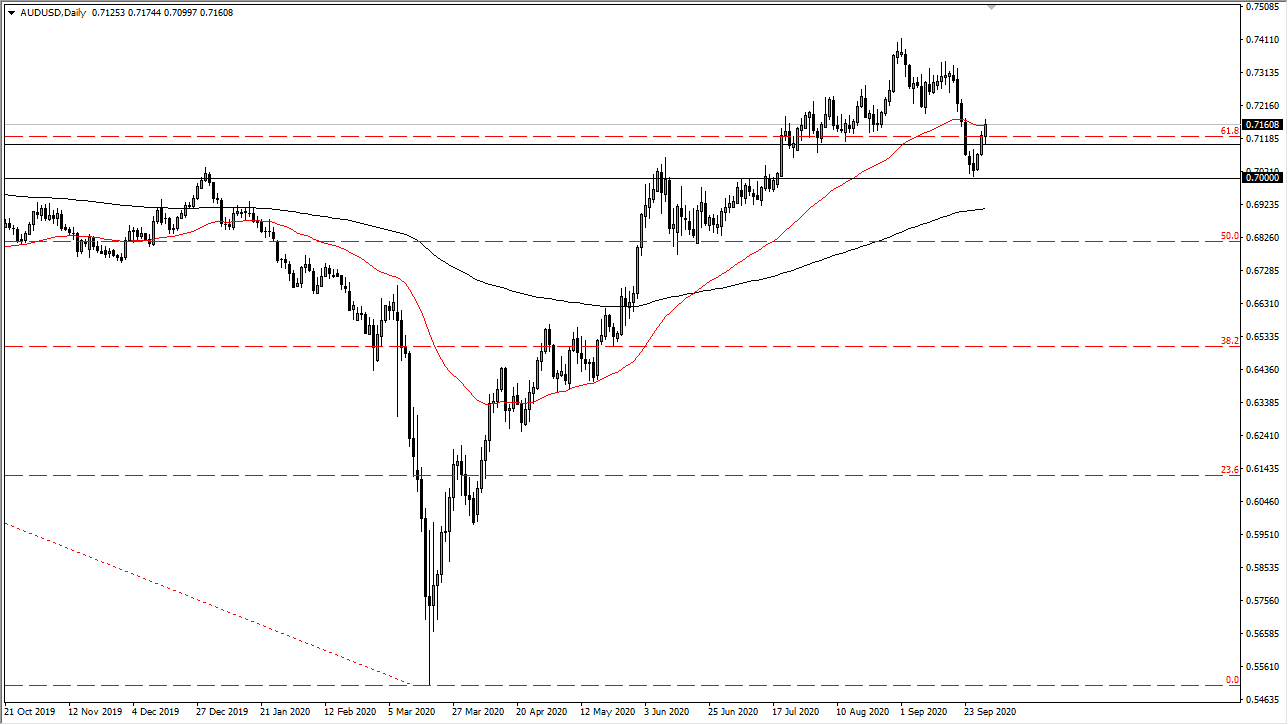

The Australian dollar rallied a bit during the trading session after initially pulling back at the open on Wednesday. The 0.71 level offered a bit of support, and we bounced back above the 50 day EMA. By doing so, the market looks as if it is ready to go higher, but we need to break above the top of the trading range for the trading session. Breaking above their opens up the possibility of a move towards the 0.73 handle, perhaps even the 0.74 level. Keep in mind though that the Australian dollar is highly levered to China, so therefore we should also pay attention to Asia in general.

The US dollar has been all over the place as of late, so it does suggest that we may have some work to do. The candlestick is rather bullish but having said that we still have not exactly broken to the upside. If we break down below the 0.71 level, we probably will find value hunters underneath and all the way down to the 0.70 level. A move below that level opens up the possibility of a drop-down to the 200 day EMA, and further. Keep in mind that the Australian dollar is highly levered to China as I mentioned previously, so pay attention to the Asian markets and the overall risk appetite in that part of the world to get a gauge as to whether or not the Aussie will continue to strengthen.

If we do break down from here, it’s very likely that the US dollar will strengthen quite rapidly against other currencies and perhaps even more so than the Aussie as it has a little bit of insulation due to the Chinese growth and economic numbers that have been better. As long that is going to be the case, it is very likely that the Aussie at the very least will be “less bad” when it comes to trading against the greenback. Ultimately, this is a market that I think is going to be more of a “buy on the dips” scenario, but only when the US dollar is losing strength. Given enough time, we could make a bigger move, but it is not until we close on a daily candlestick below the 0.70 level that I am tempted to short this market when it is going to be much easier to go long the US dollar against the Canadian dollar, New Zealand dollar, etc.