New Covid-19 infections across Germany confirm fears over a more severe-than-expected second wave, with current hotspots in Frankfurt, Hamburg, and Munich, where localized restrictions on the hospitality industry are in place. The Robert Koch Institute (RKI) cautioned that even a vaccine, which Germany anticipates by April 2021, will not end social distance requirements and masks. RKI expects they will remain in place for an extended period. The German government will discuss the potential of nationwide restrictions rather than the current approach, which per available data, fails at containing the pandemic. The DAX 30 completed a breakdown below its resistance zone, giving way to a more massive correction.

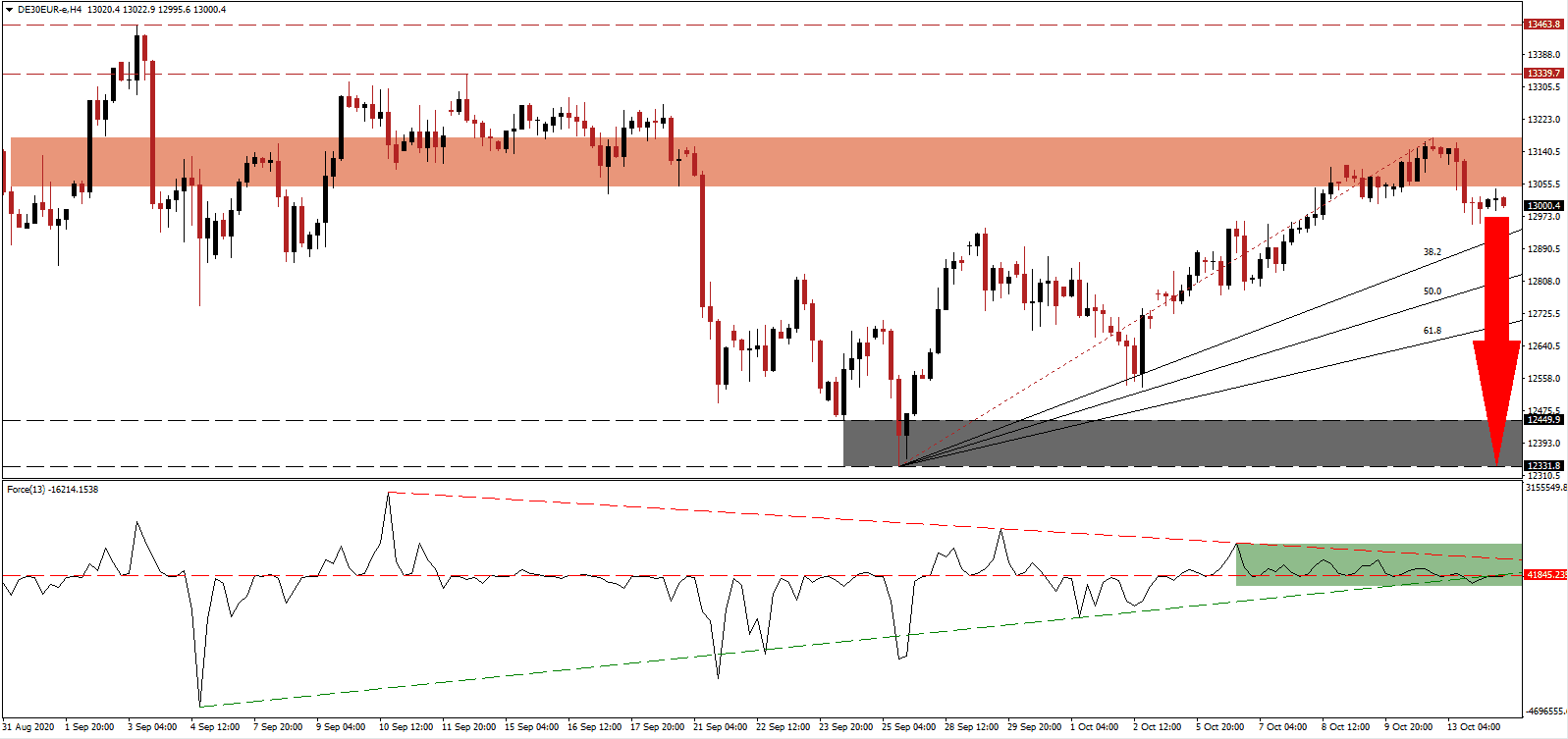

The Force Index, a next-generation technical indicator, moved below its ascending support level, adding to downside pressures. It maintains its position below the horizontal resistance level, as marked by the green rectangle, while the descending resistance level increases bearish momentum. This technical indicator remains below the 0 center-line, with bears in control of the DAX 30.

Olaf Scholz, the German Vice-Chancellor and Minister of Finance, believes the economy can reach the pre-Covid-19 level by the beginning of 2022. Countering his long-term optimism is the latest ZEW survey, which showed economic sentiment plunged from a 20-year high of 77.4 to a much worse than anticipated 56.1. The EU announced two packages worth €1.8 trillion to address the pandemic-induced problems, which await approval. Following the breakdown in the DAX 30 below its short-term resistance located between 13,049.6 and 13,175.0, as identified by the red rectangle, more downside should be expected.

Germany is additionally boosting debt, weakening its long-term financial outlook, and applying downside pressure on the Euro. It does assist its export-oriented economy. The debt-to-GDP ratio is forecast to exceed 75%. By comparison, during the 2008 global financial crisis, it reached above 80%. Conforming a slowdown is the weekly activity index (WAI) of the Bundesbank. A collapse in the DAX 30 below its ascending 50.0 Fibonacci Retracement Fan Support Level will clear that path into its support zone between 12,331.8 and 12,449.9, as marked by the grey rectangle.

DAX 30 Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 13,000.0

Take Profit @ 12,330.0

Stop Loss @ 13,180.0

Downside Potential: 6,700 points

Upside Risk: 1,800 points

Risk/Reward Ratio: 3.72

In case the Force Index reclaims its ascending support level, the DAX 30 may attempt to retrace its breakdown. Traders should take advantage of any temporary price spike with new net short positions amid a deteriorating outlook over the next few months. The end of the golden decade for German automobile manufacturers adds to an uncertain outlook. While Germany is well-positioned to benefit from China in the long-term, the medium-term conditions favor more downside. The upside potential is confined to its resistance zone between 13,339.7 and 13,463.8.

DAX 30 Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 13,260.0

Take Profit @ 13,460.0

Stop Loss @ 13,180.0

Upside Potential: 2,000 points

Downside Risk: 800 points

Risk/Reward Ratio: 2.50