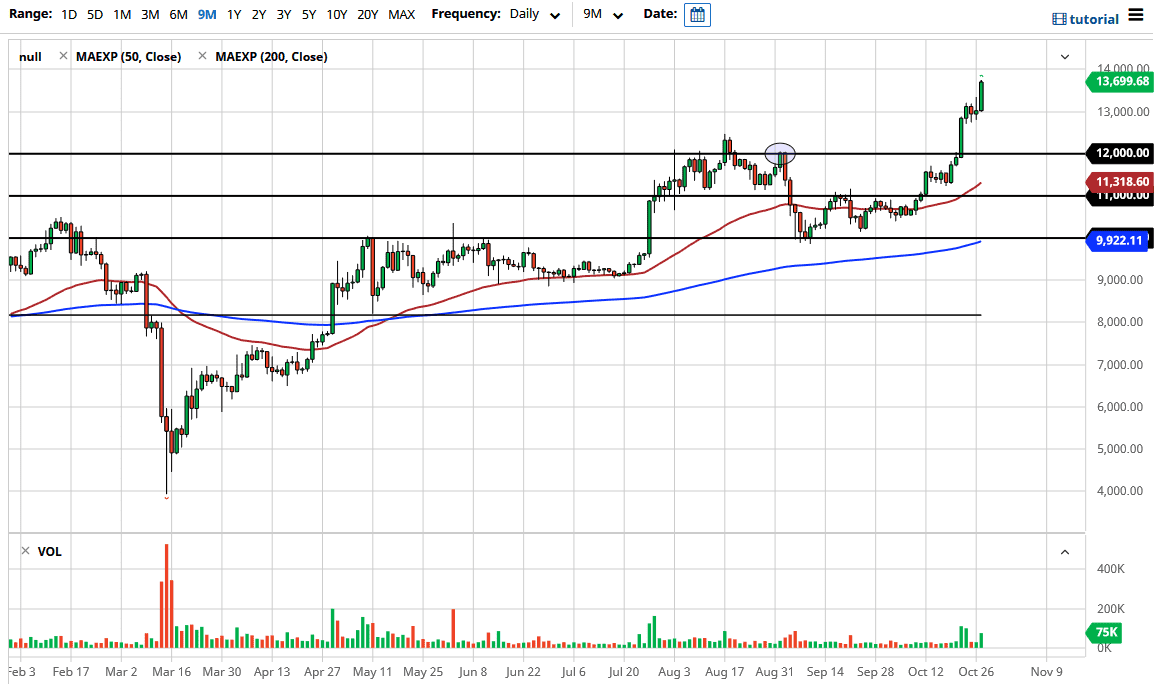

One of the hardest things to do as a trader is look for a buying opportunity. If you are not already in Bitcoin, I would offer this scenario to think about:

You walk into an electronics store. You see a television that you have been wanting for some time. For one reason or another, you have not bought the television yet. When you walk into the store, you recognize that it is now on sale for $600 instead of $800. This is how most people act in the real world, but when it comes to trading, they seem to throw this away. Think of it this way: if you were to buy Bitcoin here, it is like paying $1000 for that to be said instead of $600. In other words, it is expensive. That is exactly how this looks, and as a result it is possible that the best play is to wait for value. I thought we would get that after the recent price action, but I also warned yesterday that we could break the top of the shooting star and become a little bit more parabolic. Because of this, I am very cautious about trying to go long here.

However, if we do get some type of pullback to the $13,000 level, at the very least, then we might get an opportunity to pick up a little bit of value. Regardless, I would be much more interested in this market at the $12,000 level as well. In other words, you are looking for “cheap Bitcoin.” All things being equal, it is obvious that you cannot sell Bitcoin at the moment and that makes perfect sense considering the central banks around the world should continue to flood the markets with fiat currency, which of course by extension means that Bitcoin should continue to gain. The trend is firmly ensconced, and at this point it would take something rather drastic to change things. The US dollar suddenly strengthen it would probably drive Bitcoin much lower, but even then, I believe that it is probably somewhat short-lived as the Bitcoin market could also get a bit of a boost due to central banks in other parts of the world as well.