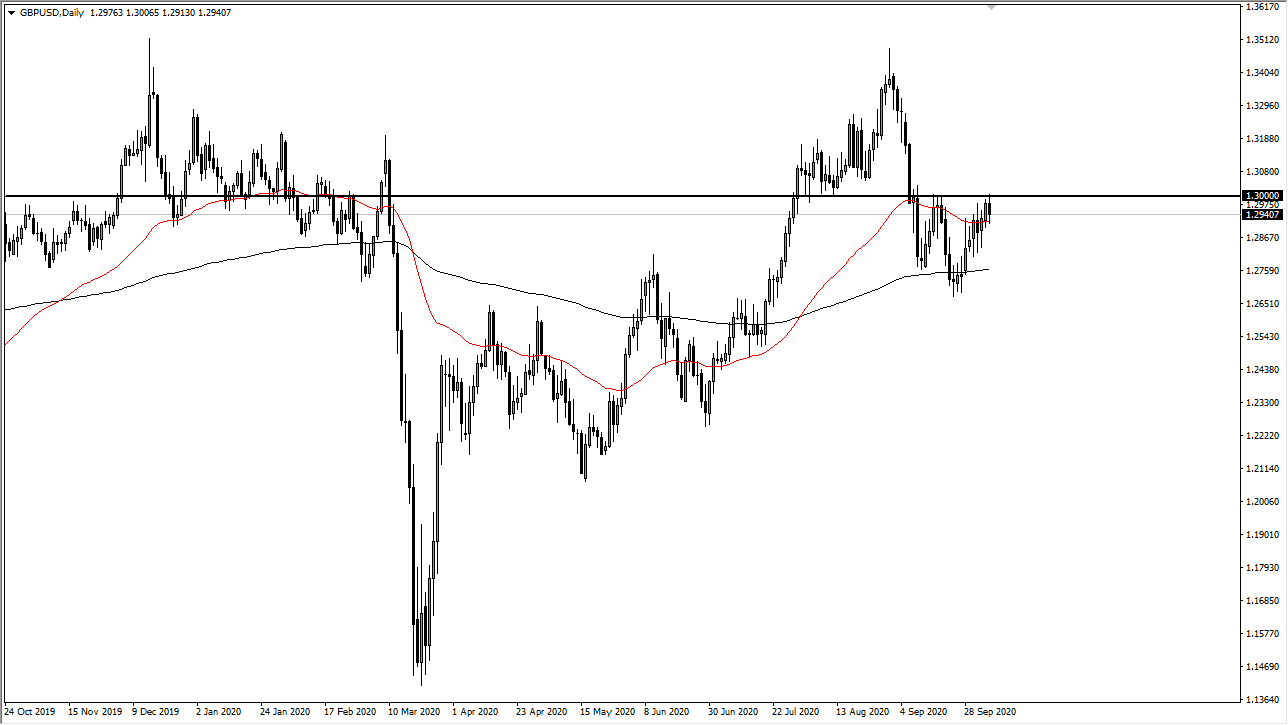

The British pound initially tried to rally a bit during the trading session on Tuesday, reaching towards the 1.30 level. This is an area that has been difficult to overcome for the last several weeks, and therefore I think it becomes a bit of a “binary trade”, based upon some type of daily close that shows a significant shift in one direction or another. One obvious trade would be if we can get a daily close above the 1.3050 level, as it would show a significant amount of strength in the British pound, a currency that has caused a lot of headaches for various traders that I know.

If the market was to break down below the 50 day EMA on a daily close, then we could have an attempt to reach down towards the 200 day EMA next, which is an indicator that a lot of people will pay attention to. This is a longer-term signal that a lot of traders will pay close attention to, as it is a long term trend defining indicator that people use. Breaking down below that is a very negative sign and could open up the possibility for the market to go down to the 1.25 handle, perhaps even down to the 1.23 level.

The candlestick for the day is negative, and it shows just how difficult it is going to be to get above the 1.30 level. I think at this point the British pound will continue to cause a lot of headaches due to the fact that most of what is going on with the British pound has to do with Brexit, which is fraught with rumors and headlines that can cause markets to jump back and forth rather rapidly. Furthermore, at the same time people are trying to figure out whether or not a deal was going to be done. The most recent headline has been that the European Union is willing to “call the bluff of the United Kingdom” as far as the October 15 deadline is concerned for some type of an agreement. This is all nonsense but it continues to throw the market around. Because of this, you need to be very cautious about your position size, and quite frankly I think things are going to get much more difficult before they get easier.