Investors demand to buy the USD as a safe haven, amid a violent second Coronavirus wave. This led to the reimposition of the economic shutdown, which contributed to the collapse of the EUR/USD to the 1.1717 support, its lowest level in two weeks, before stabilizing around 1.1755 at the time of writing. Ahead of the European Central Bank's monetary policy decisions announced later in the day, amid growing expectations that the bank may comment on the recent strength of the Euro in the exchange market, which usually hurts the economic recovery of the export-dependent bloc.

Countries around the world have rushed to impose new restrictions to stem record numbers of COVID-19 cases. As Germany moved yesterday to announce the closure of restaurants, bars and theatres again, and France calls for another country-wide closure, with a new wave of Coronavirus infections in Europe and the United States that ends months of progress against the epidemic in two continents.

The increase in infection cases and the imposition of restrictions contributed to the shivering of global financial markets.

For her part, German Chancellor, Angela Merkel, announced a partial lockdown for four weeks, starting on Monday: "We must act, and now, to avoid a severe national health emergency." Prior to that, French President Emmanuel Macron had planned to deliver a speech on Wednesday night as many French doctors called for a nationwide lockdown, with COVID-19 patients now occupying 58% of the country's intensive care units.

Amid those fears, the World Health Organization said more than 2 million new confirmed cases of coronavirus were reported globally in the past week. This was the shortest time for such an increase. 46% of new cases were reported in Europe.

Regarding the monetary policy of global central banks, policymakers at the European Central Bank were hostile to the Euro's appreciation in early September when the coronavirus was still largely contained on the continent, fearing the target for inflation and economic recovery will be missed given that a strong European currency could stifle both inflation and export competitiveness. But since then, the second wave has grown larger than the first, leading to renewed restrictions on activity with a question mark over the economic recovery.

As such, it is not clear exactly what ECB President Christine Lagarde and her colleagues can do about the Euro on Thursday, although it is likely that they will at least try to engineer the EUR/USD decline. Most analysts' expectations indicate that the European Central Bank may repeat its recent message, that it is closely monitoring currency market developments and assessing their impact on growth and inflation.

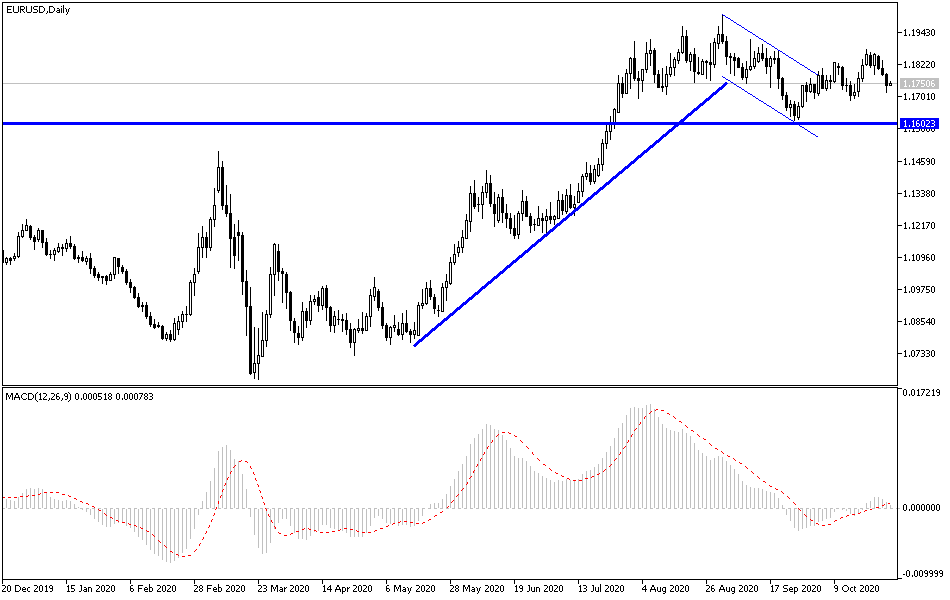

According to the technical analysis of the pair: The bears’ domination of the EUR/USD performance is still in place as long as it is stable below the 1.1800 support, and losses may increase in the event that the European Central Bank indicates its annoyance with the strength of the Euro exchange rate, and therefore the closest levels of support may at 1.1735, 1.1670 and 1.1590, respectively. If the bank ignores the comment on the Euro’s level, which is unlikely, the pair may move higher, but gains will still collide after that with the imposition of more restrictions to contain the outbreak of the Coronavirus in Europe. Technically, it is still the most important psychological resistance to a stronger control of bulls on performance.

As for today's economic calendar data: From Germany, the Consumer Price Index and the change in unemployment will be announced there. During the American session, the most important thing will be the announcement of the US GDP growth figures, jobless claims and then the anticipated US home sales.