There are some things that a lot of market participants seem to be overlooking currently. For example, Germany has deflation that it needs to worry aband out suddenly, and that is not going to be good for the currency. Beyond that, there is also the fact that it looks like the global economy is starting to slow down right along with the European Union, and that typically favors the US dollar.

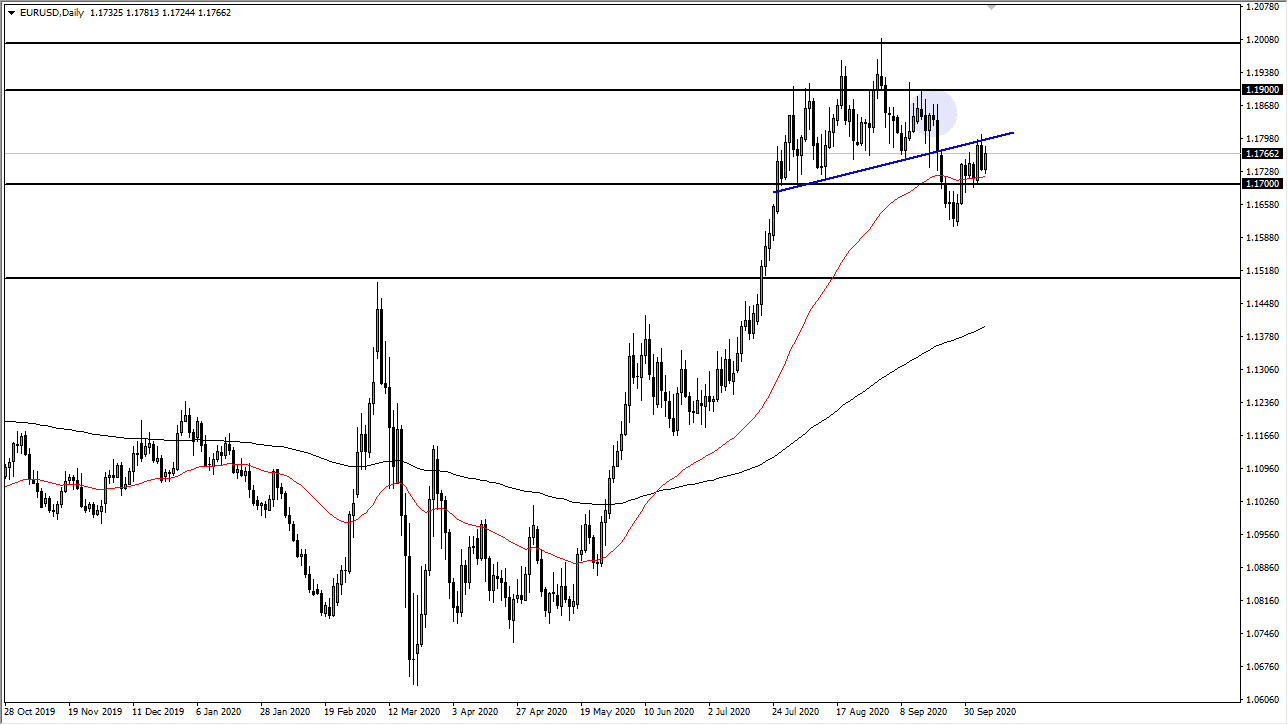

Because of this, it looks as if that uptrend line that we had broken through previously is trying to hold and it should be looked at with great interest. This is at basically the 1.18 level, so a daily close above there of course would be a strong sign but it certainly also suggests that we are running out of momentum to the upside and it says that perhaps we are getting ready to see more of a downward move. We are simply running out of momentum. When you look at the impulsivity of the move in the Euro lately, it does make sense that we would teter out a bit.

This is not to say that we are suddenly going to collapse in the Euro, because quite frankly the Euro does not typically move like that. It is more of a grind most of the time, so you need to be extraordinarily patient if you are trading it. In the short term I believe that the market may be looking towards the 1.17 level, and all it would take us some type of bad news to make it get there. If we can break down below the 1.17 level, then it is very likely that we will go looking towards 1.16 level underneath which is of course where we had recently bounced from. All this being said, this is more about the US dollar than it is the Euro, so pay attention to what is going on in the latest rumors when it comes to stimulus. It is quite telling that we are now trading based upon the latest Tweet or rumor coming out of Washington DC more than anything else. Economics be damned, it is all about the latest drama