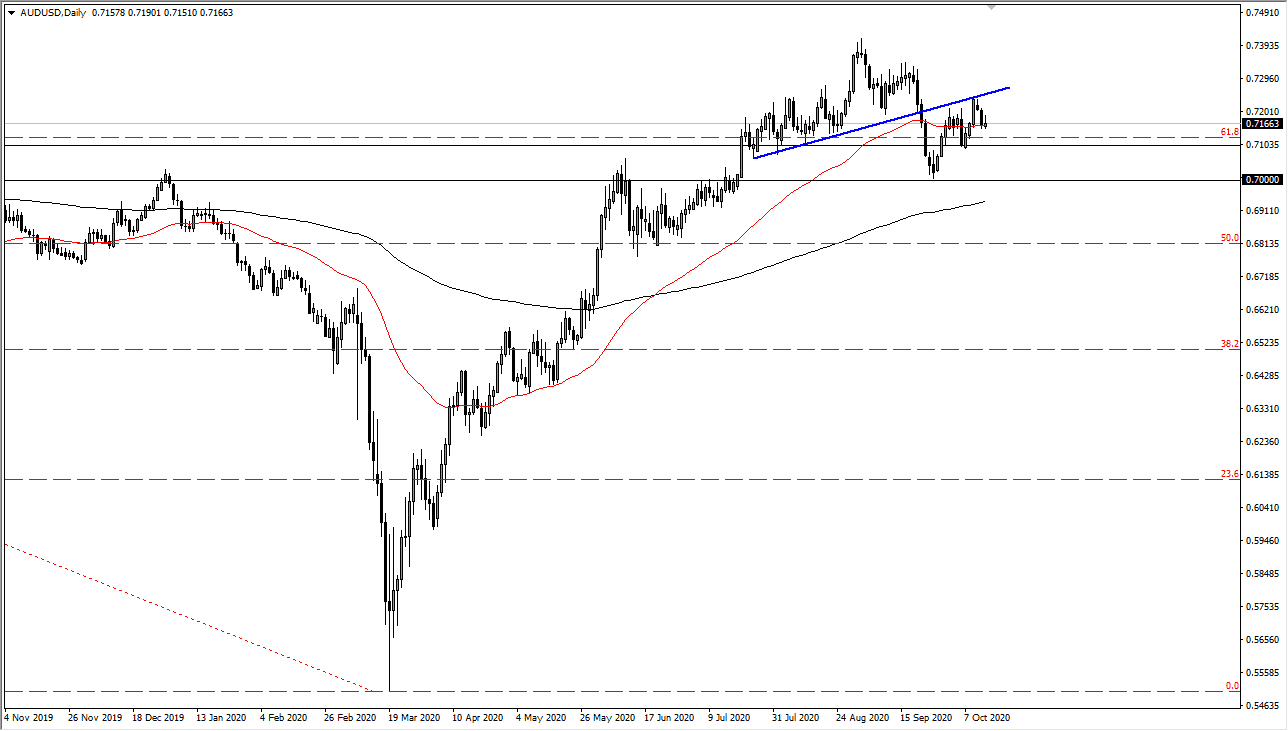

The Australian dollar initially tried to rally during the trading session on Wednesday but has turned around to show signs of exhaustion again. Ultimately, this is a market that I think continues to see a bit more downward pressure than anything else, mainly due to the fact that people are starting to be concerned about the idea of global growth shrinking. Quite frankly, the Australian dollar has been a bit insulated to the negative pressure due to the fact that the Aussie is highly sensitive to China, and that has helped. That being said, we have recently broken through a major uptrend line, and it now looks like we are trying to confirm that downward pressure.

With that being said, the market is still respecting the area between 0.71 and 0.70 as a “zone of influence.” Ultimately, I think that if we can break down below there the Australian dollar will really start to unwind. The US dollar had been oversold for some time, but it now looks as if we are going to test the idea of whether or not the US dollar will regain some of its previous mojo. At this point, I think it is very likely that at the very least we need to grind sideways in order to work off some of the massive overbought condition that we have been in.

If we were to break above the recent highs at the 0.7250 level, which features the uptrend line that had been broken through. If we can clear that area, then it is very likely that we go looking towards the 0.74 handle. That would more than likely have something to do with the idea of stimulus coming on board in the United States, driving down the value of the US dollar. Having said that, there is still a lot of concern out there when it comes to the global economy, and that could in and of itself drive people into the US dollar due to the “fear trade.” Remember, the Australian dollar is highly sensitive to growth, so if we start to see a lot of negativity out there, it makes sense that we would rollover. That being said, I like the idea of looking at this market between 0.70 and 0.7250 as being the norm, perhaps even as long as between now and the US election.