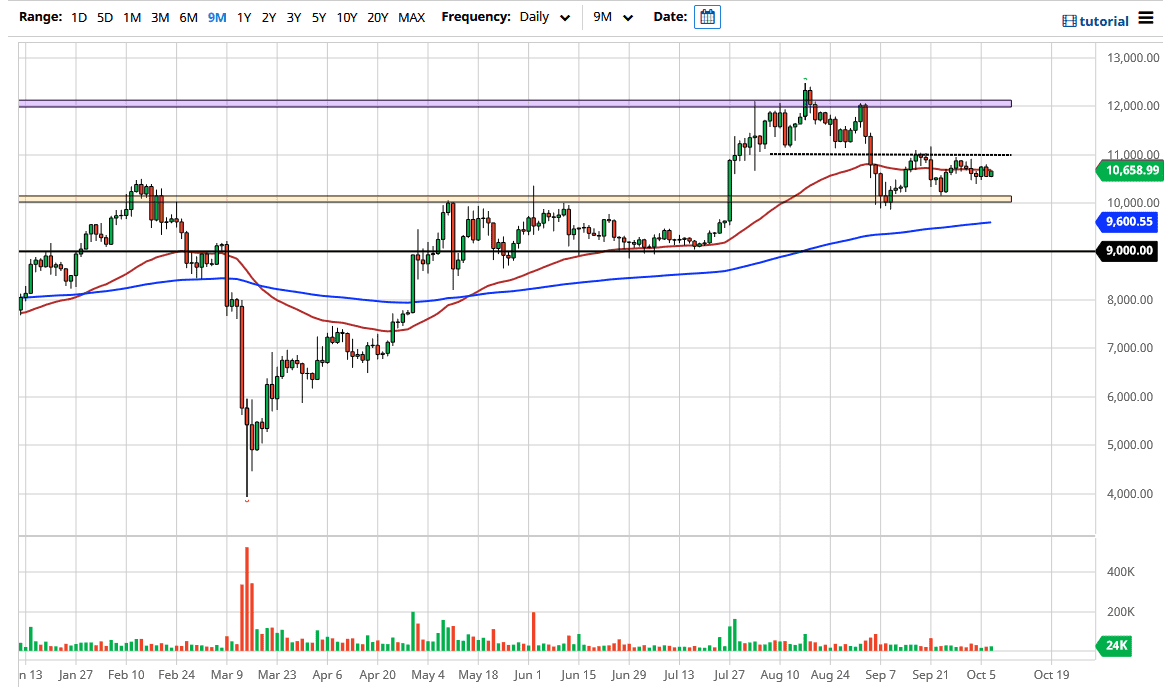

The markets in general have been relatively quiet during the trading session on Wednesday and Bitcoin of course was no different. After all, the Bitcoin market is highly dependent on what goes on with the US dollar, which has been choppy to say the least. Given enough time, I believe that the market is going to have to make some type of decision, but at this point it looks like we are ready to bounce around between the same two major levels that we have been testing. The $11,000 level to the top has been resistive while the $10,000 level to the bottom has been supportive. I do not see that changing in the short term.

That being said, the 50 day EMA is also going sideways and is flat that gives us yet another reason to think that the market is not going anywhere anytime soon. I think that most of what is going on is that people are waiting to see whether or not there is going to be a big stimulus bill coming out the United States. This would devalue the US dollar, at least in theory, and that should bring up the value of Bitcoin. I know that a lot of Bitcoin faithful out there hate to hear this, but this is just like any other Forex pair. You are essentially trading one currency against another. You can go on about storage and international transfers, ease-of-use, or lack of use, but at the end of the day this is a currency. If it is going to be used as a currency, it will be traded as one.

To the downside, the $10,000 level offering support but being broken through would bring up the specter of a possible move down to the 9600 level where the 200 day EMA sits. After that, I think the $9000 level comes into view as potential support. To the upside, if we can break through the $11,000 level it for the most part will open up a move towards the $12,000 above which has been significant supply. The thing about Bitcoin is that it is obviously moving in $1000 increments right now, so you might as well use that to your advantage. Back-and-forth trading will more than likely continue to be the case until we get some type of bigger move in the US dollar.