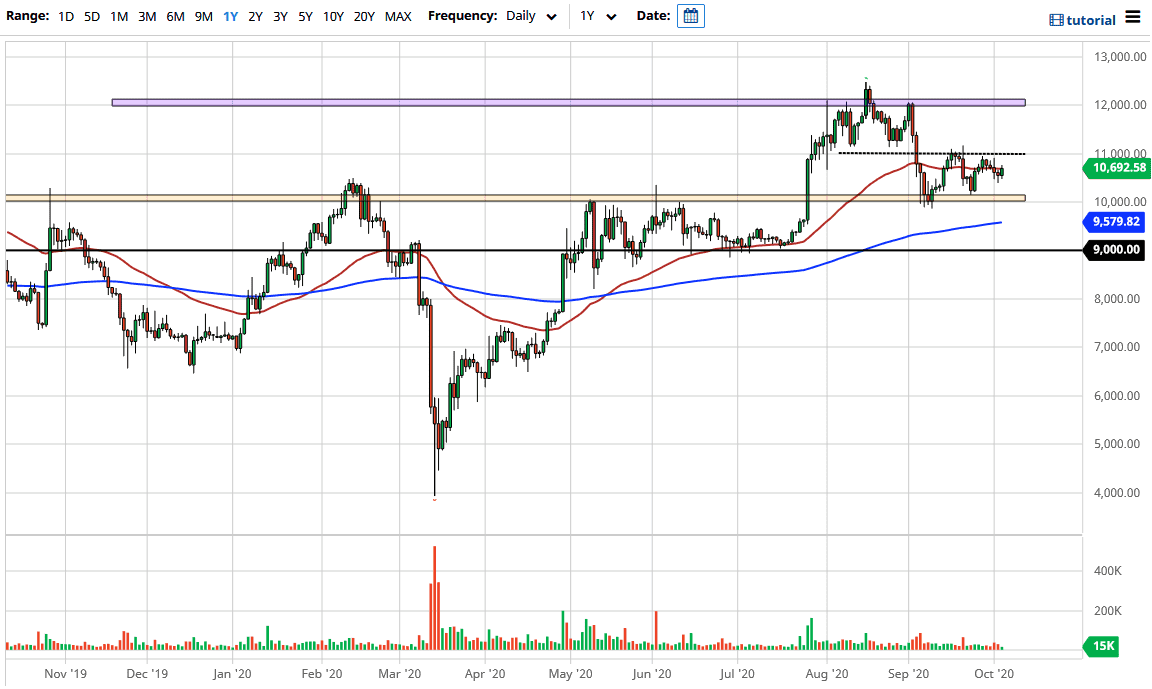

The bitcoin markets have rallied a bit during the trading session on Monday to kick off the week, testing the 50 day EMA. That is obviously a bullish sign, but at this point, we still have a lot of resistance at the $11,000 level. If we can break above there, then it is likely that we could go towards the $12,000 level above which is rather significant. At this point, it also looks as if the market is going back and forth in $1000 increments, showing signs of a market that is very structured as of late, and that is something to pay attention to.

Underneath, the $10,000 level underneath is rather supportive, and I believe that the 200 day EMA underneath is breaking above the $9500 level. At this point, the market continues to show plenty of buyers underneath, and furthermore, there is even more support at the $9000 level. At this point, I believe that buying the dips does continue to work out quite well over the longer term, especially if the US dollar falls. While many of the Bitcoin believers out there will scoff at the idea of it being measured in US dollars, that is exactly what has been going on. After all, if the US dollar rises, it puts downward pressure on Bitcoin. It is the exact opposite obviously so therefore it is likely that if the US dollar falls, then Bitcoin should rally.

In general, I believe that this continues to be a very choppy market that goes back and forth, and I also believe that the uptrend should be paid attention to, but it is also worth noting that the moving averages are both flattening out, so that tells me that it is very unlikely to make a big move anytime soon. If you are a shorter-term trader, then you can use these thousand-dollar increments to trade off of, going back and forth and playing this more or less like a day trader. As far as markets are concerned, this is a short-term game, as longer-term traders simply buy-and-hold and completely forget about any of the daily noises. All things being equal, this is a market that I think continues to see plenty of value hunters over the longer term, so pay attention to the way we behave over the next several days.