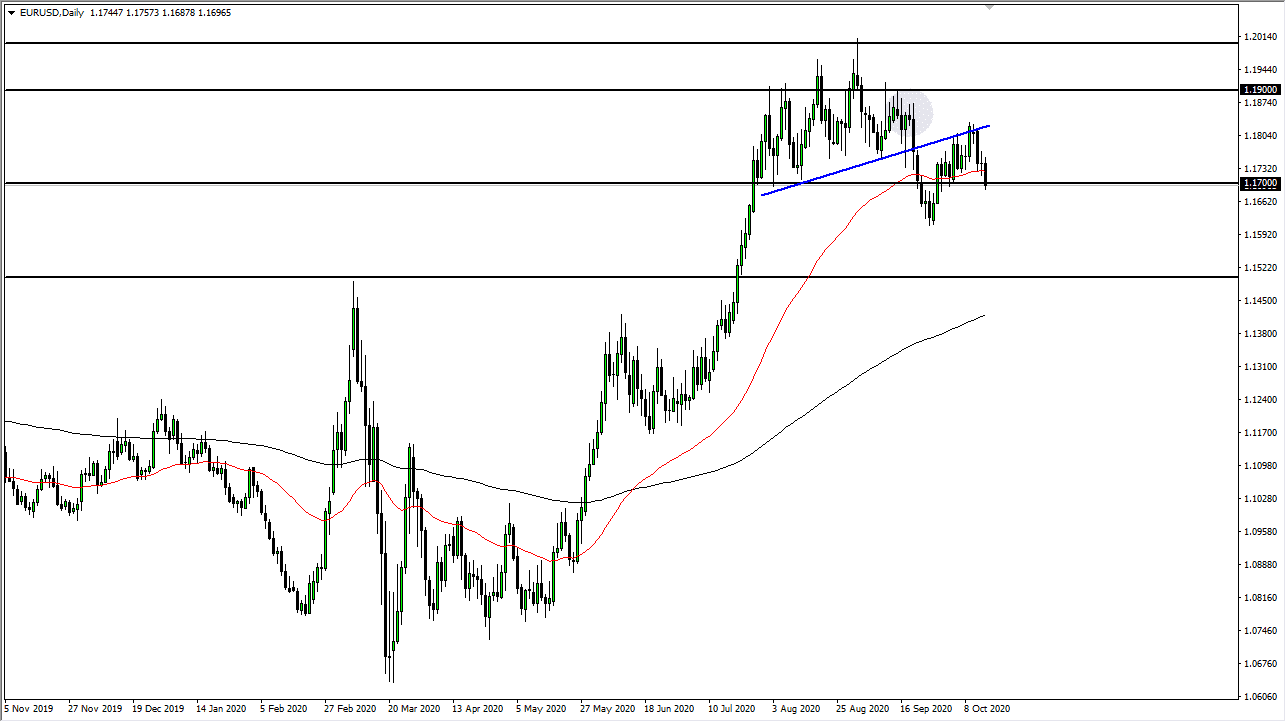

The market breaking through there opens up the possibility of a bigger move downward, but obviously this is a market that is going to be choppy, which is quite common for this market, as the pair is notoriously choppy.

Looking at this chart, I believe that if we break down below the lows of the trading session on Thursday, we could go down to the 1.16 level, which is where we bounce from previously. At this point, the market is likely to continue to see a lot of interest in that area, but if we were to break down below there it is likely that we go down to the 1.15 handle. We had recently broken through an uptrend line that had been supportive. We have also bounced to reach up towards that area and start selling off again. This shows “market memory”, as what is typically support becomes resistance later.

All things being equal, we may get a short-term rally due to the fact that we are still looking at the possibility of major stimulus coming out of the United States which could work against the value of the US dollar. The length of the candle is somewhat bearish, but really at this point we are working on the idea of a “lower low” after we have just made a “lower high.” While we do not have complete confirmation of a new downtrend, we certainly have the makings of the beginning of one. I also recognize that the market is going to continue to see a lot of back and forth between these currencies, because on one hand you have stimulus, but on the other hand you have major lockdowns going on in the European Union, which has people worried about whether or not the economy is about to get even worse than we have seen recently. I believe that is the case, so I do favor shorting the Euro overall but I also believe that you should look for short-term rallies that show signs of exhaustion that you can get involved with, because long-term clean moves in the Euro do not happen very often. Expect volatility, but I do believe that eventually money is flowing back into the US.