Ahead of the European Central Bank meeting scheduled for Thursday, there are expectations that the bank may direct a state of unease with the Euro gains in the exchange market and amid new strict restrictions for European countries to contain records of Coronavirus cases. It was natural for the Euro to drop strongly and the EUR/USD collapsed to the 1.1770 support at the time of writing after several attempts to maintain a move above the 1.1800 resistance. Commenting on the performance, Derek Halbiny, Head of Research and Global Markets for Europe, Middle East, Africa and International Securities at MUFG says: "We see this as markets become more convinced of the deteriorating outlook for the US dollar in the future." "Regardless of who wins the US elections next week, the great fiscal stimulus is coming and coupled with that, we believe that the Fed will continue its strong easing stance for a longer period than usual for the bank," he added.

On the European side, the European Union's Coronavirus Recovery Fund gave policymakers in September the opportunity to shore up some of the Euro’s gains along with improved economic outlook, but the ongoing second wave of coronavirus and difficulties among EU members in pushing the recovery fund forward means the European Central Bank will not have such an advantage when they finish their meeting on Thursday at 12:45 pm.

Commenting on this, says Stephen Gallo, European Head of Forex Strategy at BMO Capital Markets: “is there anything the European Central Bank can do in October (or December) that will “shock” foreign exchange and rate investors? We are not sure it will exist. On the other hand, it is now widely accepted (by investors) that the implicit role of the European Central Bank has become more fiscal that it has nothing to do with boosting inflation and everything to do with supporting weaker sovereign credit. ”

With interest rates at the European Central Bank already at or below zero, the bank is restricted in what they can do to lower the Euro and help Eurozone economies, with its only viable option being to increase the size of the government bond-buying program. So far, the bank has committed to buying €1.35 trillion of European government bonds in total, resulting in lower government financing costs and ensuring finance for even the most fragile economies in the "periphery" during the pandemic.

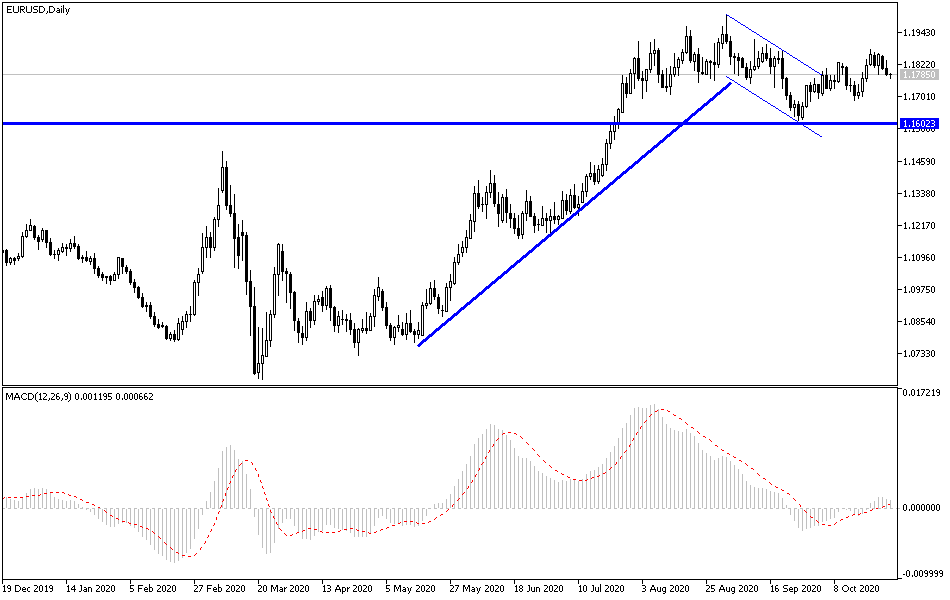

According to the technical analysis of the pair: As I expected in the recent technical analysis of the EUR/USD currency pair, the loss of control and moving below the 1.1800 level will restore bears’ control of the performance. Therefore, we are on a date with lower support levels, the closest of which are currently 1.1755, 1.1680 and 1.1590, respectively. On the upside, forex traders may await the European Central Bank's comments tomorrow regarding the Euro’s price, so any comment on its strength will support the current downward move, and in return, any disregard for the Euro’s gains may support the move up, and the closest resistance levels in that event will be 1.1855, 1.1920 and 1.2000, respectively. I still prefer to sell the currency pair from every upward level.

Regarding today's economic calendar data: From the Eurozone, the import price index will be announced, and from the United States, the commodity trade balance numbers, then the weekly oil inventories will be announced.