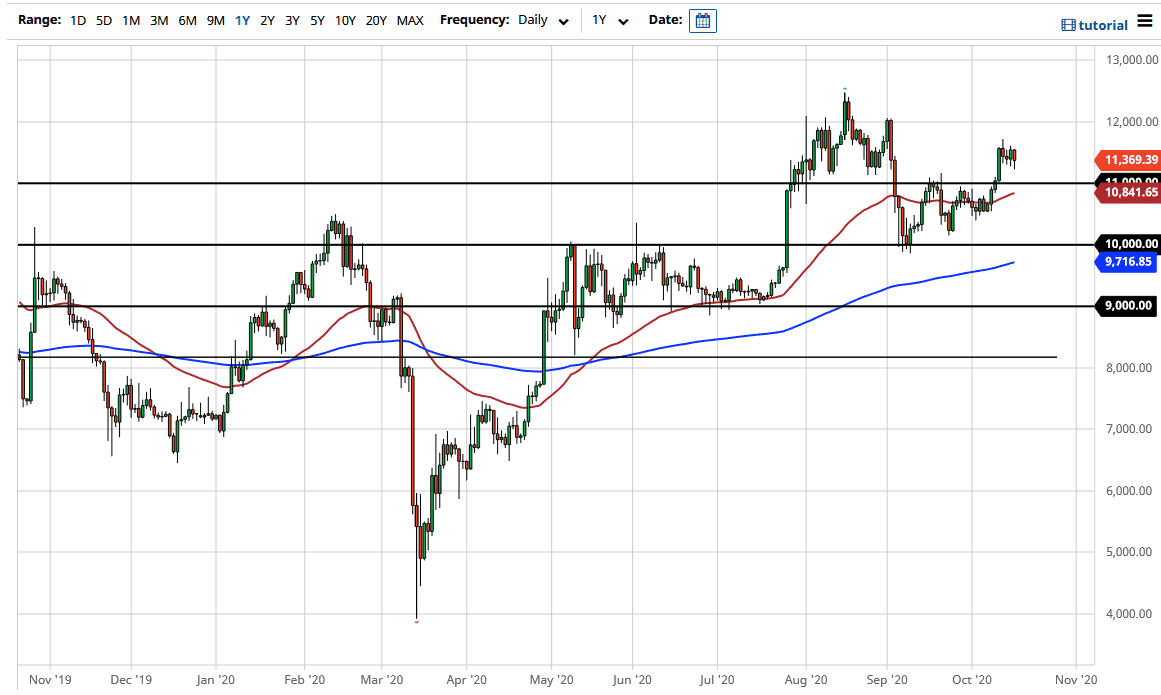

Bitcoin had initially fallen during the trading session on Friday but turned around to bounce yet again. By the time the day closed out, and it looks as if we are forming a bit of a hammer yet again. When you look at the chart, you can see that the market has initially pushed higher to break the $11,000 level, and now for the last couple of days have been grinding sideways to digest those gains. With that being said, Bitcoin looks like it is trying to build up enough momentum to finally go higher again.

At this point, the market is likely to see the US Dollar Index as a nice secondary indicator, offering Bitcoin in a perfect negative correlation. After all, if the Federal Reserve is going to keep loose monetary policy while the United States is going to embark on massive amounts of fiscal stimulus, that should drive the value of Bitcoin much higher. This is the essential idea of Bitcoin, getting away from the devalued fiat currency world. As central banks only know how to devalue and not strengthen, it is only a matter of time before assets continue to gain against those currencies. Whether or not Bitcoin does over the long term is a completely different conversation, but ultimately this is a market that should find plenty of buyers on dips.

Speaking of these dips, the market is likely to see interest at the $11,000 level, an area that was the scene of a recent breakout. The ascending triangle that broke out of previously measured for a move to the $12,000 level above, which I do think is coming. That being said, pullbacks offer plenty of opportunities in a way going forward, so buying the dips will more than likely continue to be how this market plays out. Furthermore, the 50 day EMA is reaching towards the $11,000 level as well, so that means that the $11,000 level has multiple reasons to be supportive. As we head into the weekend, volumes will drop off but it is clear that the overall trajectory as to the upside, and as a result, it is more than likely only a matter of time before we reach towards the recent highs just above the $12,000 handle and beyond. I have no interest in shorting, at least not unless the US dollar starts to strengthen quite drastically.