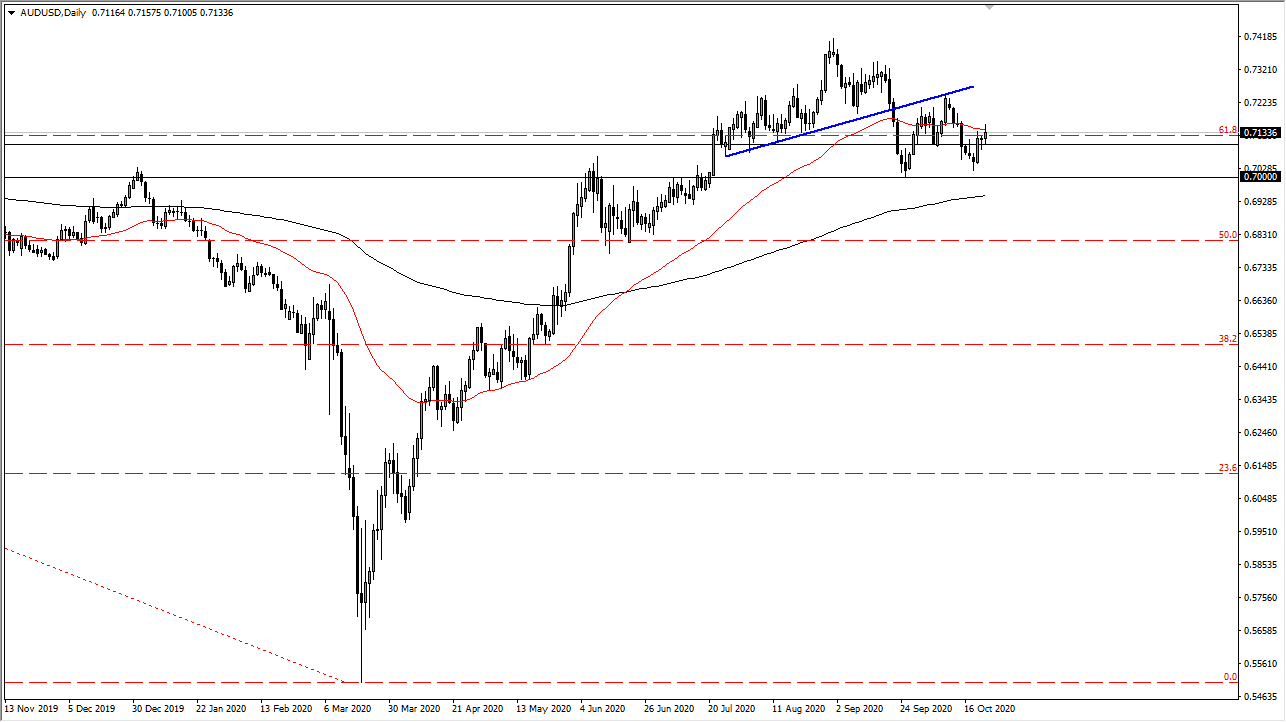

The Australian dollar went back and forth during the trading session on Friday but found resistance at the 50 day EMA to keep this market somewhat soft. Ultimately, the Australian dollar is continuing to be very choppy and as a result I think we will probably continue to see selling opportunities going forward on signs of exhaustion. The candlestick for the trading session is a shooting star, so that suggests that the market is likely to continue to find selling.

The 0.71 level underneath is support that extends all the way down to the 0.70 level. If we can break down below there it is likely that we continue to get lower, perhaps reaching down towards the 200 day EMA. Breaking down below there, it is likely that the market breaks apart as it would be a “lower low” after forming a “lower high. That would be a trend change just waiting to happen, so at this point in time if we get that I would become much more aggressive to the downside. Having said that, the market continues to offer selling opportunities on short-term rallies that fail, and I think that if you look at short-term charts you more than likely will be able to take advantage of that.

To the upside, if we break above the top of the candlestick we could go as high as the 0.73 level, but that is about as far as I think this market goes with the specter of the Reserve Bank of Australia out there cutting rates in November, and of course a lot of noise when it comes to stimulus as the Americans do get out. At this point, the market is likely to see a lot of noisy trading and therefore my default position is to fade rallies and I am getting further and further away from the idea of buying this market. Furthermore, if we break down below the 0.70 level, then we could get a 300 point drop, but at the very least I think we are looking at a move down to the 0.68 handle. At this point, I anticipate that the only thing you can count on is a lot of noise as we approach the election as well. Ultimately, this is a scenario that I think we are starting to see the tide turned towards the US dollar.