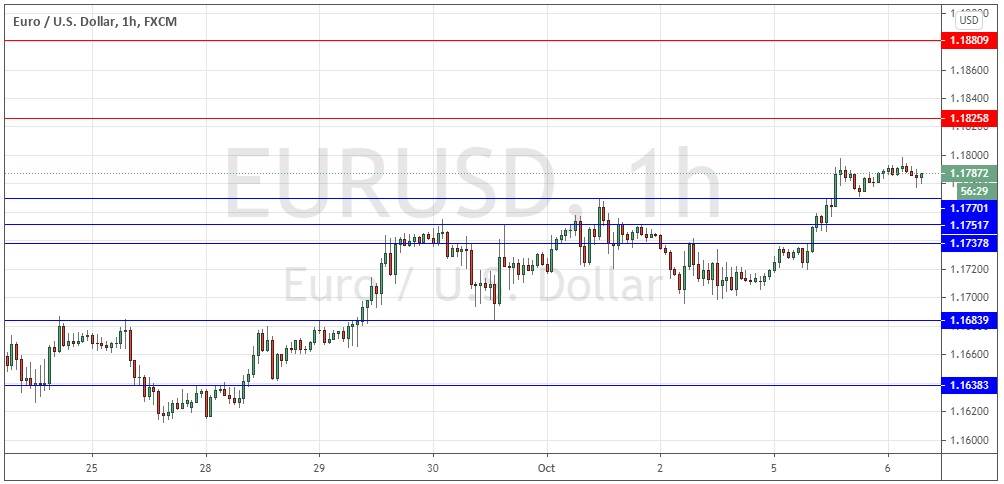

Yesterday’s signals were not triggered, as there was insufficiently bearish price action when 1.1738 and 1.1775 were first reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered between 8 am and 5 pm London time today.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1826 or 1.1881.

- Place the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1770, 1.1752, 1.1738, or 1.1684.

- Place the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote yesterday that we were beginning to see early signs of a medium-term bearish head and shoulders pattern completing, with the head just below 1.1775 and the shoulders situated at about 1.1750.

I was looking to take a short trade from a firm bearish rejection of 1.1738 or 1.1775, targeting 1.1684.

This did not set up, and the bearish head and shoulders formation failed, producing a relatively firm upwards movement. Sometimes pattern failures such as these are good indicators that a move in the other direction is about to happen, and this seems to have been the case here.

Yesterday saw a continuation of recent risk-on sentiment in the markets, which is causing safe-haven currencies such as the U.S. Dollar to be sold. There is also a long-term bearish trend in the U.S. Dollar.

The price of this currency pair is well within its multi-week range, but we look somewhat likely today to get more upwards movement as the price seems to have gotten established above the formerly strong area of resistance at about 1.1770.

I will be happy to take a long trade from a bullish bounce at any of the three support levels nearest to the current price.

Concerning the EUR, the President of the ECB will be giving minor speeches at 9:35 am and 2 pm London time. Regarding the USD, the Chair of the Federal Reserve will be giving a minor speech at 3:40 pm.