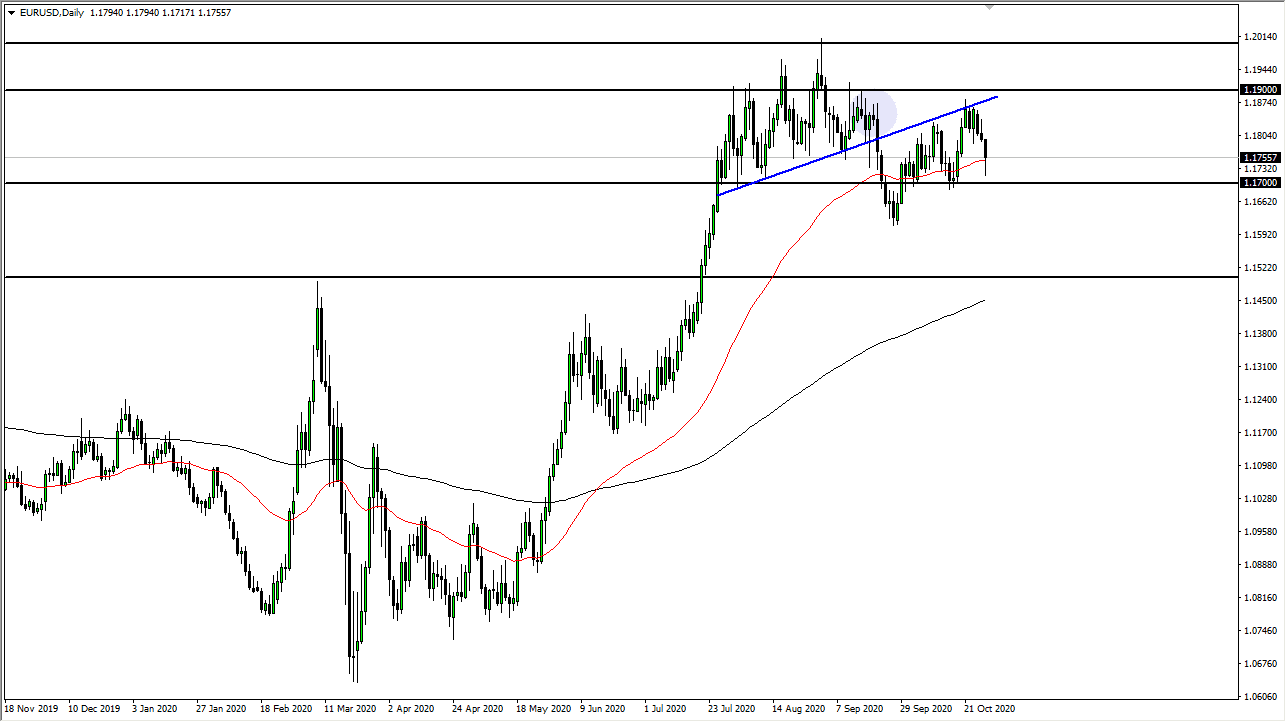

The Euro has fallen a bit during the trading session on Wednesday, to reach down towards the 1.17 level. This of course has a lot to do with the coronavirus numbers in the European Union picking up, and the fact that we are going to continue to see a lot of noise and concern about lockdowns, I believe favors the US dollar in general. We did bounce back above the 50 day EMA though, so it suggests that there is still a little bit of a fight in the Euro. Nonetheless, as the world continues to worry about more things, that tends to favor the US dollar due to the fact that it is considered to be a safety asset.

At this point, the market will probably find a bit of resistance near the 1.18 handle, and then again at the 1.1850 level. In fact, that is my plan at the moment, looking for short-term rallies that I can sell into. Exhaustion on the short-term charts is an invitation to start selling again but waiting a bit for a better price on the US dollar is probably the best way going forward. The market has plenty of resistance above at the 1.19 handle, extending to the 1.20 level. That is a massive barrier that we have not been able to break above yet, so it obviously will offer a lot of resistance.

Furthermore, we had recently broken down through a major uptrend line over the last couple of months, tested it again, and then broke down. Looking at the shape of the candlestick for the session on Wednesday, it is a bit of a hammer, but not enough of a hammer for me to be overly convinced. I think simply markets are trying to “hedge their bets” against the European lockdowns in case it is not as bad as originally feared. Furthermore, markets do not go in one direction forever so I think it makes quite a bit of sense that a short-term bounce could happen but give you an opportunity to get short. Alternately, if we were to break down below the 1.17 handle, then the market is likely to go looking towards 1.16 level underneath, perhaps down to the 1.15 level underneath. The 200 day EMA is reaching towards that level, so that of course will be something worth paying attention to as well.