Germany witnessed a fast acceleration in new Covid-19 infections, while the global pandemic keeps global trade hostage. Cooler temperatures and the seasonal influenza season will complicate the situation over the next six months. More countries ramp up restrictions aimed at halting the second wave of Covid-19, which will apply renewed downside pressure on domestic economies and trade alike. The DAX 30 reversed its most recent breakdown and now challenges its new short-term resistance zone. With the bearish trend intact, more selling lies ahead for this blue-chip index.

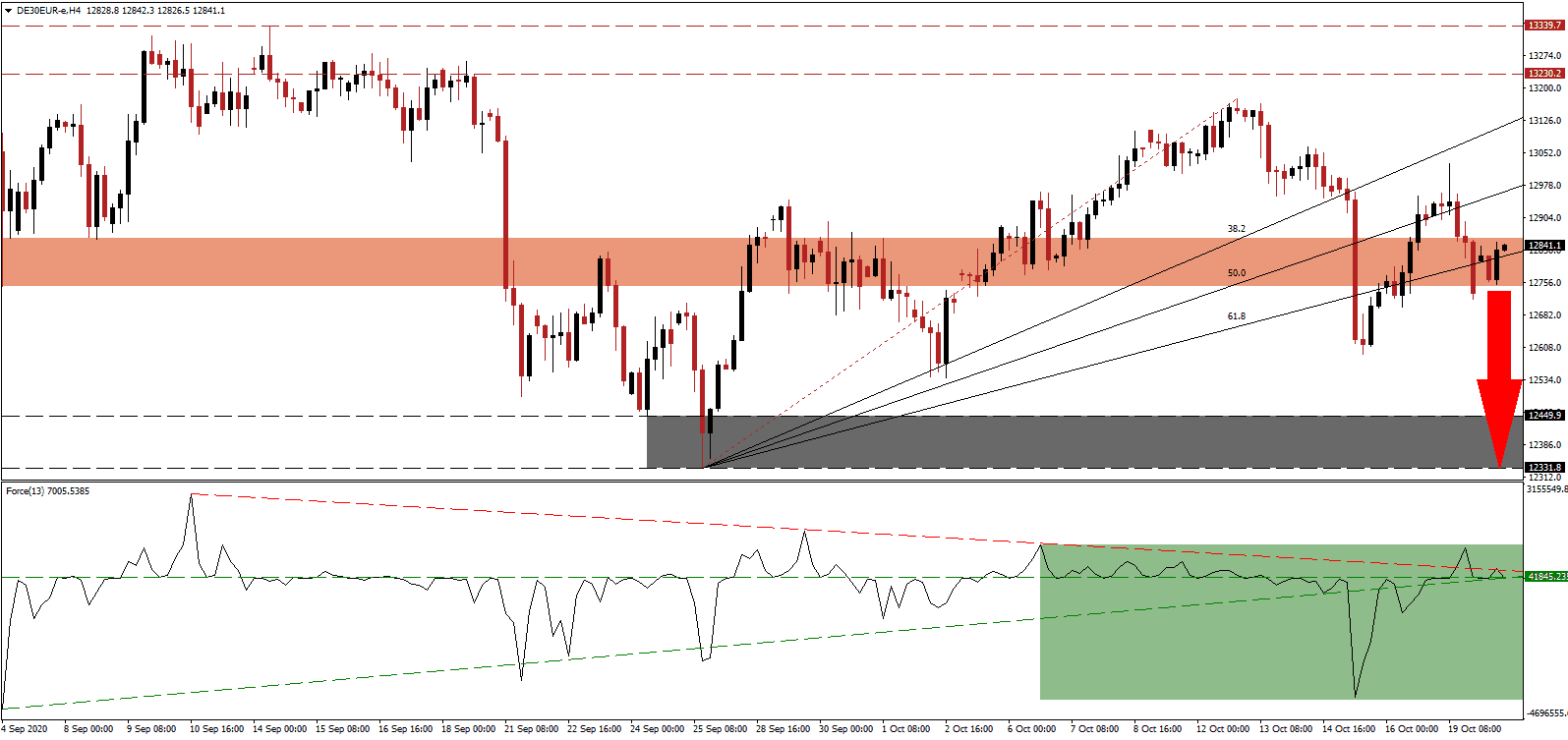

The Force Index, a next-generation technical indicator, was able to move above its horizontal resistance level, converting it into support, but now faces downside pressure from its descending resistance level, as marked by the green rectangle. This technical indicator is vulnerable to a reversal into negative territory and below its ascending support level, granting bears control over the DAX 30.

Given the export-oriented nature of the German economy, and the dependence on China and emerging market demand for precision machinery and high-end technology, the outlook for remains bearish. Current estimates call for a return to pre-Covid-19 levels by 2022, but the severity of the second and any subsequent infection waves will alter the assessment negatively. The DAX 30 presently faces rising breakdown pressures inside of its short-term resistance zone located between 12,745.6 and 12,855.6, as identified by the red rectangle.

More restrictions for an extended period will likely follow the unexpected severity of Covid-19. While a rebound in the third quarter is all but guaranteed, data from several economies suggest a milder recovery than forecast. Growth outlooks for 2021 also experience downward revisions. Price action presently tests its ascending 61.8 Fibonacci Retracement Fan Resistance Level, from where rejection and a sell-off into its support zone, located between 12,331.8 and 12,449.9, as marked by the grey rectangle, is favored to materialize.

DAX 30 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 12,840.0

Take Profit @ 12,330.0

Stop Loss @ 12,980.0

Downside Potential: 5,100 points

Upside Risk: 1,400 points

Risk/Reward Ratio: 3.64

In case the Force Index eclipses its descending resistance level, the DAX 30 may extend its current reversal. Traders should take advantage of any price spike with new sell orders due to rising bearish pressures on this index. Germany also sacrificed long-term growth potential for short-term monetary fixes related to the pandemic, adding to a reduced outlook. The upside potential remains confined to its intra-day high of 13,175.

DAX 30 Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 13,050.0

Take Profit @ 13,175.0

Stop Loss @ 12,980.0

Upside Potential: 1,250 points

Downside Risk: 700 points

Risk/Reward Ratio: 1.79