Throughout last week's trading, the EUR/USD was subjected to downward pressures, which it pushed towards the 1.1688 support and closed the week’s trading around the 1.1716 level. The most prominent factors stressing the performance of the pair are the new Coronavirus outbreak forcing European countries to re-impose restrictions to contain the pandemic, in addition to concern about the future of relations between the European Union and Britain after an important summit last week.

In light of the COVID-19 outbreak, doctors warn that Europe is at a turning point with the return of the coronavirus spread across the continent, including among people at risk, and therefore governments try to impose restrictions without shutting down entire economies. With newly confirmed cases reaching record levels, the World Health Organization warned on Friday that intensive care units in a number of European cities could reach their maximum capacity in the coming weeks.

In response to the increase, the Czech Republic has closed schools and is building a field hospital. Poland has limited opening hours in restaurants, gyms and closed schools, and France plans a 9 pm curfews in Paris and other major cities. In Britain, authorities are closing pubs and bars in the north of the country, with restrictions on socialization in London and other parts of the country. But as officials are sounding the alarm about the rising cases, they are also wary of imposing stricter nationwide lockdowns that have devastated their economies this spring. Instead, they try to impose more targeted restrictions.

Consumer prices in the Eurozone declined for the second month in a row in September, as initially expected, according to final data from Eurostat on Friday. According to the results, consumer prices decreased by 0.3 percent year-on-year, after a drop of 0.2 percent in August. The Census Bureau confirmed the rapid estimates released on October 2. A similar lower rate was last seen in April 2016. The European Central Bank aims to keep the inflation rate “below 2% but close to it”. But the bank expects inflation to average 1 percent in 2021 and 1.3 percent in 2022.

From the United States, retail sales increased for the fifth month in a row. In contrast, the federal budget deficit in the United States reached an all-time high of $3.1 trillion in the 2020 budget, more than double the previous record, as the Coronavirus pandemic shrank revenues and led to higher spending. The Trump administration said on Friday that the budget year deficit that ended on September 30 was three times the size of last year's deficit of $984 billion. It was also $2 trillion higher than the administration had expected in February, before the pandemic spread.

It was the government's largest annual deficit in terms of dollars, surpassing the previous record of $1.4 trillion set in 2009. At that time, the Obama administration was spending heavily to shore up the nation's banking system and limit the economic damage from the 2008 financial crisis.

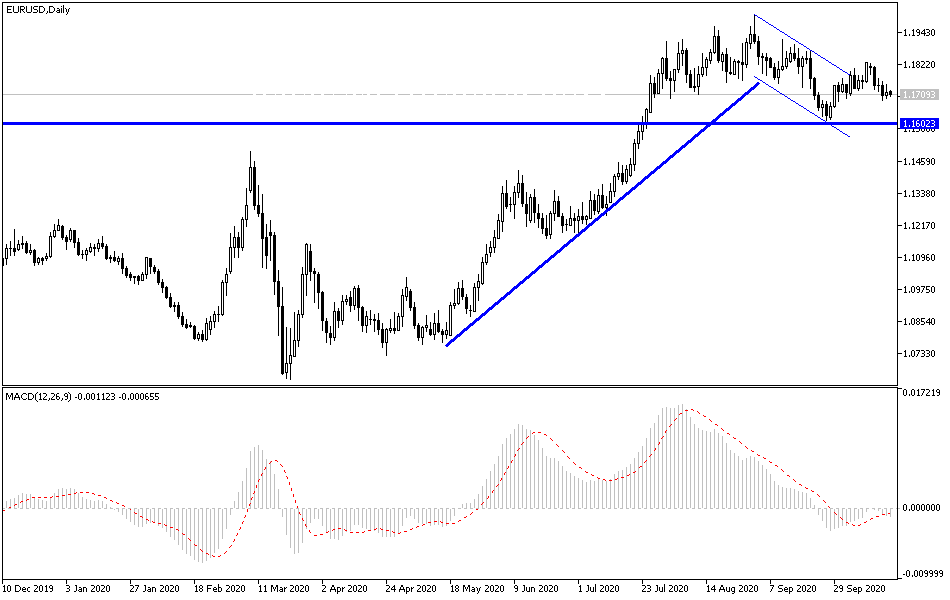

According to the technical analysis of the pair: There is no change to my technical view of the EUR/USD performance, as the downward momentum remains in place and stability below 1.1690 will raise the bears' desire to move the currency pair to stronger support levels, and the closest ones may currently be 1.1655, 1.1580 and 1.1490 respectively. On the other hand, there will be no opportunity to change the current bearish direction without the pair's success in breaching the top at the 1.1800 resistance level, because it stimulates the bulls to push towards the 1.2000 psychological resistance, which was the subject of widespread controversy among monetary policymakers of the European Central Bank.

As for today's economic calendar data: There are no economic releases from the Eurozone or the United States, but there are upcoming statements by European Central Bank Governor Lagarde and Federal Reserve Governor Jerome Powell.