EUR/USD upward rebound attempts stopped the testing of the 1.1807 resistance during yesterday's trading, at its high levels in two weeks. Investors' appetite for buying the dollar has returned relatively after new comments from US President Trump about the future of this presidential election, along with the bank governor’s warning. US Central Bank Governor Jerome Powell said that the temporary recovery from the pandemic recession may falter unless the federal government provides additional economic support. Accordingly, the currency pair retreated to the 1.1724 support at the beginning of trading today and is stabilizing around 1.1742 at the time of writing.

Trump recently hinted that he is preparing to return to the White House soon as the media have reported that he is excited by the speedy release from the hospital. Markets see Trump's health as important for holding the elections in a timely and reliable manner. Therefore, Trump's serious health implications are likely to translate into complications for US political and economic expectations. Analysts see the health of the US president as crucial to keeping the upcoming elections on the right track and could take into account whether Washington will soon agree to a massive stimulus package at a time when the US economy is showing increasing signs of slowing down. As the United States continues to lead the global numbers of COVID-19 infections and deaths, reaching the White House team in a time that is very sensitive to the country's political future.

US President Donald Trump announced that he will cut talks with Democrats on a new economic aid package until after the November elections. Trump's move means that millions of unemployed Americans, businesses, and distressed states will not receive more federal support for weeks, if not months, to come as the US economy struggles to recover from a deep recession. On this, Trump wrote on Twitter, "Our economy is doing very well. The stock market is at record levels, and jobs and unemployment are back in record numbers."

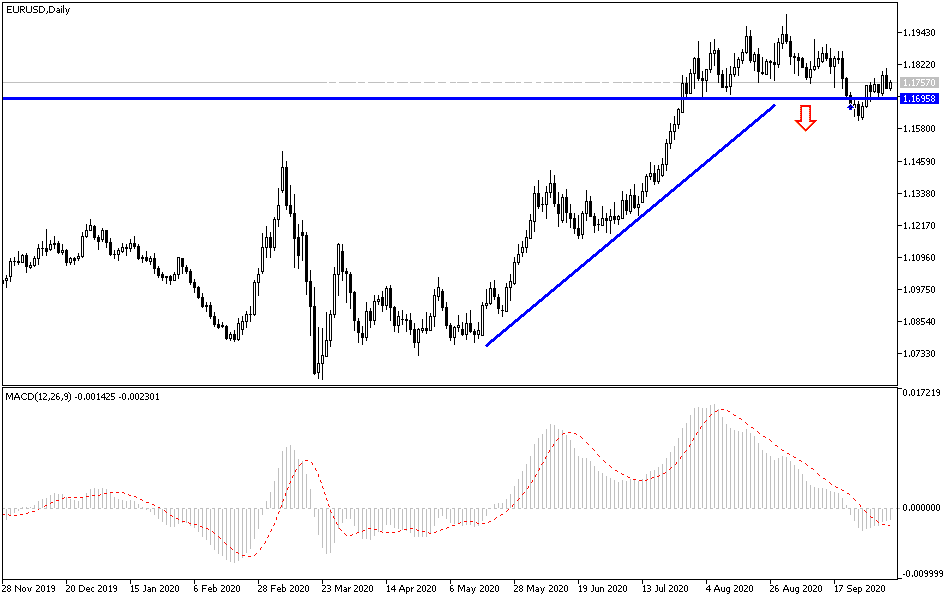

According to the technical analysis of the pair: There is no change to my technical view of the EUR/USD, as the upward correction path still needs more stimuli and the bulls may get some support with stability above the 1.1800 resistance, and at the same time, the rush towards the 1.2000 psychological resistance, despite the importance of the upward correction, is a price level that increased the comments of European Central Bank officials about the seriousness of the Euro’s gains at a time when the global economy is suffering from the Corona pandemic, which has not ended yet. On the downside, according to the line in the middle of the daily chart, the support level at 1.1695 will increase the bearish momentum again. The general trend for the pair in the long term is still bearish.

As for today's economic calendar data: German industrial production will be announced, followed by new statements by European Central Bank Governor Christine Lagarde. During the American session, the most important thing will be the announcement of the Federal Reserve Bank last meeting’s minutes.