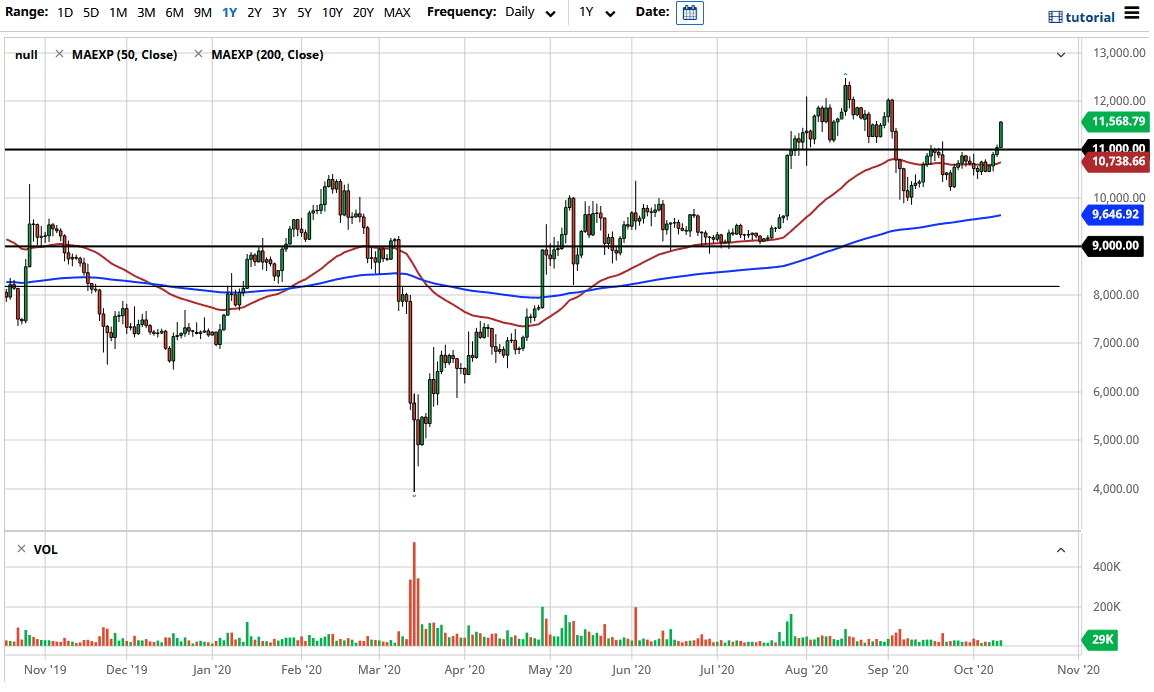

The bitcoin market rallied significantly during the trading session on Monday to kick off the week, as we are well above the $11,000 level. This was an area that was resistance previously, and now that we have broken through there it is very likely that we continue to see buyers jumping into this market and looking towards the $12,000 level next. After that, the $12,300 level will more than likely be the next area of interest.

What is interesting is that the US dollar falling has been one of the main drivers of Bitcoin going higher, and therefore it is important to pay attention to the US dollar in general when trading Bitcoin. The US Dollar Index chart is an excellent want to use because it gives you a wide view of what is going on in the Forex markets, at least in the realm of the greenback which is by far the biggest influence on Bitcoin.

To the downside, I believe that the $11,000 level offers support that extends down to the 50 day EMA at the $10,725 level. Ultimately, I think that signs of support will come back in every time traders try to get involved, and they will continue to look at the Bitcoin market as one that should continue the overall uptrend. I think that we will reach the highs again, and perhaps even try to break down given enough time, this is especially true if we start to see massive amounts of stimulus coming out of the United States. However, the stimulus is not coming in the short term, so it is very likely that we will get the occasional pullback. That gives us multiple opportunities to get long in this market, and I think that is probably the best way to look at it.

You are essentially looking at the traders out there when it comes to a devaluation of the US dollar, in which cryptocurrency is quite often used to get around. Bitcoin certainly seems to have a lot of support underneath, so I believe that there will be plenty of people out there looking to pick up value as it occurs, meaning they are looking to get “cheap Bitcoin.” I have no interest in shorting, at least in the short term. Right now, it certainly looks as if we will continue to find buyers on dips.