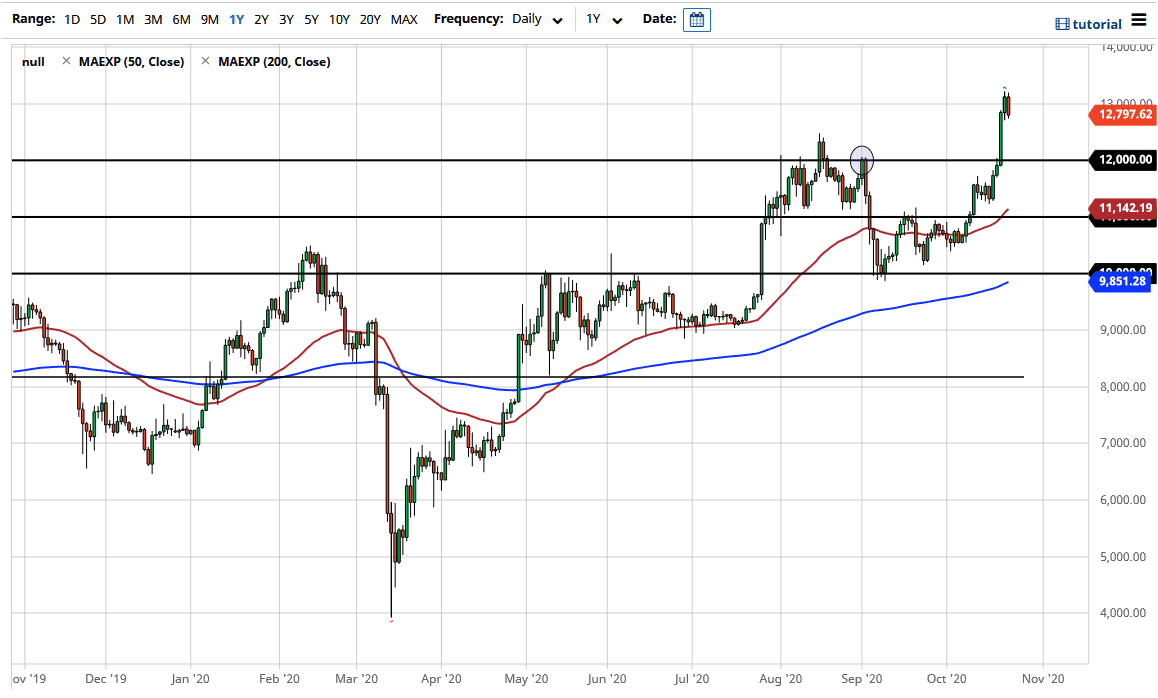

At this point in time it is likely that we will drop a bit from this overextended attitude, as the market had gotten parabolic. The $13,000 level course attracts a certain amount of attention, but you are very cognizant by now that the market does tend to move in $1000 increments, so it is not a huge surprise that we would pull back a little bit from here. I think we need to digest a lot of the gains, so the question is whether or not we go sideways, or do we get a bit of a pullback that we can take advantage of?

If the $12,000 level gets tested to the downside, I think that a lot of traders would be more than willing to get involved as it would be an area that a lot of short sellers will be interested in recovering, and of course an area where we had obviously seen a major breakout. A lot of people that have missed out on this rally would be more than willing to get involved. This is simple technical analysis and so-called “market memory.”

To the downside, even if we break down below there, I think there is plenty of support near the 50 day EMA which is currently just above the $11,000 level. Ultimately, this is a market that I think will find buyers on dips as we have a longer-term move just waiting to happen that could send this market all the way to the $15,000 level. The market has seen a lot of volatility, and upward pressure but it is probably time to give it back. Building a bit of a base near the $12,000 level would be the best scenario that we could find ourselves in. If we break above the last couple of days, it is likely that we continue to go higher but I would be very cautious at that point because we are already overextended as it is and we all know that Bitcoin tends to move very radically at times, and can be very dangerous if you are not cautious about your position size or when you jump in.