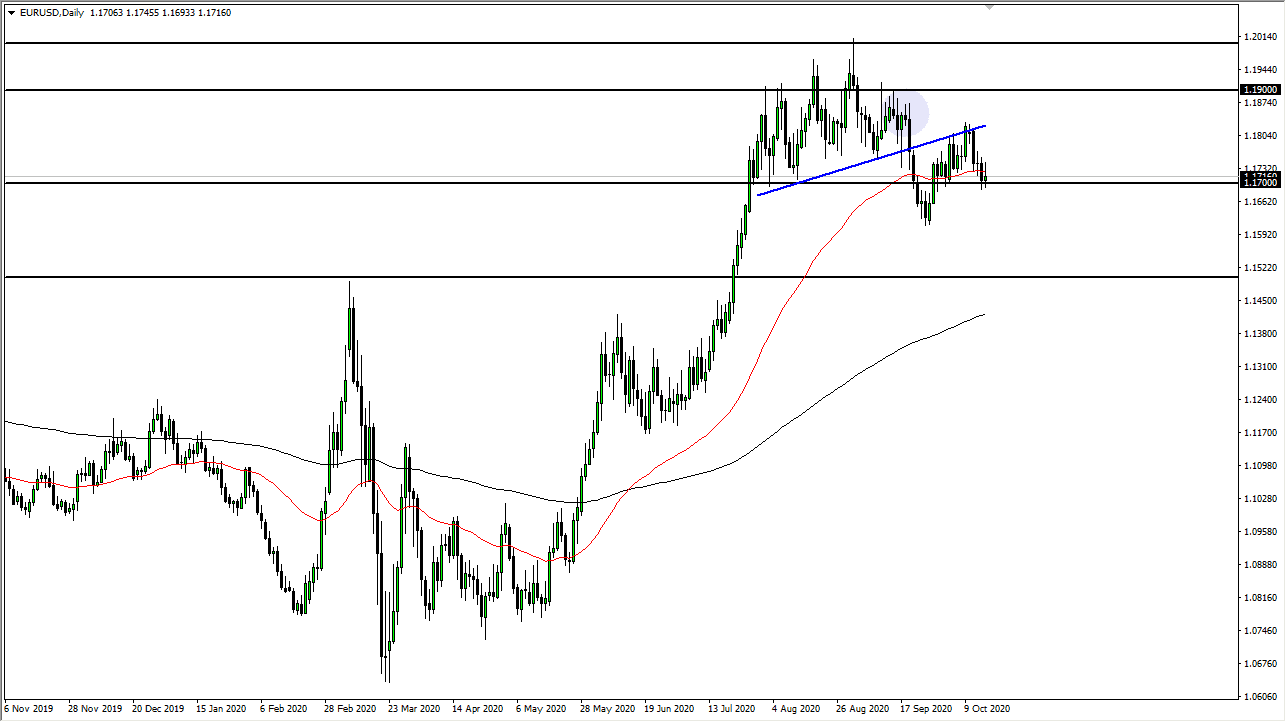

The Euro initially tried to rally during the trading session on Friday but gave back the gains to form a bit of an inverted hammer. This inverted hammer sits right on top of the 1.17 level, which is a large, round, psychologically significant figure, but this has been both support and resistance in the past. When you look at the chart, you can see that we had recently broken through the bottom of the uptrend line, retested it, and now look likely to go lower from here. If we do, the initial target should probably be the 1.16 level which was the most recent low.

A breaking of that level to the downside would confirm a trendline break, retest, and then a “lower low.” That is the very definition of a trend change, and therefore it is likely that we would continue to go much lower. The most likely candidate would be the 1.15 level because it is not only a psychologically and structurally important level, but we also have the 200 day EMA reaching towards that region. Remember, the Euro has to deal with a lot of the concern in the European Union when it comes to coronavirus and lockdowns when it comes to various European economies.

The US dollar could strengthen due to the fact that stimulus has been delayed, it does get a bit of a boost due to the fact that although coronavirus is still prevalent in the United States, it clearly has not damaged the economy as people had feared. Furthermore, it is also possible that people start to run back towards the treasury markets based upon fear. If that is the case, then it drives up the value of the greenback. All things being equal, I think that this is a market that continues to find sellers on short-term exhaustion, so I would look for short-term charts to fade this pair, just as I have been doing over the last couple of weeks here and there. I do not necessarily think that we are going to break down drastically, but clearly, the trend is starting to shift in favor of the greenback again. I not only see this against the Euro but against several other currencies around the world.