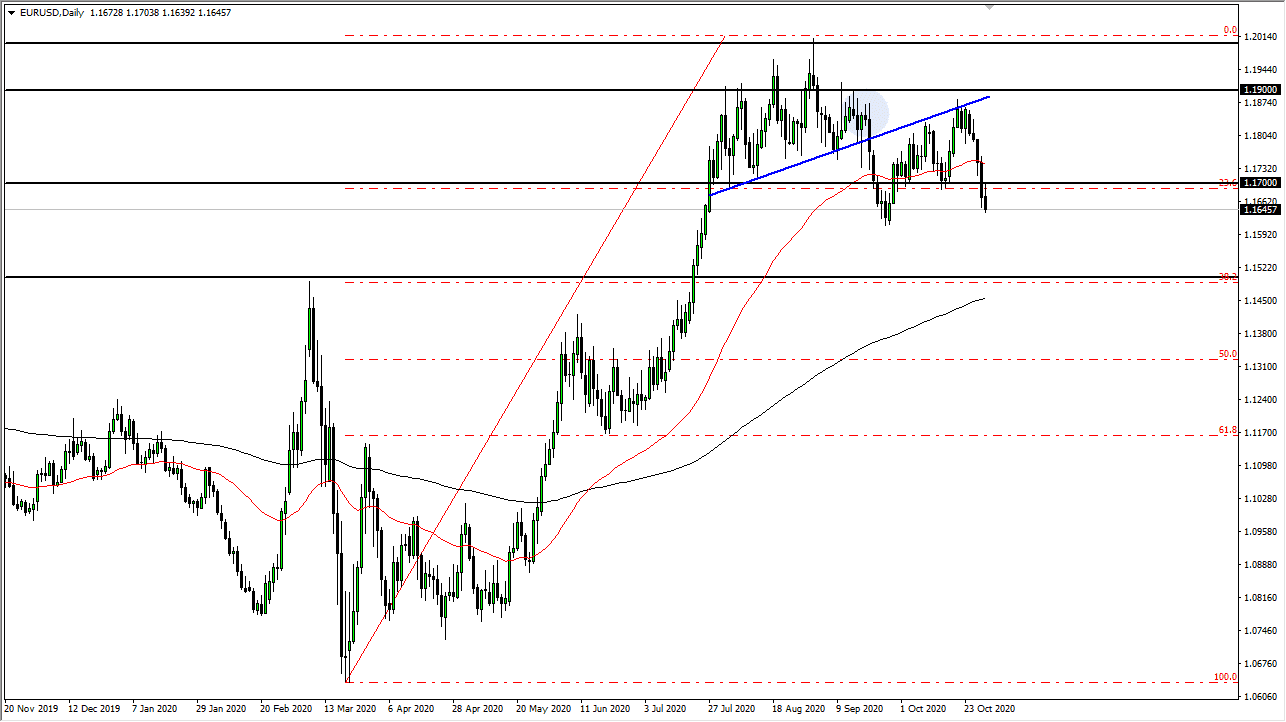

The market is forming an area of interest, as we had formed a hammer during the previous session, and then a little bit of a shooting star during this past one. This tells me that we are at a decision point, and quite frankly it does not take much to imagine that based upon the charts in the way that I have them laid out.

You can make an argument that we just tested an uptrend line and pulled back from it. You can also make an argument that the British pound failed at a crucial level at the same time, just below the 1.30 level. At this point, one has to wonder whether or not the US dollar is going to start strengthening? Speculative positions in the futures market are at extreme historic overbought conditions when it comes to the Euro, sold the one thing that I can tell you is that if that unwinds, it is going to be massive in its ferocity and will slam the Euro overall.

Looking at this chart, I think to the upside the 1.1850 level is massive resistance, and I would be a seller there as well. However, based upon the recent move that we had made, it does measure for a potential move down to the 1.15 level as well. That is an area that was previous support, and it would make quite a bit of sense that we could see a lot of interest in this pair at that point. This is a market that I think will see a lot of noise overall, due to the fact that there are a lot of confused traders out deciding whether or not they should be focusing on stimulus in the United States, Brexit dealings with the European Union, coronavirus numbers in the European Union, or the election in the United States. In other words, I think what you can count on here is a lot of noise and unfortunately that is going to be the case for at least another month. It certainly does look like there is a lot of resistance above though.