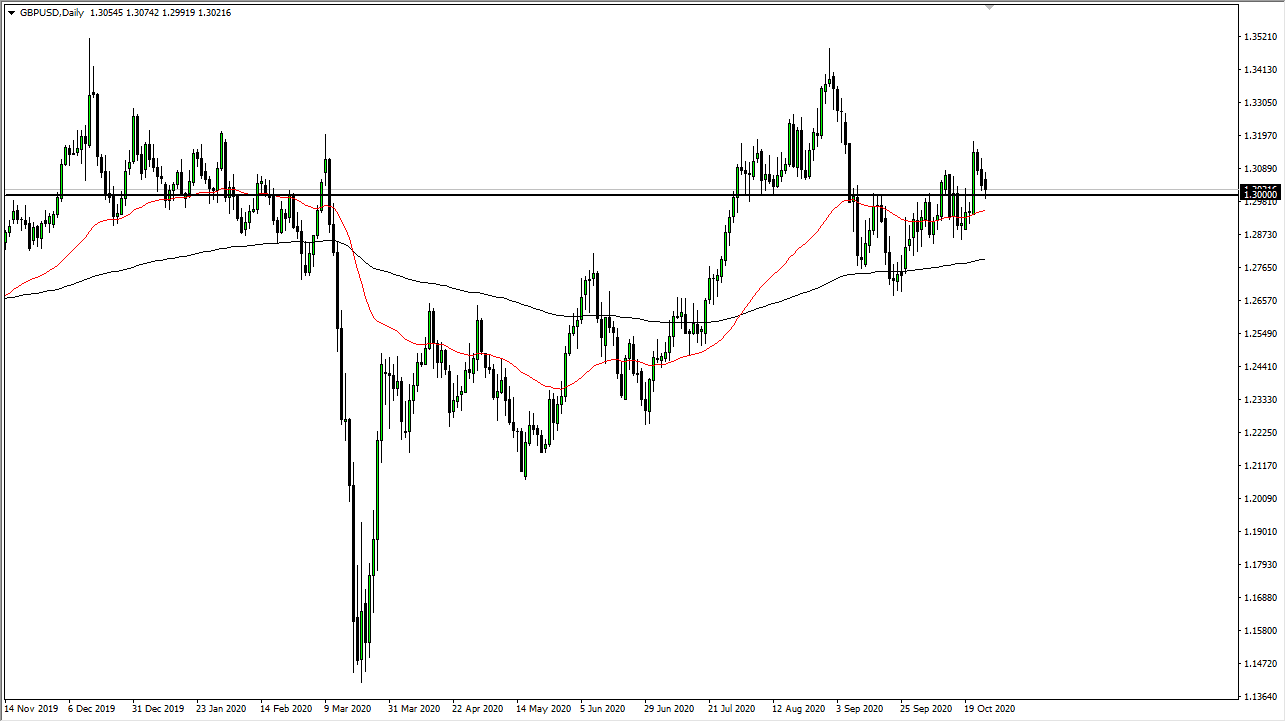

This is an area that of course will attract a significant amount of attention, due to the fact that it is such a big figure. Beyond that, it was the previous resistance barrier that the market broke above, so now it makes sense that we would probably have to pull back in order to find support. At this point in time though, I am more apt to start buying based upon a daily candlestick than a short-term one, because we have so much in the way of noise when it comes to the Brexit situation.

If we break down below the 1.30 level, it is likely that the market is going to find support underneath at the 50 day EMA, which of course would make quite a bit of sense. At this point, the market is likely to not only react to that indicator, but there is also structural support there as well. I do think that we are trying to trade based upon the idea of Brexit going back and forth, and of course stimulus. In other words, this is a huge mess just waiting to happen. With that being the case, I believe that the market will continue to be very noisy and dangerous, but it does appear that we are trying to go higher over the longer term. That being said, who knows what will happen next, because quite frankly is all based upon the latest rumor or Tweet.

The area between the 50 day EMA and the 200 day EMA should be a “zone of support”, so I think that it is only a matter of time there would be buyers in that general vicinity. All things being equal, I think that this pair will eventually give you an opportunity to go long, but not right now. At the very least, we may be forming some type of bottoming pattern, which is can it take some time to get some type of confirmation that we can take advantage of. The massive bullish candlestick Wednesday suggests that there are still plenty of people wanting to go long if they can, but unfortunately the volatility continues to be very out of control. It is probably only going to get worse than longer we get into the year as it increases the odds of a “no deal Brexit.”