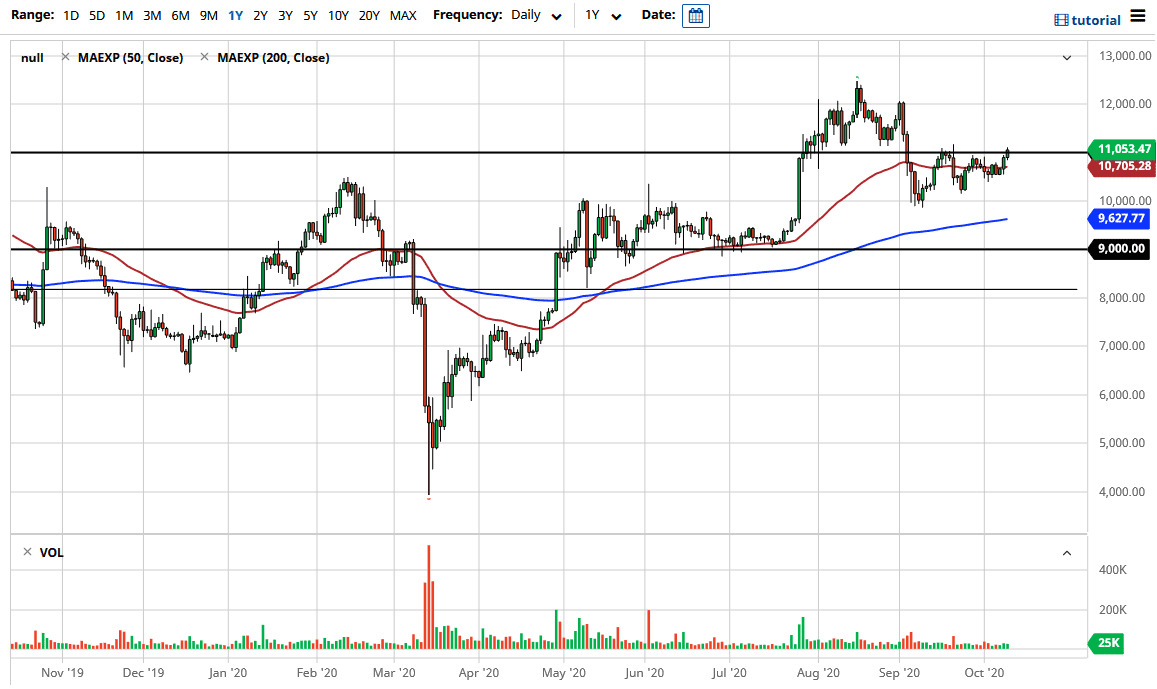

The Bitcoin markets rallied a bit during the trading session on Friday, breaking above the 11,000 level. That being said, the market is likely to continue to grind more than anything else, but at this point in time, it is very likely that we are going to move based upon the idea of stimulus and the latest headlines more than anything else. Ultimately, this is a market that I think will continue to be very noisy, but overall, it is likely that we are going to continue to move against the US dollar. The US dollar making a big move on Friday might have been exactly what we needed to see before we made the move to the upside.

All things being equal, I think that the market looks as if it is trying to form some type of ascending triangle, which measures for a tidy move to the $12,000 level. The $12,000 level course has recently been significant resistance so all things being equal I think this is likely to be a self-fulfilling trade. Furthermore, this will also move a lot over the weekend based upon headlines involving stimulus, so I suspect that if we get some type of headlines coming out of the weekend, we may see Bitcoin jump over the next couple of days.

To the downside, there should be plenty of support near the 10,500 level, possibly even the 10,000 level. The market also has the 200 day EMA sitting just below the 10,000 level, so I think that will come into play as well. Looking at this chart, we have been grinding higher for some time and I think it makes sense that we continue the uptrend. The biggest problem with Bitcoin is that it so noisy, and then will be followed by long periods of sideways trading. Now that we have broken above the $11,000 level, I think that the market is finally going to make a move again. If we can break above that $1000 level, then it is likely that the market continues much higher, as it would continue the longer-term trend towards the $13,000 level and beyond. If we were to break down below the 200 day EMA on some type of sudden breakdown, there is a massive amount of basing that has been done at the $9000 level and I think would serve as a bit of a floor, barring some type of major shift in attitude.