The currency pair tried to stabilize above the 1.1800 resistance at the beginning of the week’s trading in an attempt to rebound higher but fears of a massive wave of Coronavirus in European countries prevented this from happening. The closure restrictions have once again clouded the European economy, which is still suffering from the effects of the pandemic that began with the year 2020. The efforts of the European Central Bank and European governments may quickly evaporate if the situation is worse than the first wave of the deadly disease outbreak.

In contrast to what happened in the first wave of the disease, where the work was individual for European countries, recently, European Union countries approved a series of guidelines including a "traffic light" system that aims to facilitate free movement across the bloc and avoid further disruption to travel during the coronavirus pandemic. In March, many European Union countries hurriedly closed their borders in an attempt to stop the spread of the virus, although the European Union's Schengen agreement allows residents to move freely between countries without visas, this led to cutting off traffic and medical equipment.

Member states have also agreed to provide COVID-19 coronavirus data to the European Centre for Disease Prevention and Control (ECDC), which will publish a weekly map of screening areas according to the severity of the coronavirus outbreak to avoid as many infections as happened in the past.

On the economic side. Industrial production in the Eurozone grew at a slower pace in August despite the easing of containment measures in many member states, according to data published yesterday by Eurostat. According to the results, industrial production grew by only 0.7 percent month-on-month, after the 5 percent increase in July. Output was expected to rise 0.8 percent. Among the components, non-durable consumer goods and capital goods production decreased by 1.6% each.

Meanwhile, the production of consumer durables rose 6.8%, and the production of intermediate goods increased 3.1%. Energy production increased by 2.3 percent from the previous month. On an annual basis, industrial production recorded a decline of 7.2 percent after declining by 7.1 percent in July. The rate of decline was in line with economists' expectations.

In the USA, after reporting a modest increase in consumer prices in the United States, the Labour Department released a report showing that American producer prices rose more than expected in September. The ministry announced that the producer price index for final demand rose 0.4 percent in September after rising by 0.3 percent in August. Economists had expected prices to rise 0.2%. The report added that food prices jumped 1.2 percent in September after falling by 0.4 percent in August, while energy prices fell by 0.3 percent after declining by 0.1 percent.

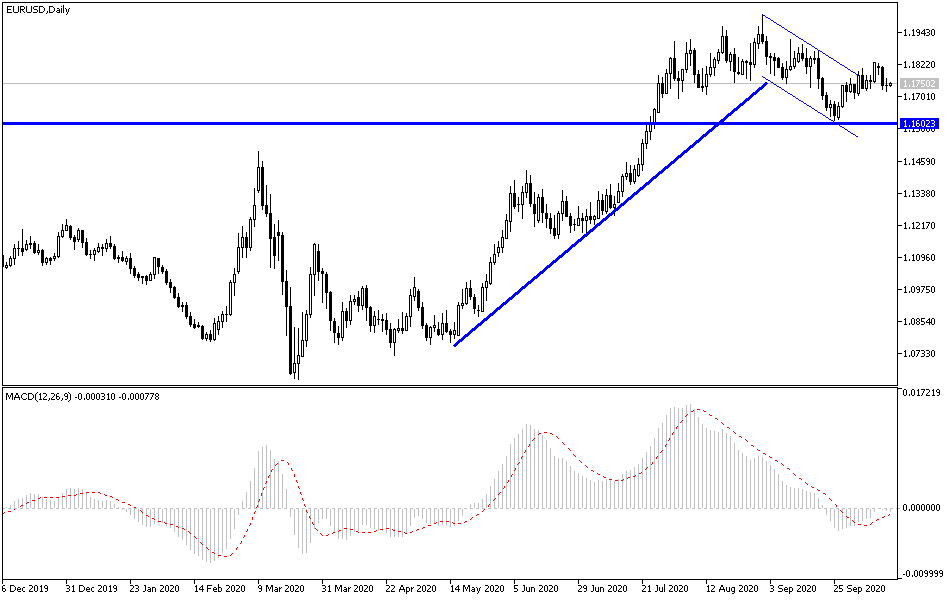

According to the technical analysis of the pair: On the daily chart, the EUR/USD is facing a new downward momentum that will strengthen in the event of a move below the support level at 1.1700, which increases the control of the bears and thus moves within the range of its descending channel, which is still the strongest on the long run. For a real reversal of the current bearish outlook, the currency pair will need to breach the resistance levels at 1.18 and 1.20, respectively, and the last level will remain questionable and widely discussed among the monetary policy makers of the European Central Bank because it is forced a lot of European efforts to revive the faltering economy.

As for the data of the economic calendar today: The French Consumer Price Index will be announced along with what will be received from the European Union summit. Later, there will be statements by the European Central Bank Governor, Lagarde. On the dollar side, the most important thing will be the announcement of the number of weekly jobless claims and the reading of the Philadelphia Industrialist Index and the Empire State Index. Along with comments from members of the Federal Reserve throughout the day.