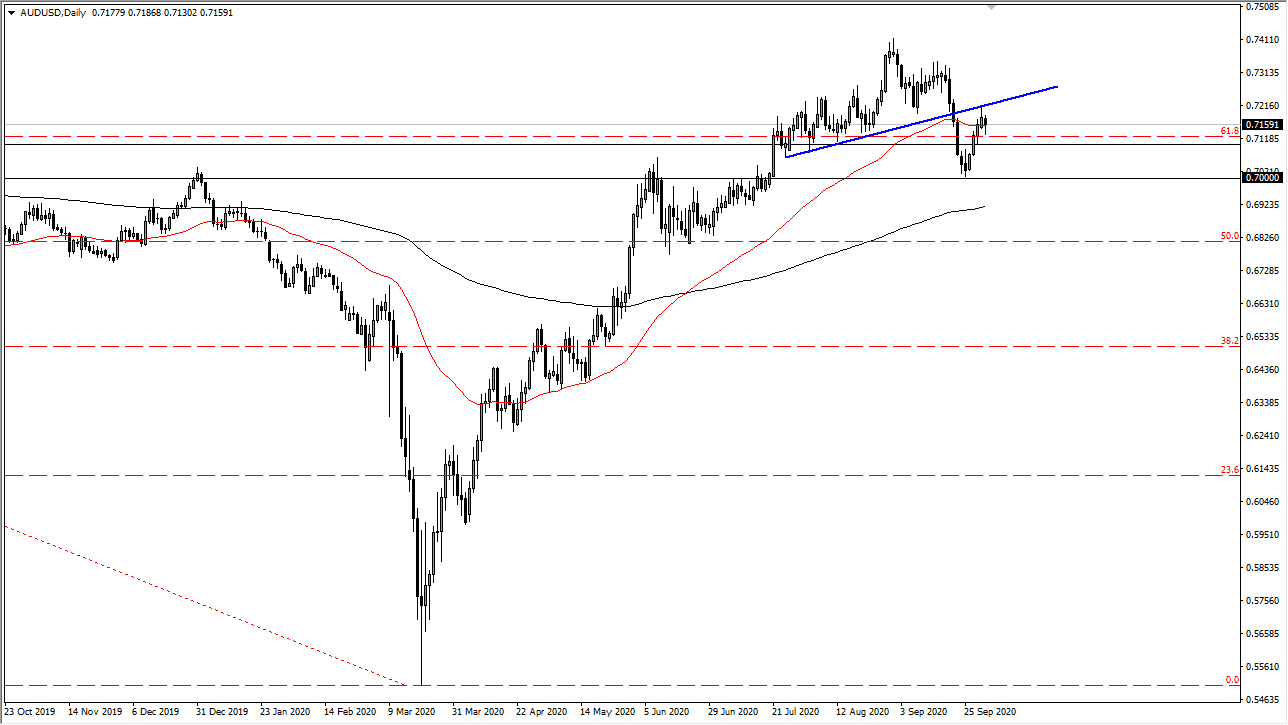

The Australian dollar has broken down a bit during the trading session on Friday, slicing through the 50 day EMA as the world got wind of the president of the United States contracting the coronavirus. Having said that, there was a sudden “risk-off” move in Asia, and that sent the Australian dollar rolling over. Because of this, we reach down towards the 0.71 level, an area that extends down to the 0.70 level. That is an area that is very important on the charts as I have stated more than once, so the fact that we bounced from there probably is not a huge surprise.

Looking at this chart, I can see that there is a significant amount of resistance just above, as the previous uptrend line has held so far. Do not get me wrong, I believe that we are in an overall uptrend, but it certainly looks as if we are on the precipice of changing, at least for the intermediate-term. I am not a seller of the Australian dollar anytime soon though, especially as it has been so strong against the greenback. I am either a buyer of the Australian dollar or on the sidelines until we break down below the 0.70 level. It is at that point in time that I think a lot of sellers will jump in and start to push the Aussie lower. As this happens, it is very likely that you will have already seen the Euro in the Pound got hammered. Furthermore, the New Zealand dollar is also much more susceptible to selling pressure than the Australian dollar as the Aussie is a bit of a proxy for China.

Looking at the candlestick, it is a little bit supportive, but when I look at the structure of the market it does suggest that perhaps we probably have a bit of bearish pressure in this area. If the US dollar suddenly sells off, and we break above the highs of the Thursday session and the market here, I would be a buyer. Otherwise, there is in a whole lot to do in this market because we have conflicting candlesticks and that typically means sideways action.