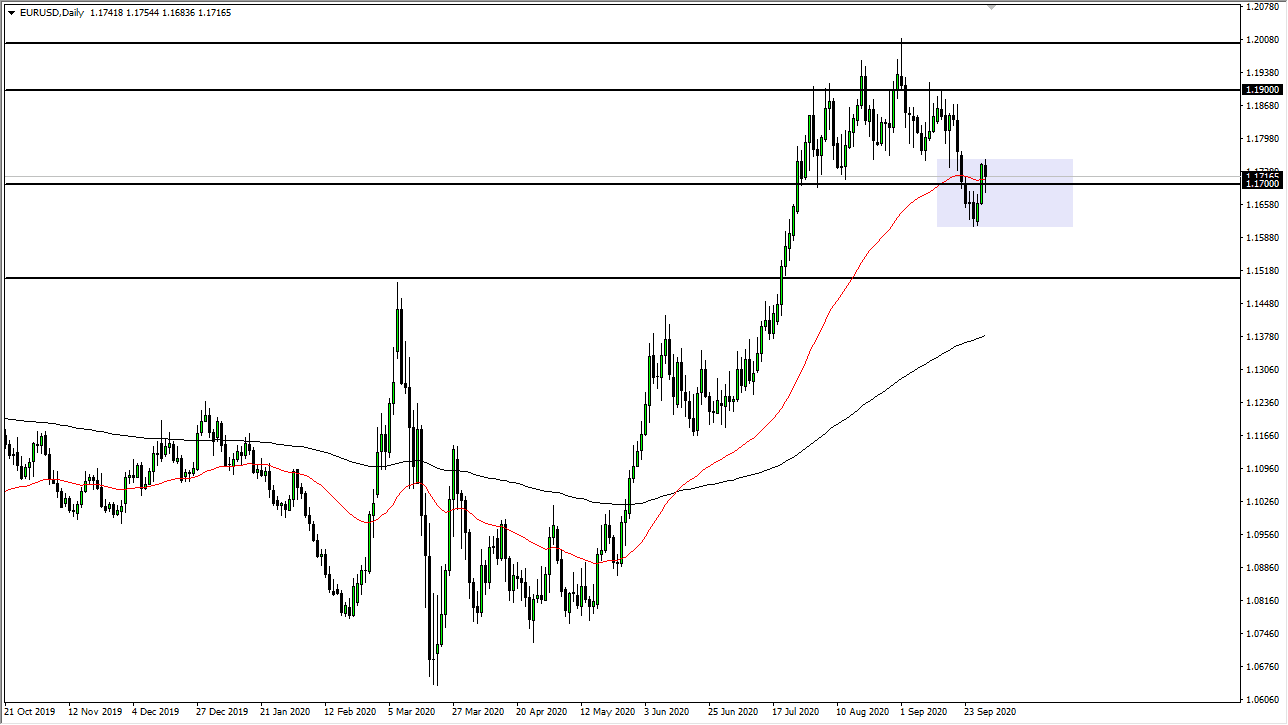

The Euro fell a bit during the trading session on Wednesday, as we continue to see a lot of volatility in the markets overall. You should keep in mind that the Euro rising is typically a bullish sign for risk appetite, and the stock market took off like a rocket in the United States. This has people looking at the risk appetite out there from a positive sense, and therefore they sold off the US dollar during the day. However, later in the day, we started to see the market revert to the downside again, suggesting that perhaps the US dollar is not quite done rallying. One thing that you can say that is going to be part of the market is going to be massive volatility.

At this point, the market breaks down below the 1.17 level it is very likely that we go looking towards the lows again. The market has recently formed a rounding top, or at the very least broke down through an uptrend line. By breaking down through that uptrend line, it suggests that we have further to go. Regardless, the next major support level is closer to the 1.15 handle, which is an area that the market broke out of previously and has not been tested since.

Looking at the candlestick for the day, it does show that there is a little bit of support underneath, but given enough time it is only likely that we see the US dollar’s strength come through, as there are a lot of concerns out there and we have to worry about the jobs number coming out on Friday which clearly will cause quite a bit of noise in the market. Based upon the measured move of the previous consolidation that got broken through, it does suggest that we could get to the 1.15 handle, and depending on how you choose to measure the pattern, you could even have a move towards the 1.1450 level underneath. Ultimately, this is a market that I think will continue to work its way lower, especially as Germany is showing signs of deflation, and the EU has to worry about the rise in coronavirus numbers. Ultimately, the short-term “fade the rally” moves could be what we see between now and the Friday labor report.