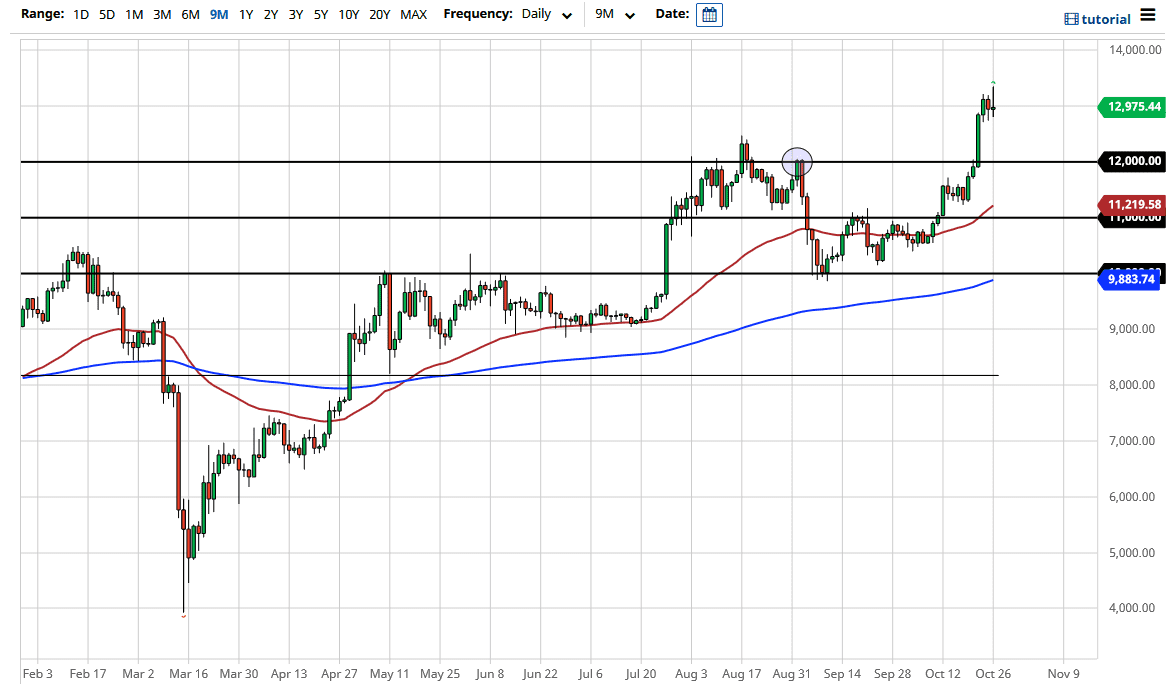

The bitcoin market has gone back and forth during the trading session on Monday, reaching above the $13,000 level. Ultimately, we ended up forming a bit of a shooting star which of course is a very negative sign. The negative candlestick course is something that will attract a certain amount of attention, as it is such a widely followed technical analysis candlestick shape. Having said that, the market looks as if it is killing a little bit of time, and the candlestick suggests that perhaps we could even pull back from here. Pulling back makes quite a bit of sense, as we had recently sliced through the $12,000 level which was a major barrier.

After all, a lot of times we have a major pull back to retest an area that has been important, and that looks exactly like what is about to happen. That is not an invitation to sell Bitcoin, rather it gives you an idea to where you can find a bit of value. After all, we are in an uptrend for a reason, mainly because the central banks around the world continue to flood the markets of liquidity. Therefore, if you are looking to trade Bitcoin, you should probably be buying it, at least for the time being. Reaching towards that $12,000 level makes for a compelling area to start buying. Furthermore, the 50 day EMA sits at the $11,200 level, which is just below the previous area where we had taken off from.

Ultimately, we could break above the top of the shooting star, which would lead to an even more parabolic move. Having said that, the $14,000 level would be the next target but I do not like that trade considering that bitcoin has a long history of going parabolic, before pulling back quite drastically. Because of this, you are better off looking for value. Having said that, we are a bit overdone already so I would much prefer to be a buyer of short-term dips more than anything else. The candlestick from last week that had the market blasting through the $12,000 level should find plenty of support at the bottom of it as well, so everything lines up quite nicely for a pullback to be a buying opportunity.