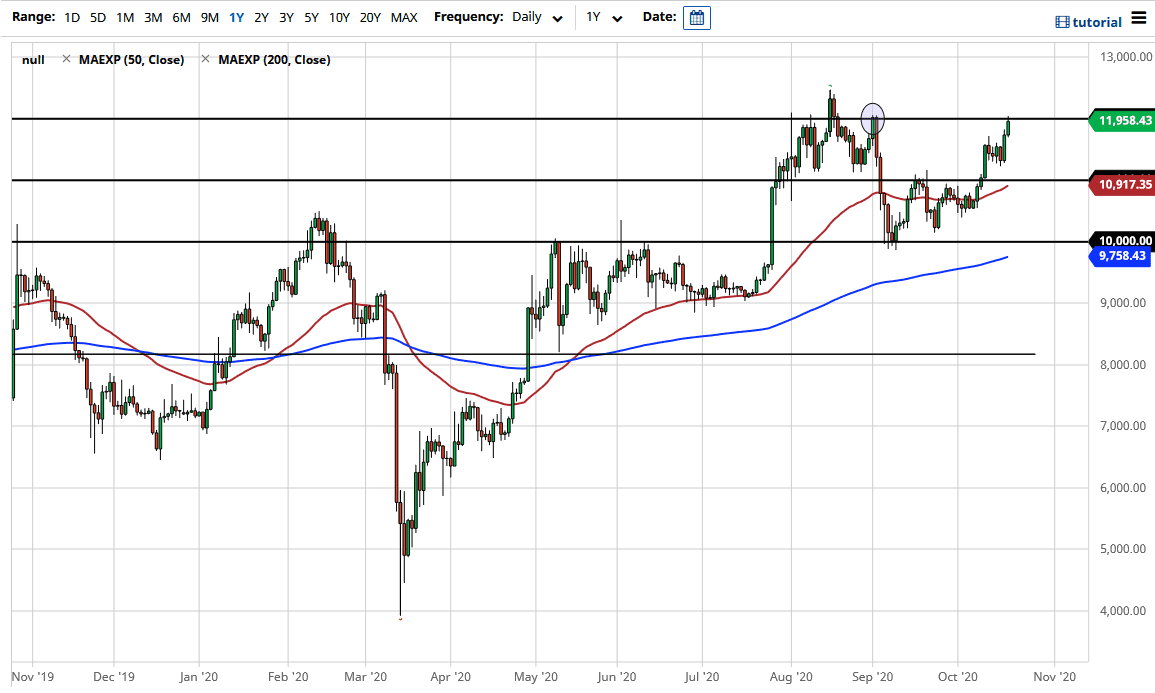

The $12,000 level is an area where we have seen a lot of resistance, so it makes sense that the market has struggled a bit to get above there. Ultimately, if we do break out above there, the $12,500 level is significant resistance as well.

The candlestick is relatively strong, as we are closing towards the top of it. Although we did pullback a little bit, the reality is that we stay close enough towards the highs that it looks like we have plenty of strength. Even if we do pull back at this point, I think it is only a matter of time before the buyers would come back on board, especially if we get some type of stimulus out of the United States. This would drive down the value of the US dollar, at least in theory, and should drive people into other assets, including Bitcoin. With that being the case, Bitcoin is starting to act as a bit of a safe paving when it comes to the destruction again.

To the downside, I believe that the $11,500 level should offer a certain amount of support, as we have had a significant bounce higher. The market underneath there extends for support down at the $11,000 level. The 50 day EMA is reaching towards the $11,000 level as well. I think that this is a significant support level that a lot of people will continue to bounce from the pullbacks that could happen. On the other hand, if we were to break above the highs, then the market is likely to go looking towards the $13,000 level, and then further. Nonetheless, I do not think that the market is going to break down significantly anytime soon, and the absolute “floor” in the market is probably near the $10,000 level, and the 50 day EMA reaching towards that level also offers yet another reason to think that there might be buyers in that area. Buying on the dips has worked for some time, and I think that it is going to continue to be the case in this market as we are continuing to grind higher over the longer term. Yes, there will be certain amount of volatility, but you should keep an eye on the US Dollar Index more than anything else, as it does tend to move in the opposite direction.