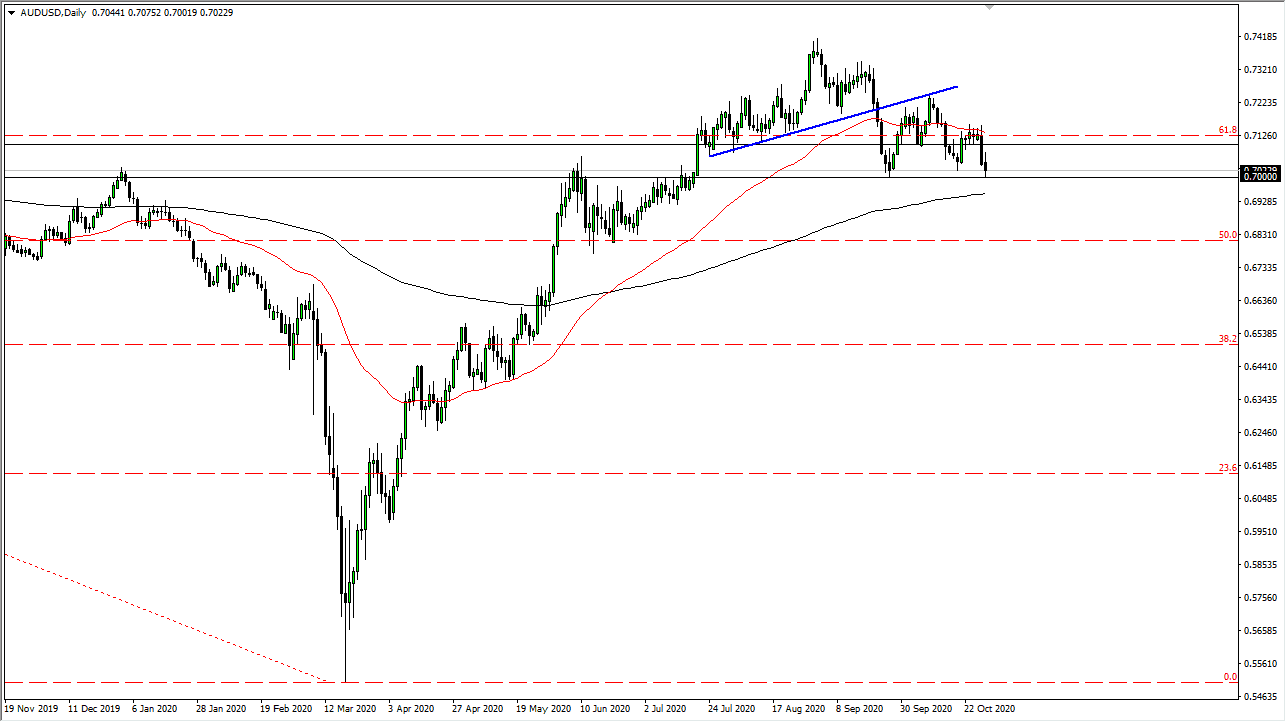

The Australian dollar has gone back and forth during the trading session on Thursday, as we dropped down towards the 0.70 level. That is a large, round, psychologically significant figure, but more importantly it has been support more than once. It does look like we are trying to break down below, so I think that it is only a matter of time before the Aussie gets hammered. After all, the US dollar is starting to strengthen against several other currencies around the world, but we did see a little bit of stabilization in the currency markets late in the day.

Looking at this chart, you can see that the 200 day EMA sitting underneath that level will also be interesting as well. If we can break down below there, then it is likely that we go even further to the downside. Having said that, I think we probably have a short-term bounce heading into the weekend, perhaps based upon some type of relief rally or something of that ilk.

Looking at this chart, you can see that we have made a series of “lower highs”, so I do think that it is likely that we will eventually break down a bit. The potential descending triangle measures for a move down to the 0.68 level, perhaps even down to the 0.67 level depending on how you measure it. Either way, this suggests that we are going to get some type of “risk off” type of situation. That typically favors the US dollar, and with so much risk out there when it comes to the coronavirus situation and of course the elections in the United States, it makes quite a bit of sense that we may see more of this “risk behavior.”

The Australian dollar has been somewhat insulated against other currencies, perhaps due to the idea that the Chinese economy would continue to support Australia. Having said that, I think it is only a matter of time before the total economic system starts to come under assault and therefore it is likely that we would see more selling. The US dollar tends to be highly favorable due to the fact that the US Treasury markets demand those greenbacks. If traders start to run for the hills, that should continue to be the attitude going forward. Unless we get some type of really good news, this market probably continues to fail to hang onto