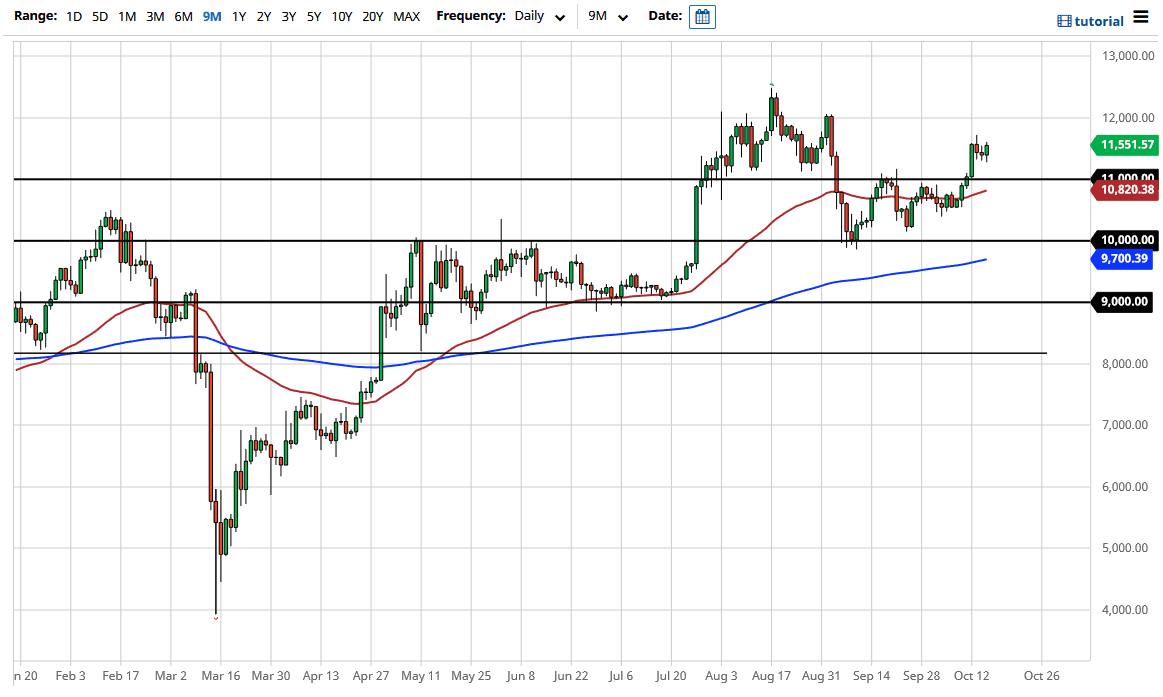

The last couple of days have seen buyers in that region, and therefore it looks like we are trying to form some type of “micro-support region.” Because of this, the market is likely to continue to finally go looking towards the highs again. The next level was where we had seen a major selloff in major supply at the $12,000 level. I have to believe that there are certain amount of unfilled orders in that general vicinity.

This is not to say that we are going to reach the $12,000 level and then collapse, I just think that there is a significant amount of resistance in that region. I would anticipate that we pull back a bit from there and then try to break out to the upside. Looking at this chart, I also think that there is a lot of support underneath at the $11,000 level, which was the scene of a breakout from the ascending triangle that we were forming last month. The 50 day EMA is reaching towards the $11,000 level as well, so I think there are multiple reasons to think that buyers might be in that general area.

On a pullback to that area, I would be looking for some type of supportive daily candlestick in order to get involved, because quite frankly this is going to continue to be based upon the US dollar and where it is going longer term. I think at this point we are trying to figure out what stimulus is coming, which is more than likely going to be the end result after the election. If stimulus in the United States is rather large, that debases the US dollar, and therefore should drive the Bitcoin market higher, all things being equal.

Because of all of this, I have no interest in trying to go short of this market and I look at any pullback as a potential value play. Again, I think that if we do drift lower if you are patient enough you should be able to pick up value, and take advantage of what is a very strong recent uptrend in Bitcoin, which would not only be found against the US dollar, but also most other large currencies around the world.