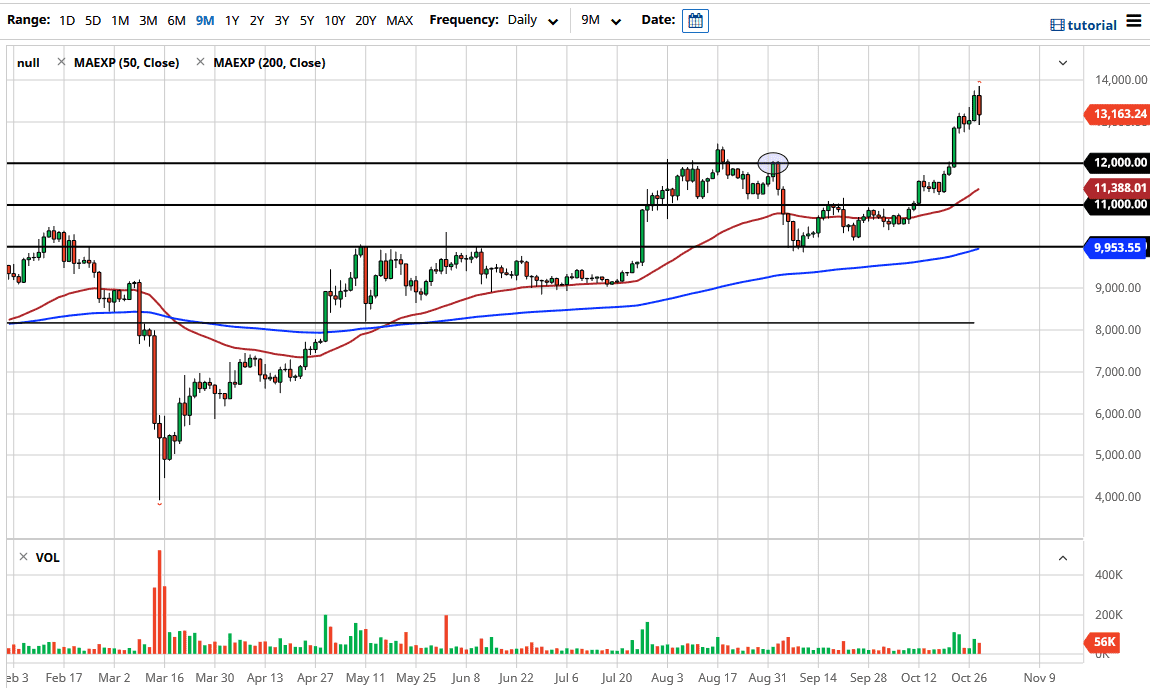

Bitcoin markets initially tried to continue the upward momentum during the trading session on Wednesday but gave back the gains in order to test the $13,000 level. We have since bounced slightly to show signs of life again but at the end of the day I think we still have to worry about more volatility up and down, because quite frankly the whole world is essentially on fire at the moment. The US dollar got a bit of a bid as people are concerned about euro, and that of course has an effect on the Bitcoin market due to the fact that it is priced in US dollars, at least in this market.

That being said, we are obviously in a major uptrend so looking at this market it is likely that eventually we will find buyers on any dip. You would be chasing the market at this point if you simply jump in, but it does make sense that the $13,000 level offers a little bit of support, but I do believe that the $12,000 level is an even better price. After all, that was an area that we had broken out of, and it needs to be retested. I believe that support should be there, but you probably need some type of daily supportive candlestick in order to get long. After all, a lot of the reasons that Bitcoin is going higher are still play now, so I think you are plenty of time to pick up a bit of value when it shows up.

The 50 day EMA is now starting to reach towards the $12,000 level as well, so at this point in time it makes quite a bit of sense that there would be a significant amount of buying pressure in that area, especially as there seems to be a lot of concern around there, due to the fact that the central banks will be flooding the markets with liquidity. This is not only the Federal Reserve, but it is also the European Central Bank, the Reserve Bank of Australia, and many others. In other words, Bitcoin should do fairly well against multiple currencies, not just the US dollar. At this point, pullback should still be looked at as potential buying opportunities, but I am a buyer of daily candlesticks, not necessarily trying to jump in suddenly on the short-term charts. I certainly would not be a seller at this point.