This is its highest level in more than a month, with the weakening of the US currency, which faces anxiety about the future US economy stimulus and a blurry scene over who will win the presidential elections, which will be held next week. At the end of the week’s trading, the pair retreated to the support level at 1.1786, but it quickly bounced back and closed the week’s transactions up around 1.1860. And as I mentioned before, stability above 1.1800 stimulates a rebound higher.

On the economic side, IHS Markit PMI surveys have warned of an October crash in the European services sector. Whereas, the services PMI issued by IHS Markit for the Eurozone fell from 48.0 to a reading of 46.2 in October, below expectations by 47.1 points, especially after the German services sector saw its national PMI drop below the 50.0 threshold which Separates growth from contraction.

As for the German economy, this was offset by sharp gains for manufacturers, who saw the PMI rise by 46.4 to 58.0, which then helped lift the manufacturing PMI in the Eurozone from 53.7 to 54.4. But for the Eurozone as a whole, the services sector is important enough for the losses there to push the composite PMI - which includes manufacturing and services together - for the bloc down from 50.4 to a reading of 49.4.

This leaves the broader measure of the bloc's overall economic momentum weakening at recessionary levels once again.

Commenting on this, Florian Hens, an economist at Berenberg, says: "The wave of curfews and other social distancing rules to contain the massive rise in coronavirus infections is affecting the European economy." And added: “At the moment, we have to treat PMI data with a certain degree of caution and judge it in conjunction with broader and more detailed surveys like the German IFO Index (on October 26) and the European Commission Sentiment Index (due on October 29) to assess the performance of the European economy,” he added. in October.

The decline in PMI is a warning of future turmoil as more governments in Europe tighten restrictions on social contact and business activity in response to rising coronavirus infections, as Germany, France, Spain, the Netherlands and Sweden, among other countries, have made meaningful changes. PMI surveys measure changes in industry activity by asking respondents to rate terms of employment, production, new orders, prices, deliveries, and inventories. The number above the 50.0 level indicates growth in the industry while the number below corresponds to contraction.

It is often closely related to GDP growth, but it also comes with a health warning that often leads to over reactivity or undervaluation. It is also believed that a severe early fall reduces its reliability due to the structure of the surveys used.

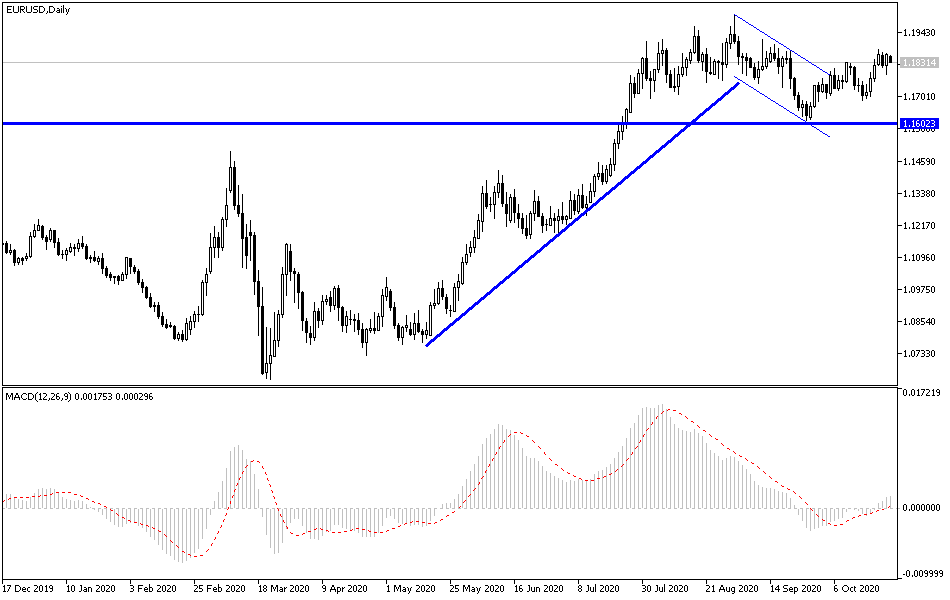

According to the technical analysis of the pair: There is no doubt, according to the EUR/USD performance at the highest resistance level of 1.1800, the bullish momentum is technically increasing to move towards higher resistance levels. This is the closest of which is currently 1.1920, then the psychological resistance at 1.2000, which raises the interest of monetary policy officials of the European Central Bank that the Euro’s strength weakens the European economy, which depends on exports. On the downside, the closest support levels for the pair are currently at 1.1810, 1.1745 and 1.1690, and the last level confirms the return of the bears' control over performance, as is the case on the long run.

As for the economic calendar data today: German IFO Business Climate reading will be announced, and later, new US home sales will be announced.