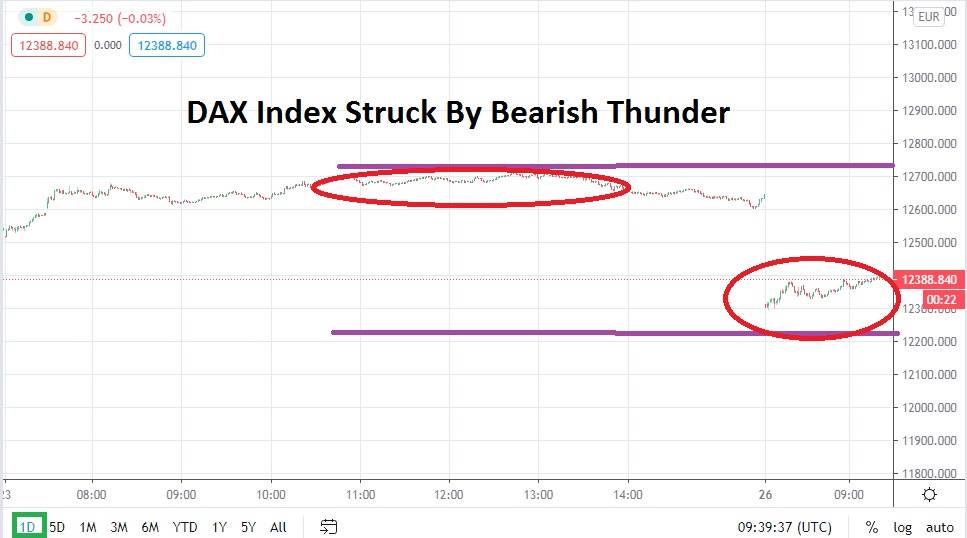

Bearish momentum dominated the opening of the DAX Index this morning, essentially opening the week of trading with a large gap lower and puncturing support levels. The German index is trading near the 12370.000 mark in early trading amidst nervous sentiment as investors now await the opening of US equities which indicate a steep decline in American stocks via calls on the futures.

The DAX Index is testing critical support levels which have been tried before, but produced reversals upwards in early August and late September. While the DAX Index has been able to spur on positive sentiment after hitting low water marks previously, speculators are certainly wondering if now is the time to abandon bullish sentiment and pursue selling opportunities with greater frequency.

After hitting a high of 13100.00 around the 12th of October the DAX Index has not been able to sustain bullish sentiment. Incrementally it has also seen support levels consistently be hit and proven vulnerable to past two weeks. In early September the DAX Index was trading near the 13460.000 level and has obviously lost ground since then and failed to approach the highs again. Global risk appetite is fragile not only because of the US elections which are approaching, but also because coronavirus implications are causing concerns too among investors as they try to quantify the costs of doing business and its effect on corporations long term.

US markets which serve as the key barometer for sentiment and largely where risk appetite is generated have produced mixed results short term. Yes US equities are maintaining their higher values among the indices, but this has come with volatility shadowing the markets and in the coming days risk adverse behavior can be anticipated as investors try to position themselves for the US elections. Short term it would appear cautious trading will continue on the broad markets. This doesn’t mean the long term bull market is ready to vanish, but it may be a signal dangerous and choppy waters are ahead.

Speculators may want to continue to pursue downside momentum from the DAX Index and might anticipate a test of support levels near the 12300.000 mark. Trading will be fast today because of the early morning gap as investors try to find equilibrium and fair market value. Speculators need to be ready with limit orders and perhaps sell the DAX Index after the market achieves slight gains and look for reversals downward to prevail.

DAX Index Short Term Outlook:

Current Resistance: 12500.000

Current Support: 12300.000

High Target: 12550.000

Low Target: 12250.000