The Bitcoin market has gone back and forth during the course of the trading session on Thursday, as we continue to see a lot of volatility when it comes to the idea of whether or are not getting some type of stimulus coming out the United States. If we do, and the US dollar gets hammered, that is obviously going to be good for bitcoin having said that, people may be using bitcoin just simply get away from the volatility of the markets in general, so that is something worth paying attention to as well after all, there is so much noise when it comes to stimulus and the presidential election that some people are simply following the momentum in bitcoin.

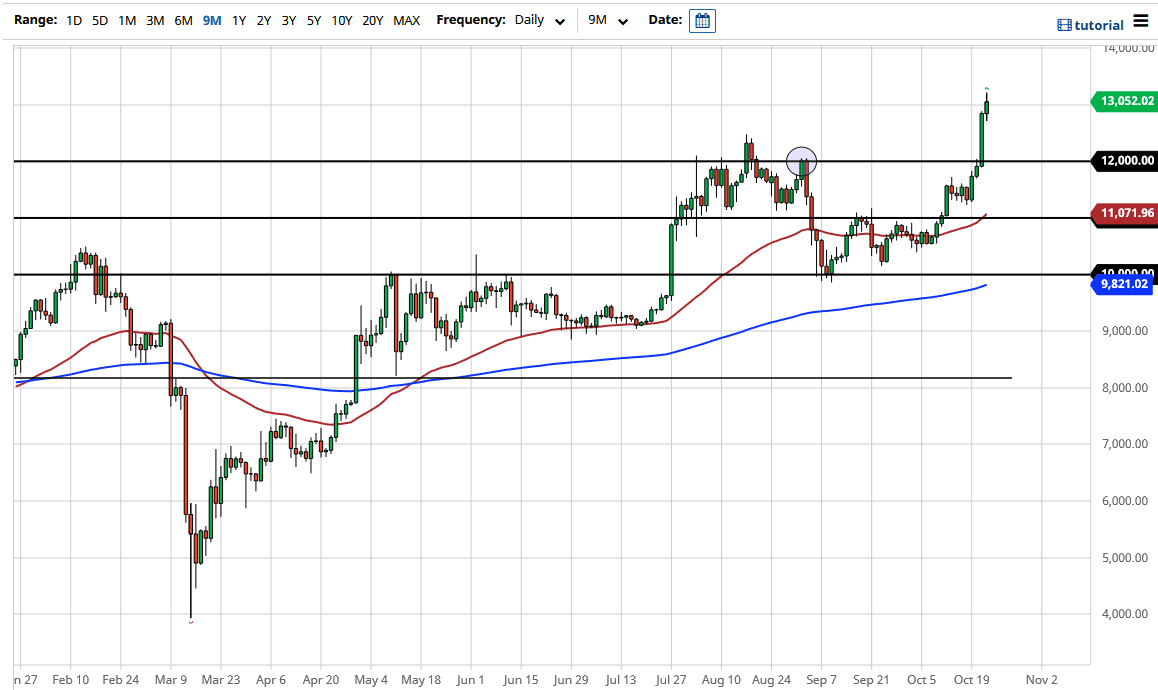

Looking at this chart, it is obvious that we have broken above a large, round, psychologically significant figure in the form of $12,000, followed by $13,000 during this past session. We have pulled back just a bit though, and it shows to me that maybe we are ready to pull back a bit and try to find buyers underneath. I would anticipate that the $12,425 level to be an area where some people would be buyers, and most certainly the $12,000 level. Regardless, I have no interest in trying to short this Bitcoin market, due to the fact that it has been so bullish. We have just made a significant break out that should in theory measure about $2400. If that is going to be the case, then we are looking at a move to just underneath $15,000 which is my longer-term target.

That being said, we are a little parabolic at the moment, so I think that a pullback is a nice buying opportunity as it offers value in what is obviously a very bullish market. Because of this, it is a scenario where you are looking for value, which is what you should be doing in markets that are so obviously in a massive trend. Bitcoin continues to look like a market that is ready to go much higher, but obviously we cannot get there in one shot. We need to “back and fill” occasionally, which is what I think we are getting ready to see. At this point, I believe the $12,000 level is going to be crucial, so I would be a bit more aggressive the closer we got to that area